Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

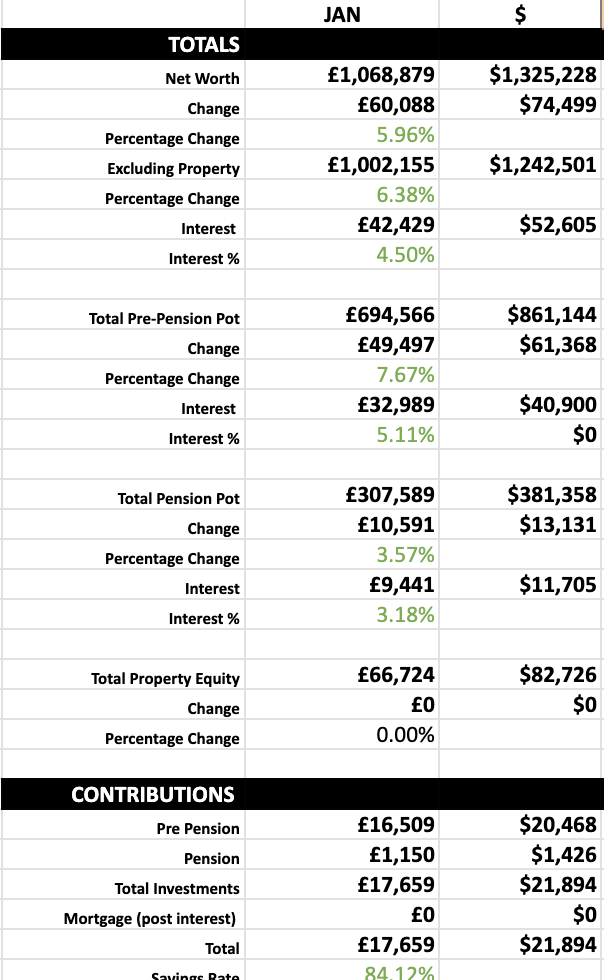

The market continues to be hyperbolic, recovering from the loss of last month and making up for it with a 4.5% increase.

I also moved my vested stock options into our main portfolio. These remain in company stock, which I know is risky, but I only want to sell when there is a tax advantage to do so, and it’s currently been rising so fast that the capital gain is too much.

So, January saw an increase of £60k already, £42k of that being in capital appreciation. I even withdrew a dividend payment this month instead of re-investing as I continue to stock-pile cash for the year.

Another goal was hit this month, £1m excluding property networth, which means we have £1m invested in the stock market. We’ll be witnessing huge swings going forward, I hope we can stomach it.

This month marked another tab in the Super Spreadsheet. My 8th year tracking finances every month. I still look forward to doing it every time!

Other News

We’re slowly starting to adapt to life with a baby. It’s still hard but it’s easier when you start to forget what it was like when it wasn’t hard.

He’s still not sleeping great but we’re getting through it, especially Mrs SavingNinja who is doing an amazing job. I definitely wouldn’t be able to do what she is doing with the amount of sleep she’s getting, or rather isn’t getting, and I’m thankful for her each day.

We’ve now transitioned him into a bigger cot a little further away from our bed. And we’re even going on a trip with him for a week in February, our first one! We’re excited to take him swimming and have a bit more time to relax away from me working.

During the trip we’ll also be visiting our rental house which is now being put up for sale after over 4 years as a BTL. I’m hoping the sale goes smoother than when we bought it 9 years ago. I’ll also do some maths afterwards to calculate if renting it out was even worth the stress this whole time.

Having the house gone will be a huge weight off our shoulders. I’m really not looking forward to dealing with shitty English solicitors again though, not after we saw how easy it was to buy and sell a house in Sweden - it literally took a week! Anyone got any recommendations?

By the next savings report I’ll find out if I’m eligible for any parental leave at work. They’ll either honour it and I’ll get 6 months, or I won’t get anything. There is a doubt if I’ll get it due to being laid off and then re-employed. My bosses are going to try, but HR might block it, wish me luck!

If I get it, it will make the next year much easier and we’ll spend it figuring out where we want to relocate to and going on lots of European trips, we’re not getting our hopes up until it’s been approved though.

Expenses

We’ve been tracking our expenses fully every month since we got back to the UK in June. The average based on that data was £2400 per month for 2024, £28,800 per year. Based on this, it looks like we are financially independent as our investment portfolio should support this annual expense at a 3% withdrawal rate. 2024 was a particularly expensive year as well needing to buy all of our appliances and furniture.

I’m glad we reached this milestone when I know I’ll still be working for a while, though, as I’d definitely like to build a much bigger buffer. We’d like to buy a bigger property wherever we settle so this will need to be accounted for as a future expense, I’d also like to know that our expenses can go up if needed as this figure is by no means set in stone.

I’ll continue to track expenses in 2025 to see if it goes up. I’m hoping we’ll continue to stay FI even if expenses creep up with the compounding of our portfolio until we’re fully confident that we can retire.