Introduction

It’s that time of year again where I review our finances and post a general update looking back at the year gone and forward to the next one.

I still think that these annual review posts are one of the most important for me. Life retrospectives can give valuable insight into what’s working, what isn’t, and they can remind me about our family aspirations and goals.

This is my 8th one!

I attribute a lot of our successes in life to finding the time to pause, review, and think when writing posts like this. Maybe we wouldn’t have reached the same financial goals if not for these posts?

With that in mind, even though the blogging passion has died down within me, I still want to make sure that I dedicate a good amount of time to these posts and give them my all.

Alright, let’s move on to the financial review.

As always, click here if you want to skip the financial update and go straight to personal updates.

2025 Financial Review

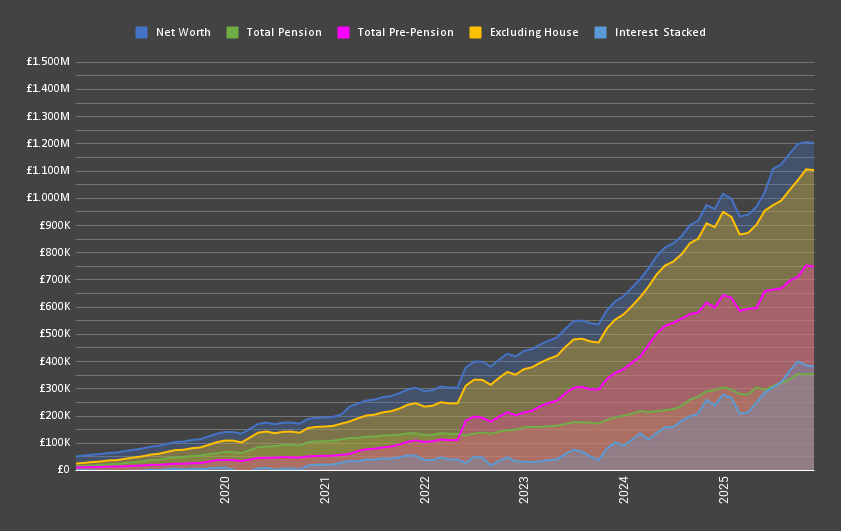

- £1,202,870 Networth (+£251,305)

- £1,102,870 Excluding House (+£209,502)

- £108,643 Contributed

- £142,661 Interest Earned

- £354,393 Pension (+£59,256)

- £14,241 Contributed

- £45,055 Interest Earned

- £748,477 Pre-Pension (+£150,206)

- £52,599 Contributed

- £97,607 Interest Earned

- £100,000 House Equity (+£33,276)

It’s been another stellar year for our finances. Our net worth soared by £250k to £1.2m.

2025 was the year that we sold our property that we’d owned for 8 years. We aggressively paid off our mortgage before the sale which meant that we didn’t contribute as much to the market as we would have done.

The property sold in November but the spreadsheet now lists £100k as ‘property equity’ - up from the previous £60k. This is because I’ve earmarked £100k in a savings account for our next purchase. I decided against investing this due to the frothy market, and I’m treating it as a de-risking lever as we think we’d like to purchase another home in the next 3 years. If the markets tank, I may reconsider and invest it.

Our invested net worth shot up from £930k to £1.1m thanks to another very good year of growth, and we also added the full £40k to our ISA’s.

I contributed the least I ever have to my pension this year. £10k for me and £5k for Mrs SavingNinja. That’s because I’ve been saving up my pension contribution allowance. I’ve decided to contribute £100k to my pension for the 2026 tax year - I still think it would be worth the tax savings to do so, and doing it as a lump like this will mean I save 65% tax on around £25k due to getting below the £100k-£125k loss of personal allowance bracket.

So for 2026, if I keep my job, I should be contributing roughly £110k to pensions and £40k to ISA’s.

I’m beginning to get more and more worried about needing to de-risk the more our net worth grows and the closer we get to really thinking about retiring. I know I should be reading about glide paths and equity allocation, but I’m being willfully ignorant right now as I luckily still have a well paid job.

I’m taking a bit of solace in the fact that Big ERN has said that it’s not crazy to hold 100% equities until the day you retire. And I’m hoping that the £100k cash buffer (for the house) will give me enough peace of mind for now.

I’m still hoping that our net worth will grow so much in the next 3 years that keeping 100% equities isn’t a problem. We’ll be able to buy a house in cash (or have a very small mortgage,) and our expenses will be so low that it won’t matter if the market tanks.

How much of this is wishful thinking, though, when we’re apparently in a mega-AI-bubble?

The reason I want to hold 100% equities is because I have a min-maxing mentality, but mainly because I think it will be simpler. I won’t have to worry about different allocations and buffers. I’d rather think about earning more in retirement or spending less if there’s a down year. I hope we can have the luxury of doing this.

Total Net Worth

There was a big dip at the start of the year, it looks like the biggest I’ve experienced since I started tracking with this graph. It swooped back up again by March, then continued on upwards. I’ll have to get used to big swings like this now that there is enough capital invested to feel the market turn.

Interest vs Contributions

You can see huge swings in both monthly interest and contributions in this chart. July was when we paid off our mortgage so I added the new house equity to the sheet. Then in November when we sold the house, we contributed £40k to our ISA’s.

Stacked, you can see the swing in interest earned, and then the bump for contributions starting in July.

Here’s a nicer representation of the yearly interest. I’m expecting a lot more to look like this going forward, maybe even dips that last years!

Lifetime Interest

Compound interest is continuing to go to the moon with this chart. Those tiny blue lines are starting to grow bigger as the orange line grows further and further away.

We continue to get very healthy annual returns, only 1 year in the negative! It’s crazy that at 15.97%, it’s still the third to worse year of my investing journey. If only we could get another 33% year like in 2019!!

Yearly Growth

Second best year of growth so far, not too far off last year.

Looking at this chart, you can see that this year was actually our best ever year when it comes to investment growth value. Even though in 2024 the markets returned almost 8% more, as our pot was a lot bigger in 2025, we earned more overall (thank you compound interest!)

It’s also the first year that interest increased our net worth more than our contributions did. I believe they call this the ‘infliction point’ in the FIRE community. When passive investment growth begins to exceed active contributions, and it should be celebrated.

Personal Life

Mundanity

On new years day, Mrs SavingNinja and I asked ourselves, how as the year gone?

We both said that it had gone very quickly and exclaimed, “What have we actually done??”

The year started with us moving back into our old, cramped, house. Sleeping on the sofa trying to work through Baby SavingNinja’s sleep regressions. Then my parental leave started and we moved again, 8 hours drive north, and settled into a new rental property while our sale went through.

The year was filled with packing and unpacking, twice. Before we knew it, it was winter.

We did get to go on a memory-making trip to the Bavarian Alps in between all of the moving, but other than that, the year has gone quickly because we didn’t do much. This is a shame as I had 6 months off, I thought we’d be doing more.

But in reality, this is what we needed. We needed life to become mundane again. Reading last years review , we were in a bad place, feeling lost and living too close to family which was too far away from our norm. I said that we need time to settle and adapt to our new normal.

This year has been mundane, but it was also healing. We’re in a better position now, we feel more like our old selves. We’re more used to Baby SavingNinja and he’s growing more independent each day. We have more space and time has healed our past traumas a little more.

In 2026, I think we’re ready to start becoming our adventurous selves again, as much as we can be with Baby SN.

Being a parent

This year I’ve started seeing some real dividends to having Baby SavingNinja. It’s not talked about much, but with a baby your life is genuinely a lot worse.

Through the screams, little sleep, and no time for yourself, you also don’t get much in return. A giggle here or a sleepy face there is all you can focus on when you think, “Why did I do this?”

This year though, more and more as he gets older, I’ve started to see what having children is all about. It’s still hard, but it’s a lot more rewarding now. Seeing him start to understand the world around him, learning to eat with a spoon and drink from a cup has bought real joy. Unadulterated joy, more pure from the quick frills of TikTok or gaming, it feels more everlasting.

He now graces us with the most genuine smiles I’ve ever seen when looking at us as he clearly says “Mama!” Or “Dada!”

I know this feeling of love is only going to exponentially grow as he learns to say “Love you,” and give us heartfelt hugs. Much like compound interest in the financial world, having a child feels much the same as they grow.

Looking forward

We’ve settled on the fact that it’s the right decision to not buy another property yet. Renting seems like the best choice financially, and also because we haven’t fully settled on the location we want to set our roots.

Flexibility is more important for us right now.

We’d like to spend 2026 exploring Scotland more. I’d like to visit enough to decide if it’s somewhere we could see ourselves settling in the future. In the UK we’ve been told that Scotland is the closest to what we like, (mountains and lakes!) so we need to go and visit and decide for ourselves.

Further on than that, I’m going to try and not focus on needing a long-term plan. This hurts a little as we had our long-term plan solidly in place when we lived in the USA and it felt good to know what lay ahead. But there are just too many unknowns to make one here.

Maybe there will be a return to office mandate? Maybe the market tanks? Maybe we get a job opportunity far away again that we can’t say no to?

Right now it makes sense to focus on the present. Focus on raising our son while exploring possible futures and enjoying what we have while our finances grow sturdier.

Goals

I usually review goals I set for the last year and set some new ones for the year ahead. But it’s starting to feel a little hollow. I’ve continuously failed to achieve literal goals that have been set and it feels like I should be trying to move generally in the positive direction than checking off paper goals.

I did mention last year that we’re going to focus on finding our new normal. I think we definitely have done that, that’s enough to be happy about I think.

General fitness has definitely suffered. I would like to do better in 2026, not just to be healthy, but because I know it makes me feel good as well.

For the first time, we also did a family annual review and set ourselves some personal goals for the year.

It’s mostly revolved around traveling more.

We’d like to visit Scotland on 4 separate trips of 1 or more nights each time. We still have planning to do to think of some more trips to take.

We’d also like to be more organized when it comes to weekly chores and activities, and have gone back to a planner that we created a few years ago.

I think that’s all for goal setting this year. I’d like us to continue to normalize, to regain more of our pre-baby adventurers spirit, to travel more and find our independent passions again.

Thanks for reading.

Let me know in the comments how your year has gone, I really appreciate it when you reach out to me via email or comments, I enjoy reading every one!