Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

Propertyless

We’ve sold our house!

After a very bumpy road, we finally signed the contract in November and got the money.

It feels very liberating to not own any property.

The whole process was terrible and cost a lot of money. After owning the house for 8 years, I can confidently say it was a terrible financial decision. Bear in mind that we bought this house as a way to save money, we spent way less than we could have afforded at the time as we didn’t need the extra space. We refused to sell after 3 years when leaving the UK for less than we bought it for and rented it out for 5 years instead.

It’s pretty sobering to realize that we would have had more money had we continued to rent and invested the capital instead.

All of the boomer advice to “Buy property, you’re throwing money away renting!” is terrible. The value proposition only looks worse now that we’re in a high interest rate environment - much worse.

I found this handy rent vs buy calculator and I couldn’t find any way to make buying work out better.

Using our current rental property, a 3 bed in the north of England costing us £900 per month, which would cost around £300k to buy new, with a 25% deposit, the calculator shows that we’d be almost £100k worse off buying after 10 years.

You can see this summary here

You can see this summary here

That’s huge!

Have a go yourself and tell me your results.

Of course, we may have to buy in the future if there aren’t any suitable rental properties. If we do, we’ll make sure that we go into the purchase knowing that it is a worse financial decision that will also anchor us to one place.

Finances

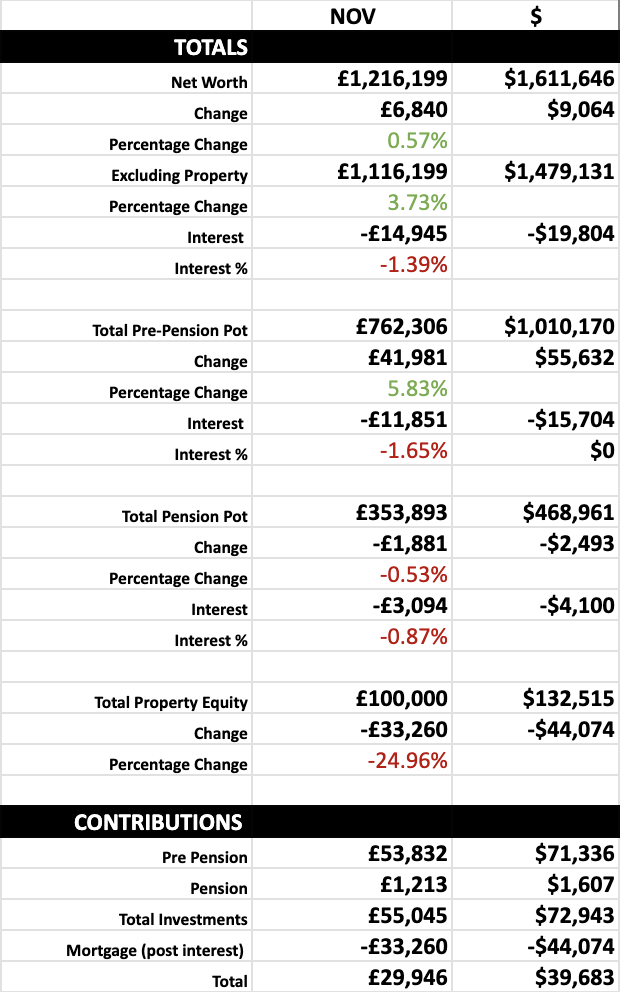

November bought a pretty sharp decline in value for our portfolio. It had mostly recovered by the end of the month but still ended up 1.3% down. I think it’s already recovered since releasing this post, but I’ll see in December.

With the house sale, we received £220k into our bank account. We used around £35k to pay off the remaining IBKR margin loan, put £20k into two ISA’s, and put the rest into a current account earning 4.5% (Ulster Bank.)

Now there’s the tricky task ahead of us deciding what to do with this money.

Currently, we still have £45k in 0% interest credit cards owed that expire at different points with the earliest starting in March next year, so I’ll leave at least that much in the current account. I plan to not touch another £40k so our ISA’s can be filled in April straight away.

For now, I’ve marked £100k in “house equity” on the Super Savings spreadsheet. Right now, I have no idea if we’ll want to buy a house again in 2-3 years, so it seems sensible to leave at least that much in cash ready to put into a deposit. I’m also very aware we’re in an all-time-high for the market as well, and I don’t know how I’ll feel pulling £100k out for a deposit if we were in a massive bear market.

This kinda feels like market timing though… And I know that we could use margin to get a house deposit if we had to, £100k being about 15% of our general investment account, which would be pretty safe.

I need to do some more thinking on this.

Is it smart to leave £100k (plus the £45k in 0% credit cards,) in a 4.5% earning current account to potentially use in 3 years on a house purchase, (and a little bit as a de-risking strategy?)

Or should it be invested into VWRL in our general investment account - meaning we can’t withdraw it again without paying a huge capital gains tax bill due to UK capital gains being averaged (which is stupid) - and then we’d use a margin loan to front-load the capital needed for a house deposit if we need it?

Traditional advice would be to leave this money out of the market if we think we may need it. And with it being only 10% of our capital that we have invested, it doesn’t seem as bad as it would have if it was more like 50%. But at the same time, £100k is a lot of money to leave off the table if the market takes off to the stratosphere upon the shoulders of AGI, it could be a very costly mistake - but then would it matter if our £1m doubles or triples along the way? Would that £100k-200k potential loss out of £3m be worth it for some peace of mind that having this money set aside in case the market crashes would give?

What would you do? Leave me an email or comment below, any advice would be appreciated!

End of the year

We’re almost at the end of 2025!

I’ve started getting my spreadsheet and analytics set up for an end of the year post, it’s shaping up to be a very profitable one just like last year. I’m hoping there’s a santa rally to push us over the edge of another couple of milestones.

Christmas is going to be special this year with Baby SavingNinja being over 1, it feels like his first Christmas. It’s the first time we’re hosting our family as well! We’ve already began prepping the food.

Anyway, see you in the new year. Thanks for reading during 2025 and have a Merry Christmas!