Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

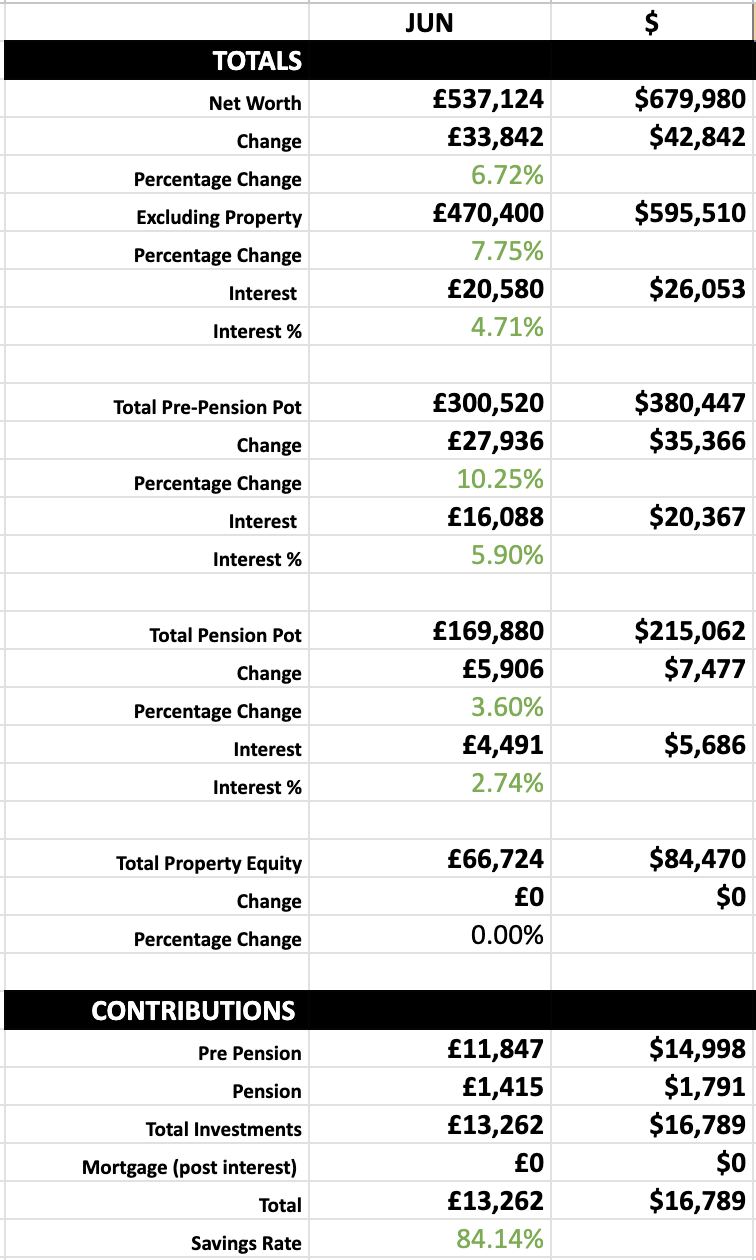

This month we added $15,000 after tax cash to our brokerage. I had some extra money lying around from a Swedish tax refund, so I topped up our regular 10k deposit.

The big deposit and a very good month for the stock market (almost 5% growth) meant we saw our biggest net worth change in a single month at £34k ($43k), a staggering $28k in stock market growth.

That’s almost a third of the interest we’ve earned in total since 2018, in a single month.

Crazy!

Maybe the compound interest flight is finally starting to take off.

Roth IRA’s

I got around to researching these american tax vehicles today. It seems that over here, the IRS likes to make things super complicated. But here’s what I effectively learnt.

Roth IRA’s are kind of similar to UK ISAs, you can invest money into them and the growth is tax free. With some differences:

- The limit is $6500 per year, $13k joint, much less than an ISA!

- You’re not supposed to be able to use this if you earn over $228k, but you can if you invest it in a different account first and then “roll it over” into a Roth IRA, which is ridiculous and just makes the IRS look stupid, it just means extra paperwork for high earners. (This loop hole has been open for the past 5 years.)

- You can withdraw the initial investment, penalty free, whenever you want. You can withdraw the interest earned penalty free if it’s been in there for at least 5 years, better than an ISA here!

I assumed that these accounts were similar to a pension where you couldn’t access it until 59, but now I’ve found out that you can, I’ll be maxing this out ASAP, hopefully in July.

Accounts in the US are generally better. Tax rates for capital gains up to $84k per year (if married filing jointly) are taxed at 0%. So, if you’re a frugal FIRE type, most unsheltered investments are kind of like UK ISA’s in the fact that they’ll be tax free. Even if you go over that, the rate is only 15% up to $500k per year. Pretty low!

There is so much you can write off in the US as well, primary home mortgage interest, any other loan interest for that matter, home renovations, property deprecation, all sorts. Tax seems to be virtually 0 if you retire here.

Other News

My company has approved the green card process so it has now begun! I’ll find out in the coming months how long it might take from the lawyers.

Life in the mountains is going well.

There are still some frustrations with renting as I outlined in this rant to fellow blogger TotalBalance.

I don’t like that we’re not in control of what we have to live with, we’re at the whims of the landlord. There are so many things that we would replace if we lived here, like the 20 year old oven, or the half broken fridge. The cost isn’t too much for us, but we don’t want to replace it when it isn’t ours, and the landlord is a cheap ass (never thought I’d say that). There are 2 rooms upstairs which have skylights and they don’t open properly, meaning the office gets too hot on some days to work or game in, I found out that they’re 25 years old after I rang Velux to try and debug what was wrong with them.

We can’t force him to replace or repair them, and there are barely any locations this rural to rent, this was literally the only one at this price range ($1850!) So, we have to suck it up and live with the things that we don’t like and try to appreciate what we do.

It seems the US is catered toward buying. Although we’re still resigned to the fact that we should wait until we can indefinitely stay in the states (when we get a green card) before we buy as the agent purchase and selling fees are too high for it to be short term.

Other Other News, Cheese!

I ventured down a bit of a rabbit hole with dairy this month. I’ve created a spreadsheet comparing the difference between making and buying popular dairy products and how much savings it might offer.

I’ve always enjoyed making dairy products and started years ago before leaving the UK, but this month I went dairy crazy!

Some sneak peak conclusions from my initial experiments:

Yogurt is super easy to make and it’s 4 times cheaper to do so. It tastes a lot better too.

Fresh cream cheese is delicious, it’s also super easy to make if you have a blender, it’s 4 times cheaper to make it yourself than to buy philadelphia cream cheese. If you’re making a Cheesecake Factory style cheesecake (my favorite cake recipe), it will save you a staggering $11 per cheesecake if you make the cream cheese yourself.

Heavy cream. In the USA, it’s 10X cheaper to make heavy cream yourself, and guess what you have to do? You whisk milk and butter together, you don’t even have to cook it!! What the hell.

Mozzarella and cottage cheese is next.