This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Click here to see all of my past Savings Reports and view my interactive net worth chart

We made it to Sweden!!

I’m sitting in the corporate housing right now, a coffee in hand, my cat by my side (not traumatised), writing this post.

Surprisingly almost everything went smoothly, but still, what a journey it was! If you’re wondering what I’m yapping about, the Ninja family drove across Europe with our cat so we could move house and I could start working for my dream employer in Sweden.

Get over to the Ninja Instagram page to see some photos of every leg of our journey, courtesy of the new marketing manager, Mrs SavingNinja .

It’s a good thing I didn’t move country and all but halt my savings contributions until I had over £100k invested .

If I did, I wouldn’t have anything to write about in these monthly updates.

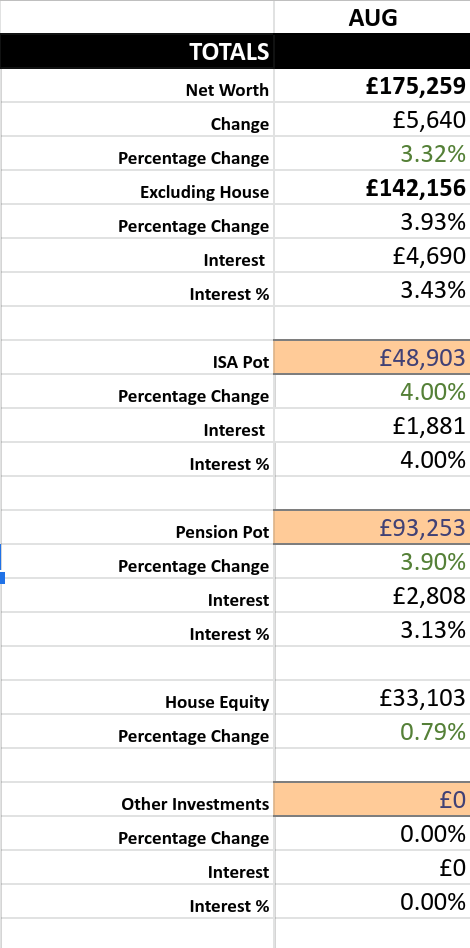

August saw my net-worth grow by £5,640. This puts my wealth back up to before I took my Tesla ‘alt-investment’ out last month . Any higher from £175k and I’m in new territory!

I was hoping to make it to £200k net-worth in 2020 but unless the stock market really shoots up, I’m probably going to miss that goal as I won’t be contributing much - if anything - this year whilst I see where the dust settles on our new financial situation.

Saying that, my new employer does pay into some kind of pension scheme, but I need to investigate to see if it’s even worth adding to my FIRE calculations. I read that you may not be able to take anything out until way into your 60s (post coming soon.)

Other News

Mrs SavingNinja is releasing a post soon about moving to Sweden, so more to come from her in this space soon.

For me, my dream job has begun. I’m still pretty overwhelmed at the amount of different things that I need to learn and set-up, I’m trying to figure out how I’ll ever be able to write another SavingNinja post again!

I’ve also learned many more ‘cool’ things that I didn’t know about before joining, like my employer giving employees a ’lunch’ card and topping it up with over £200 per month (enough to pay for our groceries, even in Sweden); Being able to order your own company Amex card and spending on it whenever you go out with work colleagues, and being able to buy my own £500+ curved gaming monitor and ergonomic chair which I get to keep as my own (I think this one is mainly due to COVID remote working.)

Everyone I’ve met is super-friendly, my manager is the nicest person in the world even offering to lend us his personal car if we need it. It’s definitely shaping up to be one of the best employers I’ve ever worked for and I can’t wait to get stuck in!

Landlording

We’ve not yet got all of the certificates required to lease out our house back home, our letting agent (after some long stints of not responding to us,) has finally got our property marketed and says they had ‘7 viewings in one day’ (don’t know how much of that to believe.) Fingers crossed this will be rented out soon so we don’t have to foot the bill for council tax and mortgage payments for long!

Share Scheme

I’ve been avoiding looking at my company stock price , I thought I’d just wait until I was given my grant price. I found out in one of my induction meetings that I’ll need to first pick my options and then a month later I will be given my grant price. I’d assumed the grant price was my first day. So that sucks. Or maybe it won’t? Depends on the price!

Blog

Coming up will be Mrs SavingNinja’s post about our move to Sweden. She’ll be writing a little more for the time being as she’s yet to find a job here.

One thing that we’ve noticed about being in Sweden is the shocking lack of blog posts comparing things like bank cards, and the extreme struggle to even find fee information on Sweden’s banking websites.

As we need to find an account ourselves, we’ll be releasing a post detailing the picks (if we can find the info!) These Swedish posts will probably be a bit dull for our English readers but remember if it’s tagged with ‘Sweden’ you can skip them.

How is everything back at home? By the way, COVID virtually doesn’t exist over here. They actually recommend not wearing a face mask! And we’ve seen mass gatherings of University induction days on the parks (literally 100’s of people sat with each other and playing games.)

It’s also staggering the number of people running, we’ve not seen any people that didn’t look in-shape, even grandmas are running and look fitter than me. Maybe that’s why the Swedes are not as worried about COVID, because their cardiovascular systems are generally higher? I need to get to the gym!