Introduction

2024 has been a crazy year for the SavingNinja household. It’s been our best year financially, but it’s also been one of the worst years for stress and anxiety in our lives.

We got laid off and lost our US Visa’s; needed to sell everything and move back to the UK unexpectedly; found out we were going to have a baby after being laid off; had to find a new job; a new place to live; a new car; buy everything to live again from scratch.

Then we had our baby and our life became 10 times more difficult. It was probably the worst timing in the world.

We’re slowly starting to settle again. And posts like this help me to put the year into perspective and stay positive.

This is a long post, so use the contents page above to navigate. I’ll start with the financial review first, if you’d rather skip right to the personal and goals section, click here .

2024 Financial Review

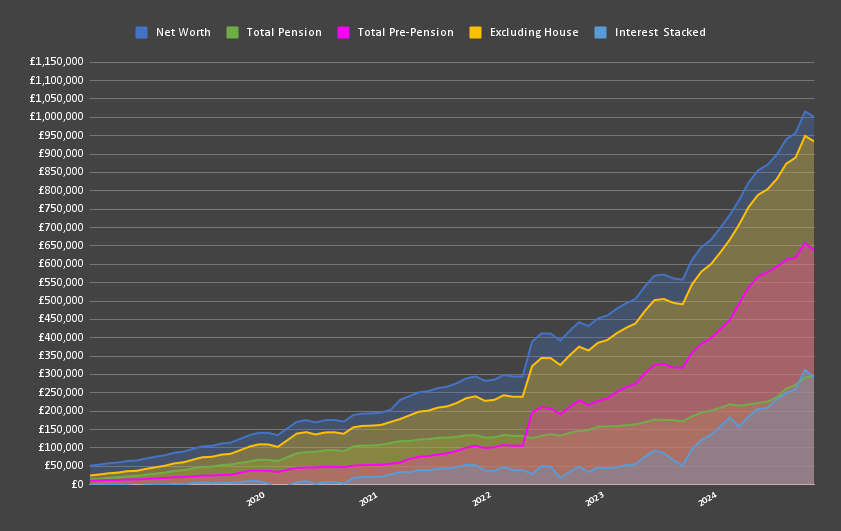

- £1,000,614 Networth (+£356,749)

- £933,890 Excluding House (+£356,749)

- £188,025 Contributed

- £168,724 Interest Earned

- £295,988 Pension (+£99,065)

- £52,273 Contributed

- £46,792 Interest Earned

- £637,902 Pre-Pension (+£257,684)

- £135,752 Contributed

- £121,932 Interest Earned

- £66,724 House Equity

In 2023 reviewed , 1 year ago, I was amazed at the £200k growth in a single year and I talked about how £1m net worth may only be 3 more years away.

This year, the growth was £356k, and we reached £1m in 10 months!

The year was insane from a stock market perspective. I’m not going to pretend that this was due to my high salary or lucky investment picks. It was purely down to the market going bananas. My portfolio’s investment gains grew by a combined 30.59% in 2024.

The crazy-gains is what led to the £1m goal being reached way ahead of schedule. My contributions went up in 2024 at £188k, but not by a huge margin compared to last year where we contributed £120k. The £120k investment gains are what added the tailwind, or more like rocket fuel.

I think from this point on, if the stock market performs, our investment gains will outweigh our contribution amount, this’s something that as of today, has never happened when measured annually. I’ve heard this term described as the ’tipping point’ as contributing doesn’t matter as much anymore.

Of course, I’m more than expecting a huge down turn with all of this recent growth, in which case it’s back to the heavy-contributing!

Total Net Worth

I assumed the chart was going to dip again after leaving America last year, but it’s continued to shoot up. This is, in part, due to investing my severance. It’s such a sharp incline that I’m expecting a correction any day now, and it will surely see a dip due to not contributing as much going forward. Or maybe the compound interest will continue to lift the chart skyward?

Interest vs Contributions

You can see the contributions really bumping the chart up, as well as some remarkable months for investment gains. Many 5 figure gain months and November breaching a £50k gain in a single month!

Stacked, you can see that interest vs contribution was neck and neck for 2024. In fact, if we didn’t have the down turn in December, it would have beaten contributions. I’m hoping 2025 will be the first year that this happens!

Even with the stock market in April and December dropping by a big amount, the trajectory for the year has been nothing but up, gaining £130k in 6 months from May to November.

Lifetime Interest

To really show how wild 2024 was, this chart shows how my total interest earned has gone off the rails this year. 6X from £50k lifetime earned to £300k lifetime earned. Now I know that the first 5 years of investing was really getting the snowball formed.

Interest growth each year. I really wish I had more invested in 2019. I’ve only witnessed one year with a loss, in 2022, and it was only 8%. It’s going to be hard when we have to go through a big one.

Yearly Growth

I’ve really one-upped myself every year as shown in this chart. I really doubt this will continue in 2025, but I hope that it does!

Shows how interest has made a difference each year. In 2022 I almost contributed the same as in 2024, but the stock market did poorly then.

Personal Life

Back to Blighty

This year has been… Turbulent.

I’m kind of glad it’s over.

The year started off with a lot of sadness knowing that soon we would be leaving the USA. We also were full of anxiety as we had to sell everything we owned and figure out the logistical nightmare of getting back to England with our cat. Not to mention how we would start again over here, needing a car, somewhere to live, and a job.

At the same time, while in the US, Mrs SavingNinja became pregnant and along with a little excitement came another boat load of anxiety.

The trinity of losing a job, having to relocate across the world with no family or friends in the states, and finding a new place to live, and doing it while pregnant.

We trooped on though. We made the most of our last months in America and we got through everything.

It didn’t kill us!

In a lot of ways, it made us stronger. I don’t think we’ll have to go through the amount of change, and stress that came with it, that we had to go through at the start of 2024 ever again. As we went through that, we can go through anything together.

England has not been great.

We moved very close to Mrs SavingNinja’s family and it’s been difficult to adapt to living so close to them after 14 years away. In a lot of ways, they don’t hold the same values as us, and they haven’t respected our boundaries and need for some space, both during and after the birth of our child.

Postpartum has been a struggle. The birth was difficult, and we’ve struggled to adapt to our new life where suddenly everything is different and time together is a luxury. At the same time, we’ve still been grieving the loss of our American life. Despite our financial fortune, we’re pretty unhappy.

We will adapt though, we just need time to settle and let our wounds heal. To adapt to our new normal.

Job prospects, not all bad

What did turn out well in the end was managing to get back into the company that laid me off. This has led to some bitterness on my part as it’s difficult not to compare what my colleagues didn’t lose in the form of stock options which for me would have been worth over $500k if I wasn’t laid off. Remember this blog post ? I picked a risky option, and for my first 4 years working with my employer they were worth nothing due to the stock being below my grant price. As soon as I was laid off they were forfeit. If I hadn’t been laid off, they would be worth $500k, which effectively would have been 4 years worth of my stock grant rolled up into one.

It’s hard not to be bitter.

But, this job is still double the pay of the job I would have been in if I didn’t return.

Working back with this employer also gives me the option of potentially getting back to America, or even continuing my green card application. Time will tell if this will be possible in 2025.

We both think that we would prefer to go back to America. But we don’t want to get our hopes up. This was exactly the same feeling that we had before we went initially, it all felt too good to be true… “We want to do it, but don’t get too excited, it might not happen!” We were so close to becoming permanent residents, but it still fell apart.

Things would be different now as well. We have Baby SavingNinja to worry about. The move would be even more stressful than before. I’d also have to join a new team. Anyway, time will tell.

Easy money in the UK

A hobby that I picked back up mid-way through 2024 was getting money from bank account switching. We’d been away from the UK for long enough that we were eligible to all of the sign up offers again and the hourly rate is too good to miss out on, especially as bank account switching bonuses are tax free.

Right now we’ve been paid £1615 and another £375 is on its way. All tax free and from very little effort.

If you are organized and use a sheet and reminders, it’s easy.

Your active time will be spent setting up or cancelling direct debits, moving money in and out of the new accounts, or making debit card payments - I just move money into Revolut in £10 increments using the debit card - until the sign up bonus terms are satisfied.

I probably spend around 30 minutes in aggregate to sign up and fulfill the requirements all in for £150-£200 tax free (twice if you’re doing it for you and your spouse!)

Goals

Goal Results for 2024

Below are the goals were set for 2023 Reviewed .

1. Climb the 3 highest UK mountains

This one was a complete failure. About 2 weeks after setting this goal, we found out that Mrs SavingNinja was pregnant. We spent the year indoors or doing light walks instead. Hopefully when Baby SavingNinja is a little bigger, we can put this goal back on the list again.

2. Read 25 books

Also a complete failure. I only read 8 books. I thought I would get to read more non-fiction but instead I set myself the challenge to read all of the Harry Potters as I never did as a child.

This trend looks like it will continue as I really want to re-read Branden Sandersons’ The Stormlight Archives as the last one in the series is being released this year and they’re one of my favorite series. It took me about a year last time to read them all, they’re hefty.

3. Master interviewing

I regret the word master here. I did learn a lot compared to when I set this goal. I feel like I’m above average with System Design interviews now, and getting there with algorithms. In fact, I passed the first round to what is notoriously one of the hardest companies to interview for last February and the highest score for system design.

I’m still continuing interview practice to this day. I’m not there yet where I feel super confident, but I feel like I’m close, and I don’t want to lose the momentum that not having a job gave me.

Goals for 2025

I have even less idea what to set for 2025 than I did for 2024. Our life has been flipped upside down and it’s still not the right way up again. But let’s see…

I recently read Die With Zero and one of the parts I really liked in the book was the recommendation to split your life into age buckets (e.g. 20-25, 25-30, 75+) and set specific bucket list items them focusing on experiences.

Currently in the 33-40 bucket while Baby SavingNinja is under 7, we’ve added the bucket items of a luxury Center Parcs holiday, to do Tough Mudder again and to learn Italian. I would have loved to add more to the “do before you have a baby” bucket if I’d read this book a couple of years ago.

In the spirit of buckets, what should we really aim to do in 2025, focusing on maximizing happiness from experiences?

It’s tough to envisage any semblance of normalcy with a 3 month old, I don’t really know what we’ll even be up for doing - and we still don’t know where we’ll be living.

…

I tried for days to think of some good goals, and couldn’t!

I’m just going to go back to the cookie cutter goals and borrow some from last year.

1. Be comfortable with the NeetCode 150

I’m being specific this time, this is the definitive roadmap for data structures and algorithms. I’m already most of the way there, just need to solidify each category.

By the end of the year I want to be confident with all of the categories and be in maintenance mode, refreshing my knowledge less often to keep on top of it.

2. Exercise one day a week - building up a sweat

I don’t want to add this goal but I should. I know that exercise is important and I’ve been severely neglecting it as of late. I’ve tried so many different styles over the years to build a healthy habit. 10 pushups a day, exercise every other day, Yoga, running, Darebee , but I’ve always fallen out of the habit.

I can surely manage one day a week! With the caveat that it should be a good enough session that I break a sweat, whatever it is.

I’ll have to find a way to properly track this…

3. Do an activity with my son at least once a week

I’m already realising that I can sometimes be a little distracted. I’m constantly on my phone, constantly ruminating and planning, even when I’m watching Baby SavingNinja. I don’t want to live to regret not giving him my full attention.

This goal is to make sure I spend some quality time with him at least once per week. This will also allow my wife to have a break.

Of course I spend a lot of time with him in dribs and drabs, but I want to be purposeful with an activity and give him my full attention for this one.

Last year I wrote about potentially either moving to Scotland, moving back to London or leaving the UK again.

This year, we still don’t know what we will do. Luckily, I re-joined the company I was laid off from. But now the focus is entirely on our son.

For 2025, we’ll focus on selling our rental house, getting past the infant stage with our baby, and finding our new normal. At the same time, we’ll slowly start considering our long-term goals again when we know what options become available to us.

Happy new year to everyone reading this!

I hope your 2024 was great and here’s to a happy and prosperous 2025.