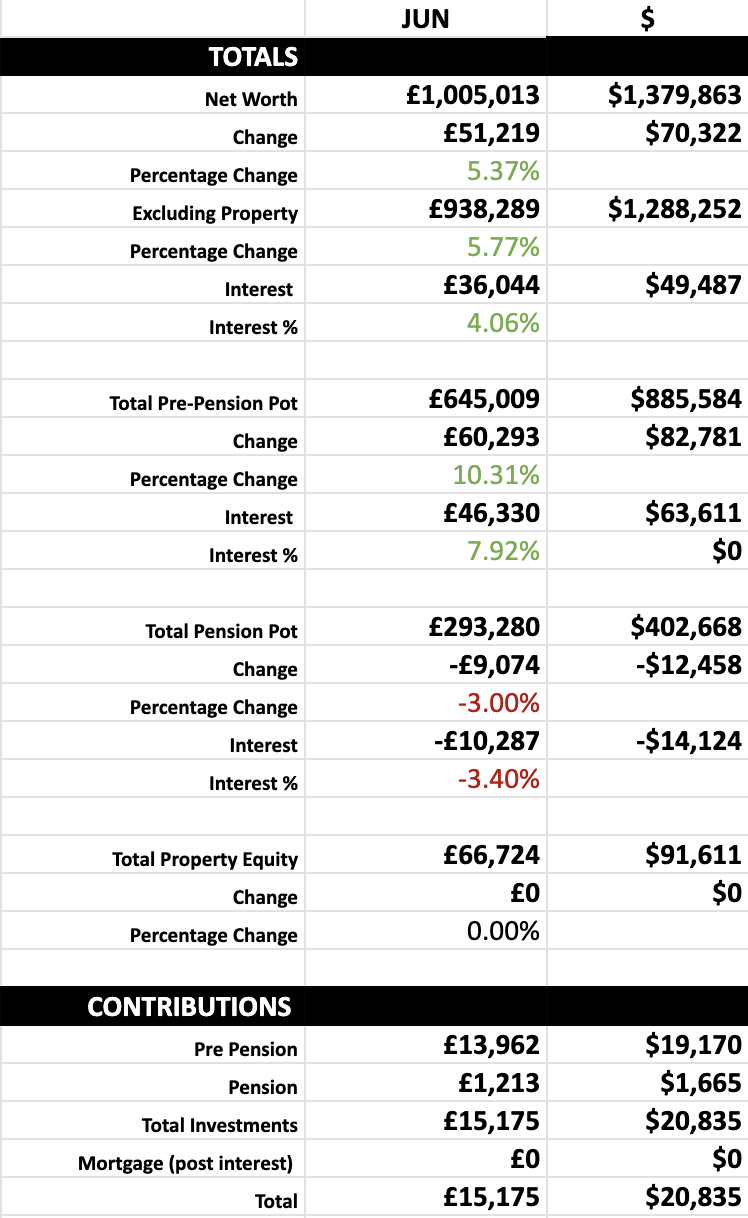

Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

The stock market has gotten back into full swing now, funds sitting at the same price they were back in February. As GBP is 10% stronger, these USD denominated funds are still showing around 10% less, though, which means right now they’re still on sale!

I’m hoping to complete the house purchase before the USD rebounds then there may be a good profit from dumping an extra £180k in at a 10% discount.

House sale update

We’ve accepted an offer of £217.5k on our place. We’re thankful to have an offer, but this is way lower than expected. I even had the value of this property marked at £220k pessimistically in our savings spreadsheet 5 years ago.

We bought the place for £195k 8 years ago and I think we made a mistake getting a leasehold with no parking. We should have put more money in for a freehold with parking, we could more than afford it. I’d just read Early Retirement Extreme at the time and wanted to move into the cheapest place we’d be comfortable.

The problem is, we put in a new kitchen, a new bathroom, new flooring and a new boiler, amounting to over £20k. Those renovations make the property £215k, great, £2.5k profit right? No… It cost us around £5k to buy it (we had to pay stamp duty back then.) £5200 more to sell it - solicitors and estate agents are way more expensive in the South East. We’re £7.7k down.

If we account for the opportunity cost of our initial £30k deposit, which if I’d have shoved it in the S&P 500 8 years ago would be worth £147k now then this house purchase was a terrible investment.

I hear some of you saying, “What about the saved rent?”

Yeah, the mortgage interest alone was always about half of the cost that renting would have been, having the deposit invested would have more than covered it.

We even, stupidly, rented it out for 5 years! Adding a lot more anxiety and stress for barely any gain post-tax, and missing out on the best stock market rally ever… All because we didn’t want to “Sell at a loss,” 5 years ago.

It’s not even bought us much joy living here. It’s tied us down. Even right now it’s tying us down, the place isn’t big enough for a baby and it’s very inconvenient having to walk across a busy road to get to our car. But we didn’t want to pay for two places while we got this sold.

All of this is leading me to think, buying is a dumb financial decision. Or maybe we just made a bad choice when deciding what to buy? My parents have made £50k profit with every house move every 3 years up north. Luck maybe?

For the next few years, we’ll be renting again, but I’m hoping to find a better rental accommodation by paying a little more than we have in the past, maybe in the £1,500 per month range rather than the £1000 per month that we normally look for - we have started looking up north for a change of scenery and lower rents.

We won’t buy again until we’re absolutely sure on the location, and the property.

Paying the mortgage

We now have £116k cash sitting in a Chase savings account. £45k of that we have stoozed on 0% credit cards. I still plan on taking out a margin loan against our IBKR portfolio to make up the shortfall for £156k left on the mortgage by the time the fixed rate ends on October 1st, but we’ve done a lot better than I thought we would with savings and stoozing.

One more credit card application and we may not need to borrow on margin at all. The two cards I used which gave me the highest limit (£18k each) was Santander and MBNA. MBNA had a 2.99% fee to balance transfer, Santander was free.

Any recommendations for high credit limit 0% cards, let me know! How would people feel about a guide for stoozing? I couldn’t find a lot of info on the cash transfer method, but I’ve got the hang of it now.

If I wasn’t using this to pay off the mortgage, in the Chase savings account at 4.5% it would currently make £2025 per year. I got the £45k credit for a total of £500, some finish in 18 months, others in 33 months, it’s a good deal!

Now we just have to decide where we’re going to rent for the next couple of years.

Any suggestions?