This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Click here to see all of my past Savings Reports and view my interactive net worth chart

What goes down must come up. This seems to be the markets 2020 motto.

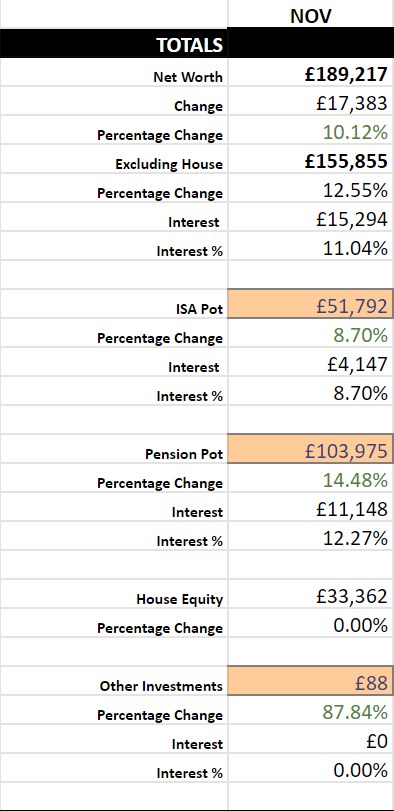

After losing £4,200 last month , £15,300 was gained in November!

This push bought my investment portfolio flying over two important targets - over £150k total investments, and over £100k pension investments, pretty cool.

After some more research (it seems incredibly hard to get accurate information in Sweden,) it seems that my Swedish ‘occupational pension’ is theoretically the same as a UK private pension, meaning I can withdraw from it at the age of 55 currently. This means that I can include my Swedish pension savings in these reports, woo!

My employer is paying the equivalent of £1,045 per month into this pension which I’ve set to invest globally via Avanza Global , this seems to be the closest thing to a world weighted passive index fund, so I’ve added £2,090 to the pension contributions this month and I’ll add this each month going forward.

Today I Win…Two Pensions!

Looking at the rules of the Swedish and English pension systems, it seems that they both do not take into account any overseas private pensions. This made me think a little.

Hitting the £100k UK pension figure before the age of 30, some people would suggest that I no longer contribute as I run the risk of hitting the £1m lifetime allowance before I draw from it imposing a *dramatic tone* super-tax.

As I moved to Sweden as soon as I was ‘done’ with my UK pension, I believe this means I can start a new pension pot which will be completely separate from the UK lifetime allowance and affectively go over the normal UK threshold by not rolling my pensions into one.

This is cool! Although there is one problem; Sweden doesn’t have a lifetime allowance, this is mainly due to them having no ‘25% tax free lump sum,’ they’ll also not observe the UK pension tax free lump sum. This probably outweighs all of the benefits of hacking the LTA by moving out of the UK, although it may be beneficial if I end up moving back to the UK - we’ll see.

Getting back on Track

I opened up my first ISK, which stands for Investeringssparkonton. Try and say that after a couple of pints. This is the closest thing Sweden has to a British ISA. It charges a wealth-tax which equates to around 0.375% of the total invested, this gets charged whether the markets rise or tank, which sucks, but is apparently better than paying 30% on any capital gain.

Right now I’m only adding 100 SEK per month, which is the £88 that you see in ‘Other Investments.’ I may separate this out into a different category if/when I begin to contribute more.

Right now the Ninja family are trying to buy a property in Sweden, you can offset things like renovations and mortgage interest from your ludicrously high tax bill over here, and rent is extremely high, so by buying we’ll be able to save a ton more money, and we plan on staying for a minimum of 3 years, so buying definitely works out better.

Due to moving and needing all of the money we can get for the 15% deposit, furniture, and other moving costs, I’ve held off on resuming my normal monthly savings for the time being. As soon as we’ve moved and things have fallen back into a regular routine, I’ll ramp it up again!

Other News

This month I realized that I was being royally ripped off by the web hosting company that SavingNinja used, they were charging me $30 per month, and I’ve been paying this figure for over 2 years, so I began to look for a new hosting solution.

I’ve been working with Google Cloud a lot more in my new job , and so I know how damn cool and capable it is. I’ve also been a Google fan-boy my whole career, AND being a professional engineer, who better to manage hosting SavingNinja than myself?

So, I set to work migrating this website to the Google Cloud platform, and you’re now viewing this blog post from the cloud! And hopefully having a good experience?

Better yet, I’m using Googles Free Tier . So this website is being hosted for free and I’ll save around $360 per year. Why didn’t I do this sooner?

The migration process was smooth and I believe anyone could do it. I had a few outages at the beginning, but now things been have been ironed out everything seems to be stable. I even have server logging, analytics, and daily back-ups being made.

Share Options

Remember when I asked you which share options I should take all the way back in July. Here’s an exciting update with how they’re doing.

If you’ve been following along, you’ll know that I took 50% ‘Option B’ and 50% ‘Option C,’ the medium and high risk options.

The graph looked like this:

Now, after only 3 months, my stock options are at the 30% growth mark. If they continue to grow like this over the 5 years that they have, we could be looking a very large pay out. It may even mean instant FIRE in 5 years.

Here’s to hoping.

Snowboarding

I still plan on going Snowboarding in the north of Sweden over Christmas. Everything is booked and so far it’s not been cancelled. Remember how sad I was last March when my snowboarding trip to the Swiss alps was cancelled?

This year, myself and Mrs SavingNinja even bought our first ever snowboards, we normally rent, but as we won’t have to pay to travel with snowboards this year due to catching a train instead of a plane, it seemed like the economical choice.

Check them out!

We’re super excited to hit the slopes on our very own boards, it will make this Christmas extra special, which is what we need after this dire 2020. I just hope our trip doesn’t get cancelled again.

How was your month?