Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

In September, Baby SavingNinja was born!

The birth was way more harrowing than I thought it would be and it really affected me to the point where I can’t imagine doing it again. Mrs SavingNinja, however, went through it like a champ.

She ended up being induced due to some risk factors, this is where the doctors stimulate labour. This meant 2 days in the hospital waiting to go into ‘active labour.’ Active labour happened at around 5pm on the second day and we then went through the terrible process of contracting and getting to 8cm dilated. The active labour went on through the night and into the next day for about 18h.

After all of that hard work and no sleep, in the end, the baby got stuck and we needed an emergency C-section.

The C-section itself was fine for Mrs SavingNinja but I nearly passed out when I inadvertently saw her cut open and I felt an overwhelming feeling of “What the fuck are we doing!?” and a feeling of the doctors defiling my wife’s body for this little baby alien that came out of her.

After this was a week of being shell shocked, having no sleep, while trying to keep this thing alive, contemplating our life decisions the whole time.

This is HARD!!!

Right now, Mrs SavingNinja is feeding every 2 hours, trying to get him up to his birth weight, our bodies have slowly started adapting to our new normal, Mrs SavingNinja is healing very quickly, and we’re beginning to feel human again.

We’re still in the trenches and right now can’t think how we’re ever going to have hobbies, go on hikes, or travel ever again. I’m going back to work in a little over 1 week, but each day it gets a little better.

We also love the little dude more each day.

Finances

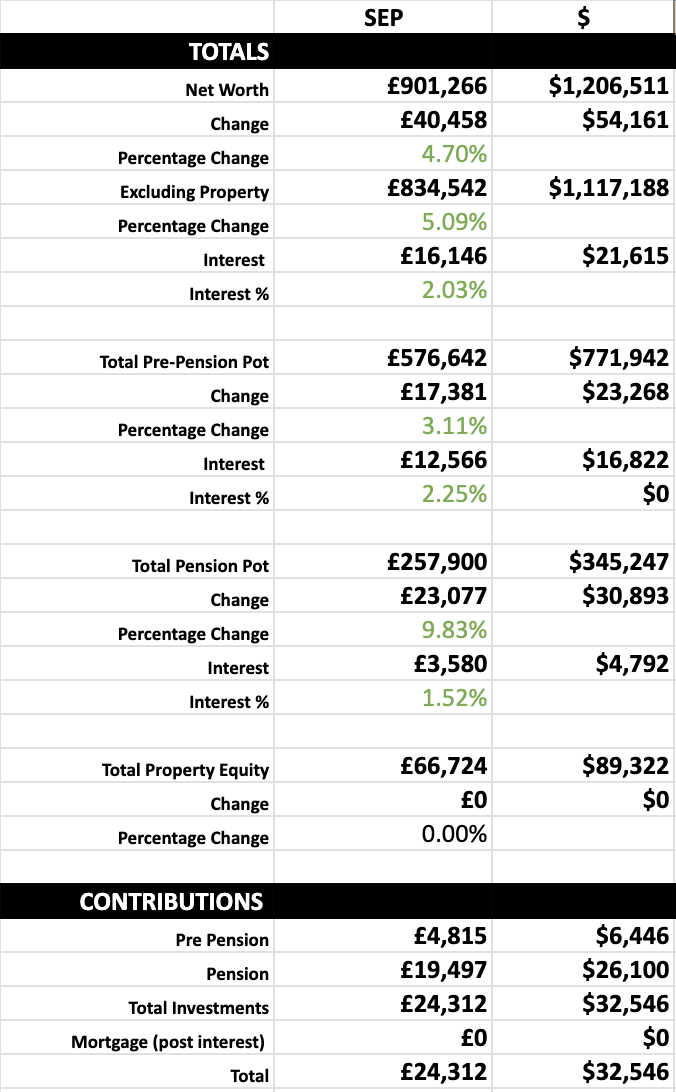

In September we both used our £3000 capital gains allowances. I sold some of my RSUs and Mrs SavingNinja sold some stock from our VTI invested General Investment Account and we re-invested it, along with a top-up, into VWRL .

We also consolidated Mrs SavingNinja’s pensions into Fidelity and added another £5k, we’ve yet to receive the governments 25% top-up.

All of this combined meant we contributed an extra £25k net to our savings. Along with £16k of growth from the buoyant stock market our net worth grew by £40k and pushed us over the £900k threshold.

Only £100k more to go until we reach that big £1m!

Will we reach it before the end of 2024?

Pondering

The more our money grows, the more anxious and depressed I seem to get. We’ve gained £250k net worth since January. The pot is growing so fast that there is a sense of dread that we can lose it again just as quickly.

There is also a feeling of needing to ‘choose’ what we want to do with our lives after becoming displaced from America, and now displaced further with the new Scream Potato in our lives. The more we achieve our financial goals, the closer that big decision seems to get.

I know, of course, that I’m just too anxious, we don’t have to make any decision if we don’t want to. I just feel like we have to.

We’ve already committed to spending 2 more tax years (after this one) filling up our SIPP’s in the UK if I keep my job. Maybe we should just focus on that and exploring potential new homes via family holidays when we feel ready. I always like a good contingency plan, though. If I lost my job tomorrow, I’d want to know what we should do.

More on this contingency planning soon when we get caught up on sleep!

Fingers crossed the October budget isn’t too brutal and I’m really hoping that they don’t put in place an exit tax as that would be catastrophic for us.

See you soon.