Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

The stock market is now back at its Pre-2022 all time high. Scanning the web, the sentiment seems to think that another crash must be coming. But then again, people have been saying that for the last year. Maybe this is the beginning of another 10 year bull run on the back of the wings of AI.

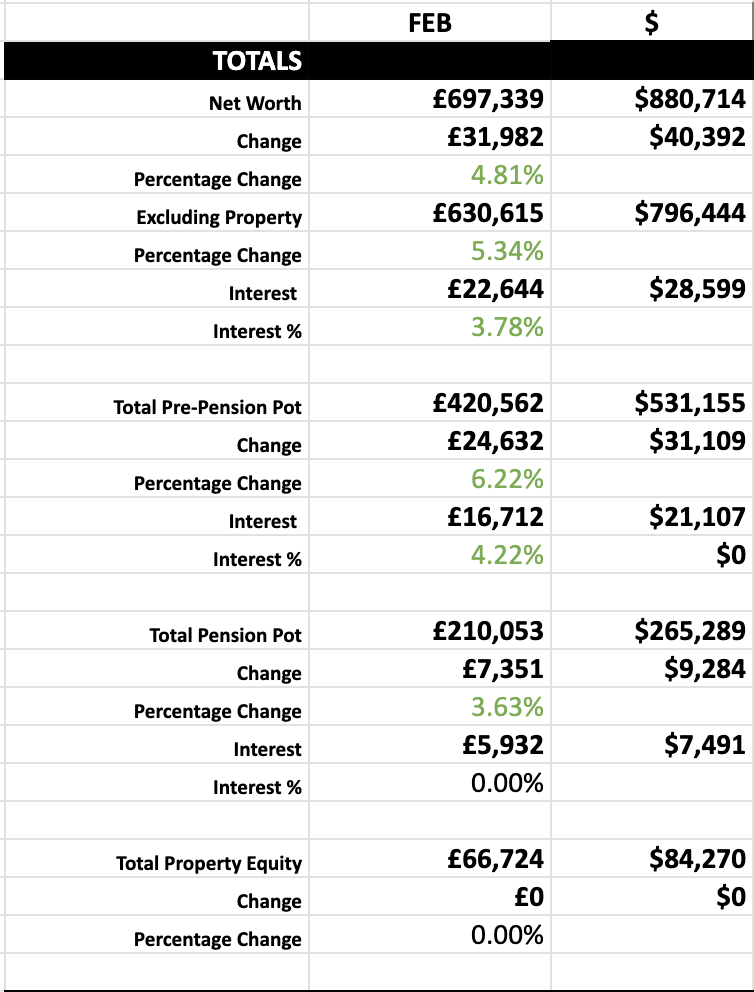

For now, it’s making our numbers look good. But I’m trying not to get too invested in these new net worth figures to brace for the inevitable drops which will hit harder due to the bigger pot. I only hope that I’ve got a well paid job by the time it drops so I can take advantage of it!

My job hunt has been fruitless so far, but I’ve got a few interviews lined up. It seems most will require me to move back to London on a hybrid model if I want to earn around £120k and up, otherwise I’d be looking at around £75k for most fully-remote companies (there are some exceptions.)

Right now, I feel like it would be worth going back into London for 2-3 days a week for a couple more years. This would allow me to max my pension contributions at £60k annually and bulk it out a bit more, as my UK pension pot only has £120k in it. This was good before, at 32, with the LTA in place, but with it removed, I want to load it up again.

Now that we have roughly £500k in our pre-pension accounts, continuing to save a lot for a couple more years into a pension would make it even easier to consider truly retiring early.

We also have 2 more years left on our UK buy-to-let mortgage, so we’ll be renting until that’s sold. This coincides perfectly with aggressive London-earning savings, then when we sell the rental and can buy another UK property, we can consider if we want to take a pay-cut and go fully remote to buy a house somewhere again. Maybe Scotland?

There are only 5 weeks left until we leave the USA to return home. We’re pretty stressed about it, selling items every day and making arrangements. We haven’t had any interest in the car, it seems most Americans buy via car loans from dealerships, so our chances of selling a $20k+ car to said random American is pretty low. It’s looking like we’ll have to sell at an extra low rate to a bulk car buyer or dealership securing a $15k+ loss in 2 years… It hurts to lose this much on a car, but we’ll take it on the chin as the price of moving to a remote US area and needing a car before we had a social security number and US license. We can’t wait to get a £1k UK banger again!

Next savings report we’ll be leaving in 1 week! I’ll try and write one straight away before we leave, I’ll be in full on panic mode, and probably living with no furniture other than an air mattress.

See you then!