People think that earning a high salary means that they can afford to buy more things. They behave like rich people; going on multiple holidays, buying fancy cars, taking out huge mortgages. The truth is; if you have nothing invested… You’re poor. You should be eating beans and saving like hell as you’re losing tens of thousands every year and setting yourself up for an unhappy life.

To put this into perspective, let’s imagine we have two guys:

Timmy

Timmy started his career earning £17,000 per year. He worked hard and he’s now 20 years old and is earning £30,000 per year. Timmy didn’t succumb to lifestyle inflation and decided that he’ll keep living off £17,000 per year and invest the difference. He can now invest £13,000 per year into a safe, globally tracked, passive index fund.

and…

Jeff

Jeff had a similar starting path to Timmy. The difference is, he never invested anything. Instead, he bought expensive cars and a big house. He even found financing so he could get these things when he was in his 20s! Jeff is now 35 years old and is earning £100,000 per year. After tax, he is taking home £5,500 per month, but unfortunately, the mortgage on his fancy pants house is costing him £2,200 per month. It’s also costing him £1,500 per month for his two young children to go to Nursery. On top of this, he has a lot of other expenses which he’s amassed over the years to show his prestige as a rich and successful career man. He can hardly afford to save an emergency fund, let alone invest! He may even have to take out more credit.

Let’s look at how they both turned out.

From investing £13,000 per year, and from a nice salary bump at 23 to £36,000. Timmy managed to amass £86,500 into his globally tracked, passive index tracker fund by 25 years old. He can now relax in his knowledge that he has money working for him.

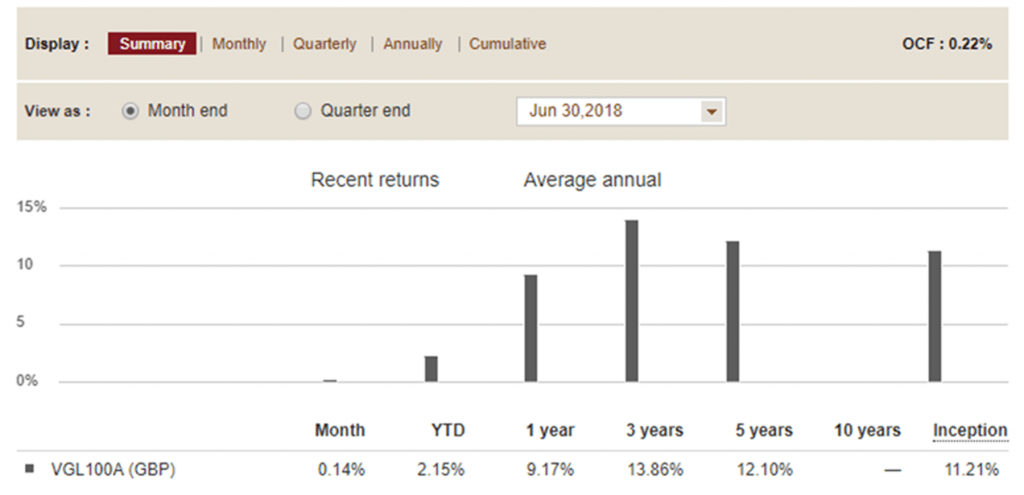

Looking at the last 5 years of the Vanguard LifeStrategy 100% Equity Fund – Accumulation below. Timmy would have made £71,500 just from having that money invested between his 25th and 30th birthday, but Timmy didn’t stop depositing.

Screen shot from vanguard.co.uk

](https://vanguard.co.uk/adviser/adv/detail/mf/overview?portId=9232&assetCode=BALANCED##performance )

When Timmy turned 25, he decided to reduce his yearly investments back down to £13,000 per year, and instead keep the extra £6000 per year from his pay rise. By the time he was 30, his investment pot was worth £247,500. Even though his salary increased each year, he kept his investments at that initial £13,000. At 35, his pot was then worth £541,500.

Timmy is now earning £100,000 per year. His investments are earning anywhere between £32,500 and £65,000 per year on their own; that’s more than Jeff’s take-home pay. Timmy no longer has to invest anything from his own salary anymore, his money is doing the work for him. He can afford to get that big fancy pants house and expensive car. He has money invested; working for him… He truly is rich. Timmy has options. He can choose to carry on working, become wealthy and create generational wealth for his kids and grandkids. Or he can even choose to not work anymore; he doesn’t need to.

Jeff, on the other hand, is pretty much screwed. He carried on financing to support his lavish lifestyle (and his past mistakes). By age 40 he had to down-size his house and he finally came to the realisation that, even though he’s earning 6 figures, he’s dirt poor.

He spent his whole life keeping up with the Joneses and mocking people who were frugal. He’s invested next to nothing. He’s going to have to make some radical changes if he wants to have any retirement at all before age 85. By not knowing he was poor back at 25, he’s made himself even more worse off now. He’s piled on his lifestyle inflation to the point where he can’t even invest anymore.

I like to go by the rule; if you’ve not got £100k invested; you’re poor. You should be doing everything in your power to make sure you’re investing as much as you can because each year, you’re missing out on gains, and worse; you’re missing out on the magical effect of compound interest. Like we saw with Timmy; the earlier the better. Your money has time to grow, and you have fewer commitments like kids and a mortgage when you’re younger. There is no better time to live off minimum wage than when you’re young! You shouldn’t be going and financing sports cars, you really would be shooting your future self in the foot.

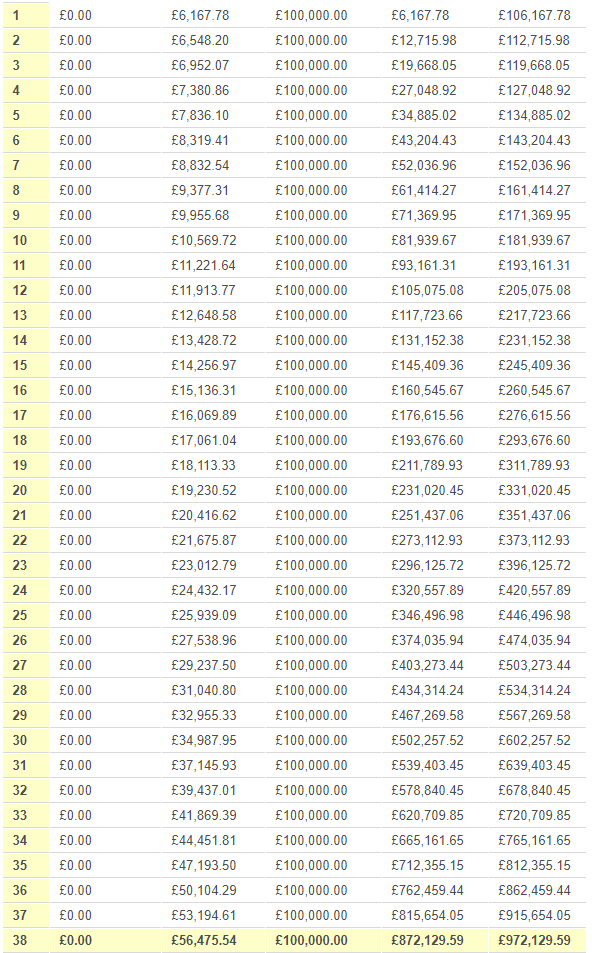

The best thing is; if you have a nest egg of £100k or more before age 30, you don’t even have to invest anymore. You can happily spend all of your salary knowing that before you reach retirement age, you’ll have between £500,000 and £1,000,000 waiting for you from your initial 5 years of saving.

Screen shot from theculatorsite.com

Here at Saving Ninja, we’re looking at ways of accelerating this. We’re looking at any and all ways of making a profit and to save, so you have more money to invest!

Remember, don’t be like Jeff; be like Timmy!