Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

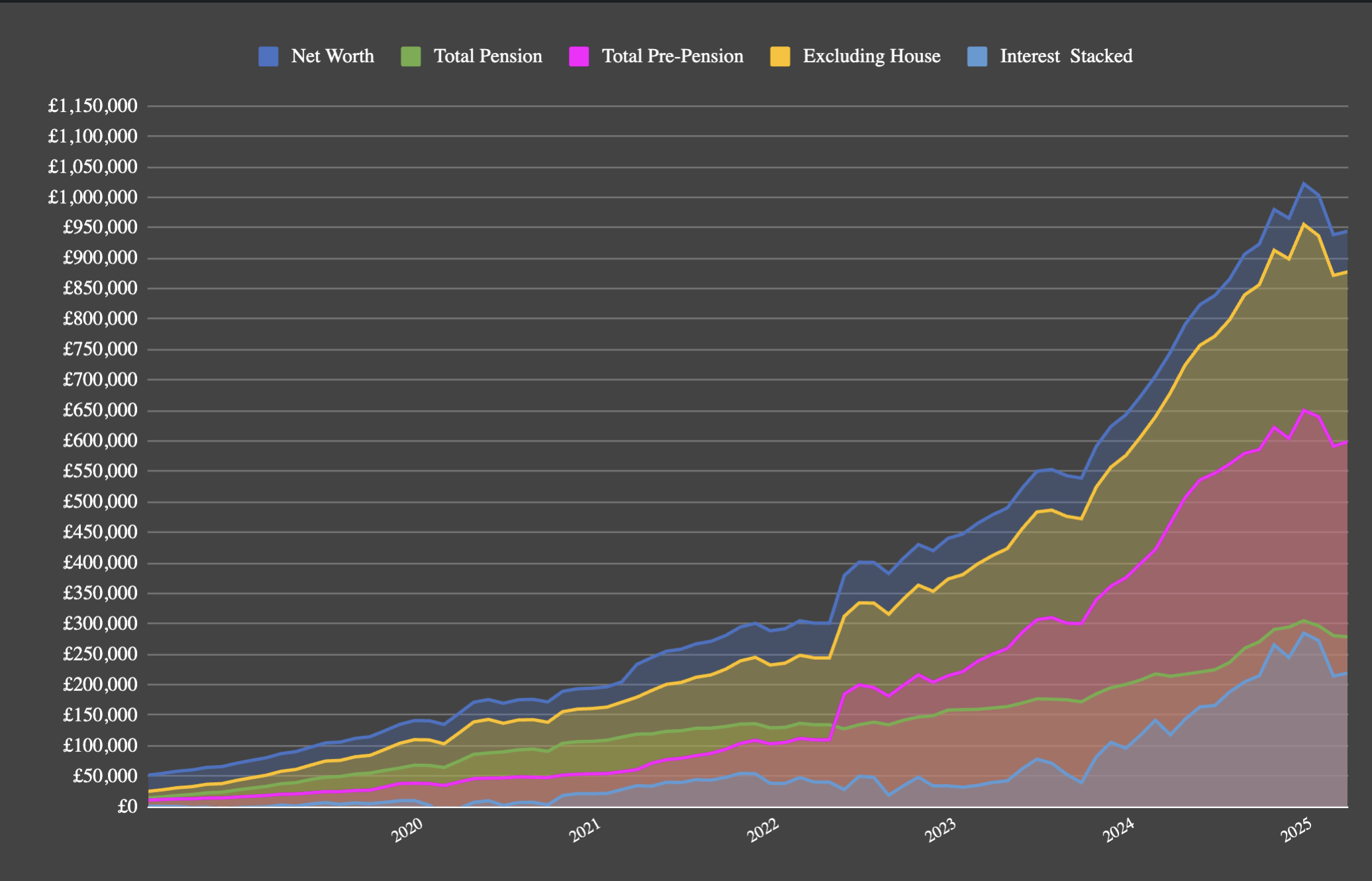

We’re still around £130k down since January. If this was 3 years ago, it would have been half of our networth!

When I look at our net worth chart from My Financial Journey , the dip still doesn’t look that bad compared to the huge gains last year.

This really just shows how much of a crazy year last year was, and how quickly you acclimatize to your new net worth number.

Maybe there’s more to drop? We’re still holding strong, and also collecting cash to pay off our mortgage in September.

We’re at £60k in cash right now, earning 4.8% in an easy-access savings account.

When the mortgage 3% fix comes to an end in September, I predict we’ll be at around £110k cash. This figure will include £18.5k from stoozed 0% credit cards. We owe £155k on the mortgage, so I’m still looking into borrowing the rest on margin from Interactive Brokers at 5.8%. This should be fairly low-risk with a £500k passive-index fund investment account, but I still need to do more research into it.

It’s been very strange not contributing to our investment pot. I hope we’re not missing out on an opportunity to buy low when the market is deflated. Aiming to pay off our mortgage in September is the first time we’ve really used our savings for the utility of it, so I keep reassuring myself that, it’s there to be used, right!?

Paying it off should make it easier to sell the house. We won’t be strapped with either an 8% rate or having to get a new loan. We also won’t have the risk of the mortgage lender finding out that we’re living here when we shouldn’t be as it’s a buy-to-let mortgage.

Using the IBKR margin is a lot easier too. No crappy retail banks to deal with, just borrow or pay it off whenever we need the cashflow.

Other News

I’ll be starting my 7 months parental leave very soon. I’m thankful that I got this approved and it validates that it was the right decision to re-join my current company. It’s insane to me that this is a benefit on offer and I’m still going to get my full salary when most other UK employers just give 2-weeks. I feel very lucky.

I’m both anxious and excited to spend that time with Baby SavingNinja. I’d like to treat it like a mini retire-early and see how it feels not having a full time job while looking after a baby with Mrs SavingNinja.

That’s all for now.

How was your month?