Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

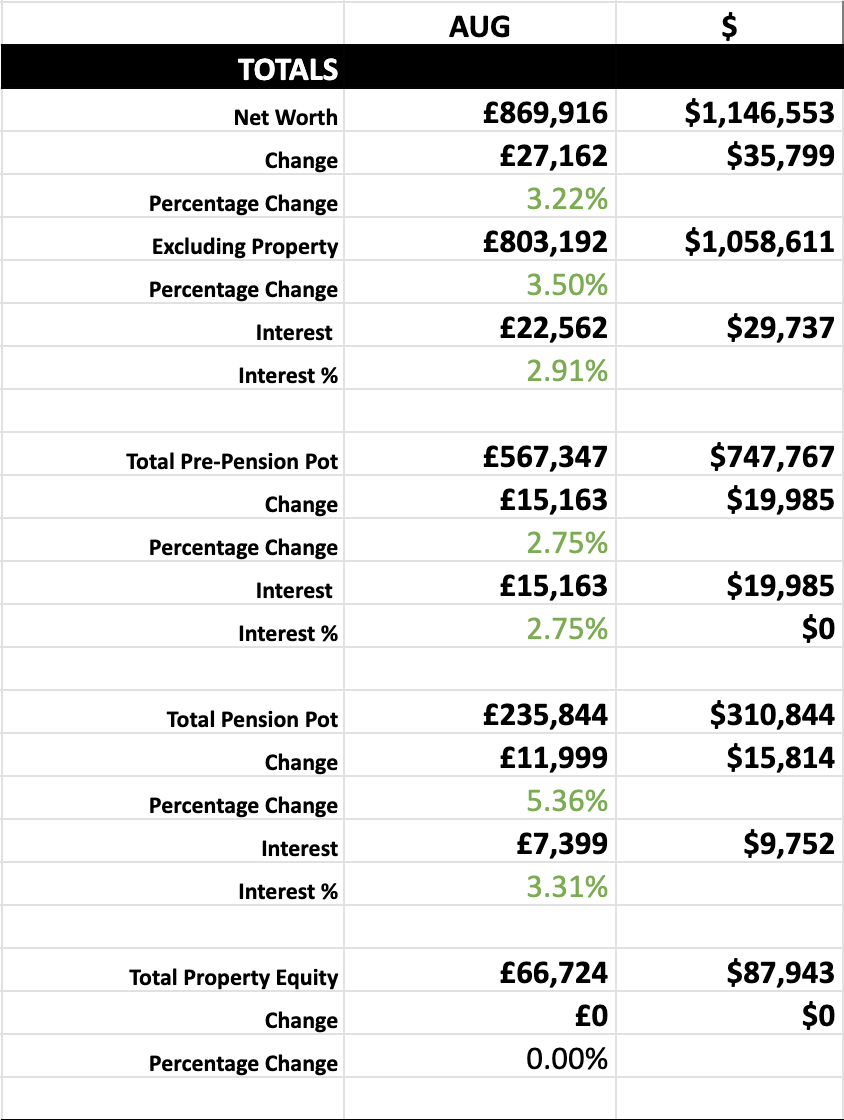

August was a rollercoaster for stocks, dipping at the start of the month but then recovering. September seems to be going through a similar swing, but I took this snapshot before the drop.

We’re quickly approaching £900k net worth. Maybe next month will be the one? I’m still very hopeful to cross the £1m mark before the end of the year. Mrs SavingNinja’s old SIPP will be added to the spreadsheet in September as well as a lump sum investment into it, this will help us get there.

Baby SavingNinja is very close to being born. I’ve started a few draft articles exploring the best savings accounts for a child.

The Junior SIPP sounds very appealing. You can contribute £2880 per year and the government tops it up to £3600.

Doing this for a few years when your kid is born would set them up for retirement! Even just 1 deposit when they’re born would give them £250k in todays money at 60. Do it for 3 years and they have a £665k pension, pre-inflation.

I really wish my or my wife’s parents had done this for us.

Capital gains

I also have another draft blog post that I’ve almost finished exploring our capital gains tax problem. We’re currently sitting on $700k in a general investment account with £150k of capital gains that we’ve yet to pay tax on.

This leaves us with the headache of tax planning as this pot will continuing to grow exponentially, even if we need to take some out to fill our ISAs each year, leaving us with a huge potential bill at the end of the rainbow that could be avoided if we leave the UK.

This should be published soon, and I’ll need your advice on what to do!

Delayed savings reports

Baby is due very soon and I will probably be delaying the next savings report. Very excited and nervous about it all, but I’ll see you when I’m officially a Dad!