This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Click here to see all of my past Savings Reports and view my interactive net worth chart

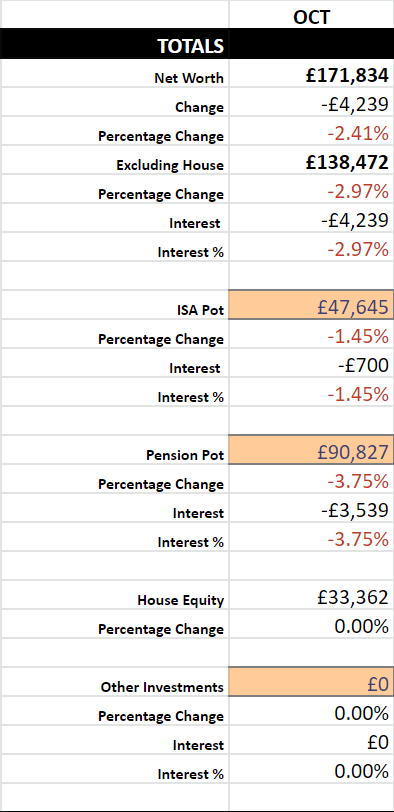

The markets are tanking again!

And this time I don’t have my own contributions propping my numbers up, so I’m feeling the full wrath of seeing my net worth drop month after month.

There is so much uncertainty right now with Brexit and the presidential election that I feel this turbulence will only get worse.

I did actually try to open my first investment account in Sweden this week to try and invest a bit whilst the market had dropped, but, as with everything in Sweden, there is no accessibility for English-only speakers, all we have are badly translated Swedish websites (I don’t understand why as more than half the people in Stockholm don’t speak Swedish, but almost everyone speaks English.)

This resulted in my opening a Nordnet account and only realising afterwards that they seem to want an 0.8% fee to buy into a Vanguard ETF domiciled in Ireland; by the way, Sweden have a stupid rule which bans Swedes from investing in US funds… WTF? You have to buy Swedish-only funds, or ones domiciled in the EU…

So, the only way to buy into Vanguard is via an ETF which tracks a Vanguard index that is listed in Germany or Ireland. BUT these have higher brokerage fees. Is taking 60% of my income and charging 25% VAT, not enough for you Sweden, you have to ban Vanguard too?

Anyway, watch this space, I should hopefully begin investing again by the next savings report, even if I have to pay extortionate fees.

The Swedish Pension is Rubbish

I found out that my employer pays roughly £1,100 per month into my Swedish private pension. This is cool, I thought. I even went as far as to include it in this savings report, but then I removed it when I found out that you can’t access your Swedish private pension until the age of around 68 (and it’s being extended.)

This makes it worse than the UK State pension, so I’ll not be considering it in my savings just like I exclude the UK state pension, as it’s simply too far away. From what I’ve experienced with the Swedish tax agency so far, I’d have less faith in this being around than the UK state pension when I reach that age.

New York

In other news, I’m working closely with my New York counterparts at work and it seems that if I wanted to, there is a high possibility of relocating to New York in a year or so. I don’t want to throw Sweden out of the window just yet, but as the US was always my initial goal; and I am kind of money-focused; this is something that we’ll seriously have to consider if the opportunity came about.

Premium Bonds Locked Away

I tried to withdraw my premium bonds this week as this will be a house deposit for Sweden and I wanted to change the currency into Swedish Krona before Brexit. They needed my phone number to confirm the withdrawal which I no longer have access to, this required them to send a temporary password, to my old address.

Now I have to go through the effort of requesting a withdrawal via post. Such a pain! I just hope that I don’t get blocked when trying to move this money out of my UK bank account and into a Swedish one, as I won’t be able to ‘pop into a branch’ like they normally require you to do.

Other News

Stockholm has increased some COVID rules, although nothing like the UK. The Swedish authorities tend to ’lightly suggest’ rather than enforce rules. I just hope our Swedish snowboarding holiday over Christmas won’t be effected as we already had our Swiss snowboarding holiday taken away from us last March.

Work is going well. 3 months left until my probationary period ends, I’ve had good feedback so far. I’m working with some extremely talented people from Google and all over the world, I’ve not actually met any other British people yet!

Making friends with people from Uruguay, Brazil, Iran, Armenia, to name a few, is very eye-opening; we’ve already gone to 2 house warming parties and tasted cuisine from countries we had never even heard of before. Stockholm, and specifically my company, is the most internationally mixed I’ve ever been, and it’s great! Also, more than half of my colleagues are women, and the amount of female programmers I’ve worked with in the past can be counted on one of my hands; my company really has their pick of the bunch!REPLACE slug: savings-report-28-brick-walls-to-climb