Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

We found a buyer for our house!

We accepted an offer quite a bit lower than we were expecting at £217.5k. I then began to panic when instructing a solicitor, as all of them said that they’d have to let the current mortgage provider know we’re living there, so my plan to wait until September to pay off the mortgage was foiled.

I then started reading about all of the bad things that could happen if we were caught living in a BTL. I thought the worst of it would be they’d force us to re-pay, but it seems we could go on a blacklist and not be able to get a mortgage again.

So, I promptly paid off the mortgage. This was frustrating as even though we were only 2 months away from the end of our 5-year fixed deal, we still had to pay £1700 in early repayment charges, triple what the remaining interest would have been.

But, I swallowed the annoyance and paid it off anyway.

The buyers then failed to get a mortgage and we had to re-list the property for sale. Doh!

It was a nice opportunity for some exposure therapy to wasting money, and at least we had some peace of mind.

Luckily, within a week, we had a new buyer - and this time at £225k, so we would have repaid early anyway.

Where to next?

We’ve settled on renting a property in the north of England, preferably close to the Lake District. We really loved it there during our visit, it’s much cheaper, has a lot of new places to explore (we’ve been in the South during all of our adult, English-based lives,) and it has good access to Scotland.

We still think long term that we would like to relocate to Canada (if possible.) We’ll stay in the UK as long as I have my job and my original stock grant which expires in 3 years. In the meantime, we’ll continue exploring the UK and if we fall in love with some place here, we can re-consider. I’m still worried that our capital gains burden may grow so big that we’ll be forced to leave - so we may need some intermittent step in the Isle of Man for 5 years after FIRE’ing to realize the gains if we decide to stay in the UK long-term.

Finances

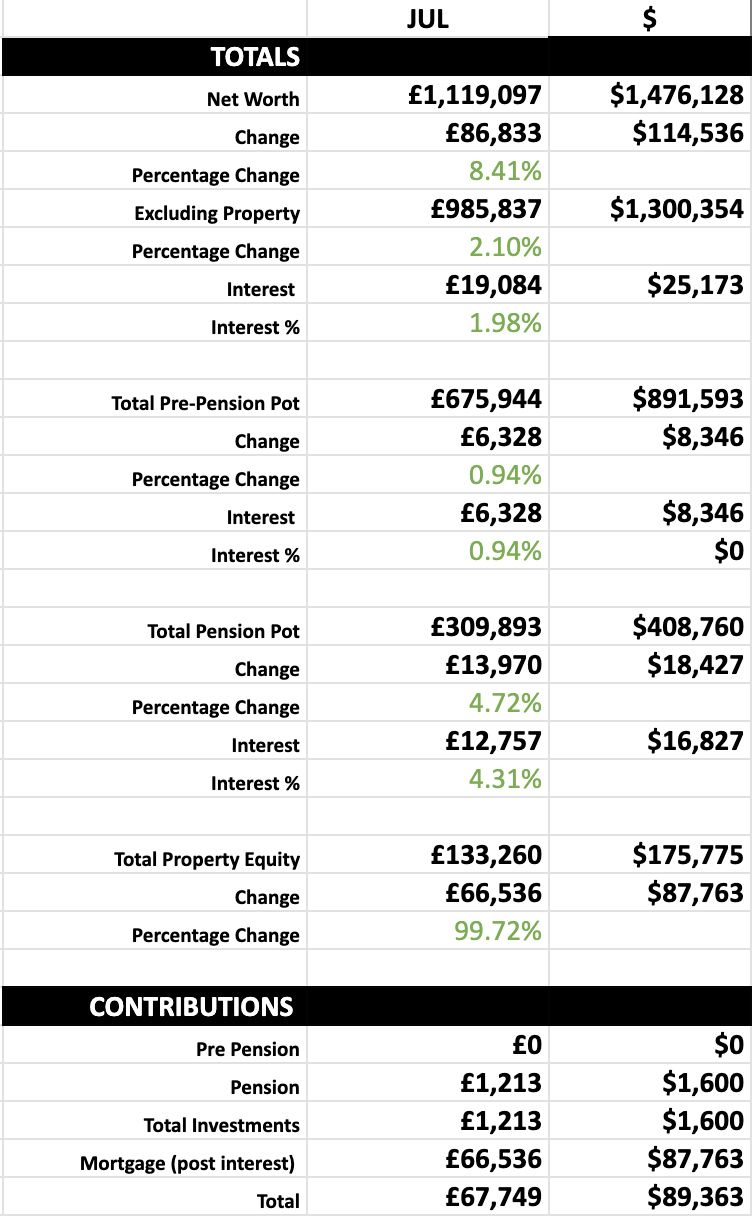

Our net worth has shot up this month. It’s mainly due to paying off our mortgage, so £66,500 got added to the house equity figure. I haven’t included the margin loan or 0% credit card balances in this, which ended up being £37k and £45k and is assuming a £225k sale minus tax, estate agent, and solicitors fees.

For the next few months I’ll be paying off the margin loan as it has 5.8% interest so we should see a big bump in investments once the house sells and we redistribute the proceeds.

As well as this house equity addition, the markets also performed well, appreciating by £20k, this would have been £14k higher if my company stock (listed in “Other Investments” in the sheet,) didn’t drop so much after their quarterly earnings. The pound also recovered some value against the dollar.

So we’re now at £1.15m! Some notable milestones are close, we’re almost at $1.5m net worth. We’re also at £986k invested; very close to having £1m invested in the market, which feels surreal!

At this point, I feel we’re just continuing to save above £1m to buy a house that we want outright. £1m and a paid off house will be enough, surely!? I’m planning on continuing to work until my stock grant is paid anyway, hopefully that will be enough time to have enough.

Of course, Monevators post about the UK safe withdrawal rate being a lot lower (2.9%!) Makes me anxious that £1m won’t be enough…

I need to remember my Mustachian values, though, surely we won’t earn nothing in retirement. We’ll be in our 30’s, I definitely won’t be satisfied not doing something for myself business wise, Mrs SavingNinja still has yearly gigs and could bring in another £5k or more annually, £1m should be enough at this age where we’ll continue earning.

Then again, playing devils advocate, maybe the ability to earn more money will get harder and harder, especially with the new AI-era. The future is uncertain and it makes me anxious. This also means it would be increasingly unlikely that I could go back into my previous profession if I wanted to, the world is changing too much. If I still have a well paid job, why not make the most of it while it’s still there before I’m made redundant?

Hopefully, 3 more years and we’ll do so well financially that we’ll be safe beyond a reasonable doubt, then we won’t have to battle with these decisions. Maybe we’ll be at £2m by then? That should be enough… Right?

Baby Life

Baby SavingNinja is getting more adorable each day, and it’s getting easier - he’s sleeping well and not crying as much.

I’ve been enjoying my parental leave, although it has really highlighted to me that I get depressed and lost when I don’t have the focus of a job. I need to do something in addition to parenting to make me feel like I’m accomplishing more. I’ve started a couple of projects in the spare time that I get, one of them game development using Godot. This has bought me some more happiness.

It really is showing me that I need to have a plan before we pull the trigger with retiring early, I am definitely the type to go on a depressive spiral unless I know what’s next and have some passion projects to fill my time.

This is why I think it’s more important for us that we transition to post-FIRE life slowly, finding our place, finding our thing, all while still working before quitting, a slow transition instead of a harsh rug-pull. Luckily, fully-remote work makes it easier to do this.

At the end of this month we’ll be going on a European road-trip to visit some mountains and lakes. We’ll then be visiting Stockholm for a week, and we may need to move house in the middle, so I’ll probably skip, or do a very short financial-only update next month.

How was your month?

Side-note, what’s going on with UK politics? I’m hearing rumours of a wealth-tax, further increased taxes, even tying council tax / NHS payments to peoples income. We’ve also now got these silly Online Verification Laws blocking all social media? Under 16 year olds can’t use Instagram or X? What is going on? It’s making me want to leave even more.