When I start work at my new place in August, I’ll have only a week to decide what type of share options I’d like. This is a decision that I’ll have to stick with for 4 years! It’s also a decision that will see me earning huge amounts, or nothing at all.

I’ve read through the share program and I’ve been left baffled, it’s super complicated. So, in this article I’ll work my way through the documentation, nothing will be omitted, and you guys can help me decide which option to choose.

A Big Chunk of Money

A good chunk of the compensation with my new employer is paid out in a share scheme in the form of dollars. It currently amounts to $126,000 base value over the course of 4 years. This figure may be less or much more depending on the options that I choose, and there are 4 options to choose from, let’s call these: Cash, Option A, Option B, and Option C.

The Options can be mixed up e.g. 25% of each or any other percentage of the base value distributed amongst them, we’re not limited to just picking one.

Let’s dive into each of the options in a little more detail.

Cash Option

This is pretty self explanatory, when picking Cash; each month you’ll get a cash amount added to your salary, although this will be 90% of the total base amount.

So, 90% of $126k divided by 48 (months in 4 years) gives you the cash amount of $2,362.50 per month.

Option A

This option is what you would find in most share schemes. Each month, 1/48 of your base value will ‘vest’ and you’ll be awarded with a share in the company which you can either sell or keep.

The benefit of Option A is you’ll only pay the share price at the ‘grant’ date (when I joined the company.)

So, with a $2,625 base value figure each month, if the share price of the company was $100 per share when you joined, you’d be awarded 26.25 shares each month, no matter how much the share price has gone up (or down.) This is guaranteed each month, and you can sell or keep the shares.

One thing to bear in mind here, is how horrible the Swedish tax system is. There are no tax incentives to share schemes in Sweden, you’ll have to pay your income tax rate each month on the total amount of shares you received based on current value, not grant value. For me, this is 54.5%, that means that of those 26.25 shares, I’ll only receive around 12. Of course, this same tax is taken if the Cash Option is chosen, so it doesn’t factor into the decision too much, it will just mean the total reward is more than halved.

Option B

This is the first of the riskier options as it will only be ‘exercisable’ (available to sell) if the share price crosses a certain threshold, in this case it needs to go up from the initial share price. If it stays flat or goes down, you will get zilch!

The way this option and the next option work is you’ll only get the difference between how much the share price has risen in profit, but this will be added to a multiplier. With Option B, this multiplier is 4, and the ‘exercise price’ is the grant value.

So using $100 as an example grant value again, if the share price goes up to $150 in 4 years, you’ll get the base value ($126k) multiplied by 4 ($504k) divided by the grant value ($100), this will give you the number of ‘options’ which you can use to buy shares: 5040.

You’ll be able to use each of these options to purchase a share at $100 and instantly sell it at the market value of $150. So the actual gain will be $50 x 5040: $252,000.

Option B becomes more profitable than Option A only if the stock grows by more than 34% in 4 years, anything less and it becomes considerably worse, all of the way to the grant value where Option B will be worth nothing, but anything more than 34% and it will become exponentially more profitable than Option A.

Option C

This is the riskiest option, like Option B, it can only be exercised after crossing a certain threshold, in this case 50%. If the company stock doesn’t grow by at least half of the value at grant within 5 years, you’ll get nothing.

BUT, if it does grow by that amount (the stock has more than doubled in the last couple of years alone,) you’ll get 8 times the base value in options. The difference here is that you can’t buy the stock at grant value, you have to buy at the exercisable value, which is 150%, so using the $100 grant value, if the stock has risen to $200 in 4 years, you’ll be able to buy the stock at $150 per option. And as the options get multiplied by 8X the base value, you’ll have double the amount of options as Option B: 10,080.

So, using the 100% growth metric, buying 10,080 stocks at $150 and selling for $200, you’ll get $504,000.

Like Option B, this option becomes exponentially more profitable than Option B, but the threshold is 101%, for example, with Option B, 100% stock growth equals the same $504k figure ($100 buy for $200 sell, multiplied by 5040 options) as Option C’s 10,080 x $150 buy and $200 sell. Anything above 101% and you’ll be benefitting from that 8X multiplier, but anything below 100% and you’ll be losing out.

Comparing Stock Options

Let’s compare all of the options together based on all being sold after 4 years depending on growth.

Value after 4 years of growth

_0% gain _

Base value: $126,000

Cash Option: $113,400 / (after tax) $51,597 ← Ouch!

Option A: $126,000 / $57,330

Option B: $0

Option C: $0

_10% gain _

Base value: $126,000

Cash Option: $113,400 / $51,597

Option A: $138,600 / $63,063

Option B: $50,400 / $22,932

Option C: $0

_25% gain _

Base value: $126,000

Cash Option: $113,400 / $51,597

Option A: $157,500 / $71,662

Option B: $126,000 / $57,330

Option C: $0

-- 34% growth Option B surpasses Option A –

_50% gain _

Base value: $126,000

Cash Option: $113,400 / $51,597

Option A: $189,000 / $85,995

Option B: $252,000 / $114,660

Option C: $0

_75% gain _

Base value: $126,000

Cash Option: $113,400 / $51,597

Option A: $220,500 / $100,328

Option B: $378,000 / $171,990

Option C: $252,000 / $114,660

_100% gain _

Base value: $126,000

Cash Option: $113,400 / $51,597

Option A: $252,000 / $114,660

Option B: $504,000 / $229,320

Option C: $504,000 / $229,320

-- 101% growth Option C surpasses Option B –

_125% gain _

Base value: $126,000

Cash Option: $113,400 / $51,597

Option A: $283,500 / $128,993

Option B: $630,000 / $286,650

Option C: $756,000 / $343,980

How to Predict Stock Growth

That’s what this is really about, trying to predict how much I think the stock will go up…

Do I think the stock will go down? Choose cash.

Do I think the stock won’t go higher than 34%? Choose Option A.

34%+ Growth? Option B.

Will the stock more than double? Option C.

But, looking at everything a little more closely, we can analyse how much gain difference there will really be, and if it’s worth the risk of not getting anything (or getting a very low amount.)

With Option C, do I really think the stock will grow 125% in value? I mean it could, but if I really wanted to predict that, why not put all of my personal cash in it? It will be less risky than choosing this option, as we have to remember, if it grows by 50%, which is a fair whack, there will be nothing to gain, where as with option B I could have got $252k.

The difference to gain for the amount of risk added is even less when you add 54.5% tax into the question. Looking at the second, after tax figures, the difference between Option B and Option C at a 125% gain is only $57k. At almost $300k gained after tax, I’m not going to be too mad. So is it worth throwing away $115k after tax at a 50% gain for the possibility of $57k on top of $300k at a 125% gain? Or worse still, gaining the exact same if the stock doubled in value with Option C at the risk of losing a lot more if it didn’t double in value.

And realistically, if the stock rose by 100%, I’d rather sell it right then. I wouldn’t want to be holding on to the rollercoaster thinking “When should I sell my Option C stocks as anything above 100% is gaining 8X the value!” I’d end up holding onto them and run the risk of the market crashing and it being worth nothing again. I’d run the same risk with Option B, but a 34% threshold is a lot smaller than a 101% threshold, I wouldn’t be as panicked.

The POWAH of Spreadsheets!

Whilst everything prior to this has been sitting in my drafts folder, I decided to make a spreadsheet to help me decide on which option to take. I calculated the difference between the 3 Options from a 0% gain to a 400% gain, check it out here .

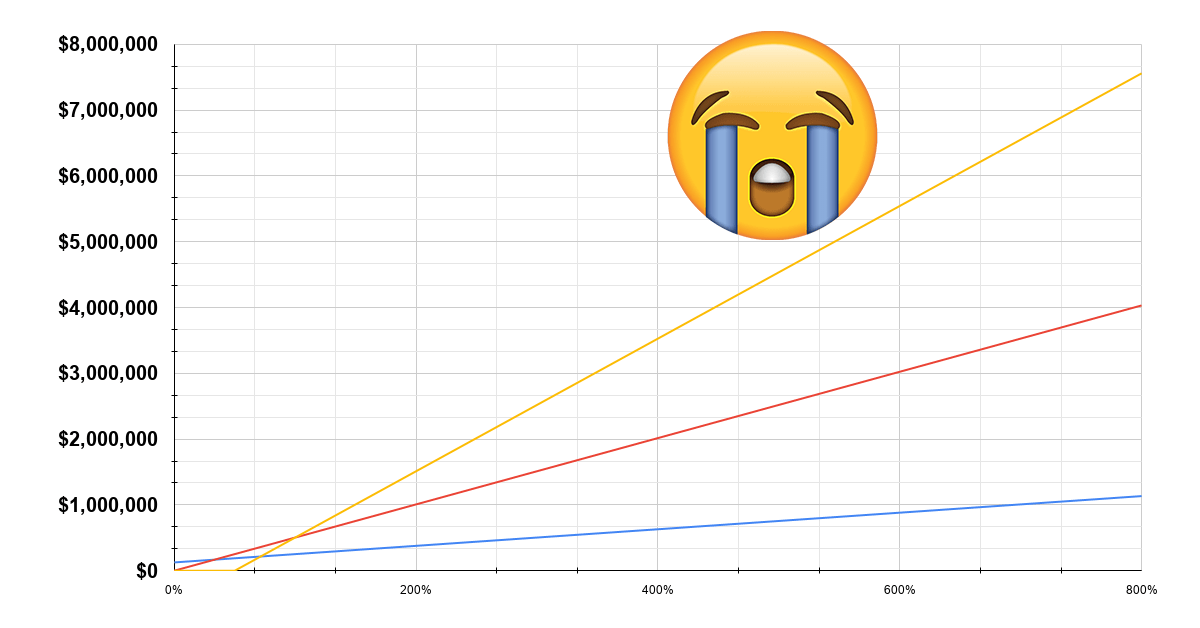

You can see in the chart below that they’ve been quite smart about how they’ve structured the scheme with appetite to risk.

You can see the astronomical differences between Option C and Option A if the stock did perform well. But you can also clearly see that it’s about perspective.

If you zoom in on the graph instead of looking at 150%-200% gains (you can’t rely on that, if you could, why invest in a passive index fund!?) You can see that the chart starts to look a lot different.

And when you take a hefty tax bill into account, the risk-reward ratio seems even less worth it.

But, I’ve also got to bear in mind that this could also happen…

If the stock jumped from $100 to $400 in 5 years, the difference between Option C and Option B would be $700k after tax, almost 50% more, with a total of $1.6 million net gain being made.

Looking at Stock Forecasts

The dreams of riches would have normally made me want to choose Option C. There is one problem however; the stock in question has stayed flat for the previous 2 years, but has grown by 100% in the past couple of months.

This is a HUGE bummer. To reach that multi-million dollar payout of 400%, the stock only has to grow by a further 100% from its current high to earn the company’s current employees their payouts. But for me, joining a mere month too late, my prospects of it growing by 400% (800% if I’d joined a month before - which would be an $8 million payout by the way) are extremely low.

If I’d joined when I got my offer instead of waiting for 3 months, I’d be looking at reaching the threshold for Option C within the first month of the 5 year growth period, almost guaranteeing a multi-million dollar payout. I certainly feel like I’ve missed the boat.

Instead, if I choose Option B, and the stock doubled, I’d be looking at a $500k payout at 100% growth rather than a $3.5 million payout with Option C at 400% growth (if I’d joined a month earlier.) Or worse still, if I join and the stock reverts back to it’s start of the year value and drops by 50%, then doubles again over 5 years, I’d be awarded with absolutely nothing as I would have locked in my grant value at the current high.

This is something I’m massively struggling with! Something that should be an employee benefit is turning out to be a surefire route to disappointment and frustration due to joining at specifically the wrong time, when, even if the stock continued to rise, I’d be working alongside multi-millionaires who had joined directly before me, or worse, I’d be awarded with nothing due to joining during a bubble.

Que Sera Sera

As my wife keeps saying, there is no point in worrying about what could have been. I really wish I could just ignore the past values and future predictions and be happy. I wish I hadn’t done this post; ignorance is bliss; but I have, and I’m going to have to try to not be frustrated or envious, no matter what Option I choose or what the stock does in the future.

I’ll just continue to study, enjoy myself, work on my career and save. Maybe one day I’ll have another chance to win the lottery in a share scheme?

What Option would you choose? How would you get over the fact that the stock had just doubled directly before you were given your grant price?