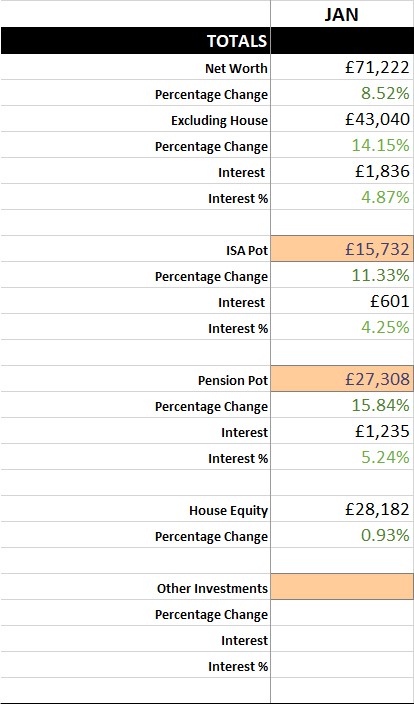

This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Woohoo, nice and positive green numbers again.

This month saw most (but not all) of the festive corrections losses come flying back with a £2437 interest gain.

That along with another deposit of £3500 saw my investments grow by 14.15%, pretty nice!

My ‘Years to FI’ number has now gone down to 4.4 years! It’s going to look pretty awesome when that number drops below 4.

The £100k figure is getting closer and closer, I can’t wait until I start seeing real gains from the stock market as the current valuation is still below the book cost.

Fun fact: $100k is currently £76k, so I’m pretty close to celebrating my first $100k! Maybe next month if the markets continue moving upwards?

I’m still mulling over whether I should shove a few extra grand into my ISA before April. I’ll have to give my finances a good review and see how much I think I’ll be spending on my honeymoon and wedding.

Other thoughts

I’m starting to get really annoyed at work. It always seems to be the case that I run into people that do an awful job and are paid more than me, I then move onward and upwards after re-evaluating my worth. In this case it seems to be contractors.

I really want to start contracting as this will allow me to fill my ISA and pension limits each year and expense things like my £3700 commute. I should have just bitten the bullet and gone into it before starting my current position. But, I’ve got to wait until next year now. The reason I’ve got to wait is that I’ve got a little over a month off in July for my wedding and honeymoon. June is also the time where we all get a 15% bonus. It would be ludicrous to leave now (if I could find any job that was willing to hire me then let me bugger off for a month that is). I’ll have to wait until after the honeymoon.

I better start brushing up on my interview skills again, I think working at a big corporation has made me a bit soft! Would you guys like to hear about any of my programming escapades or will it be a bit too off topic?

The question for Thought Experiment number 4 is up over on the landing page ! I’m quite excited about this one, if you wanna join in then make sure that your posts are written before the 15th. Feel free to let me know what your link is going to be and I’ll add you to the list before the post goes live.

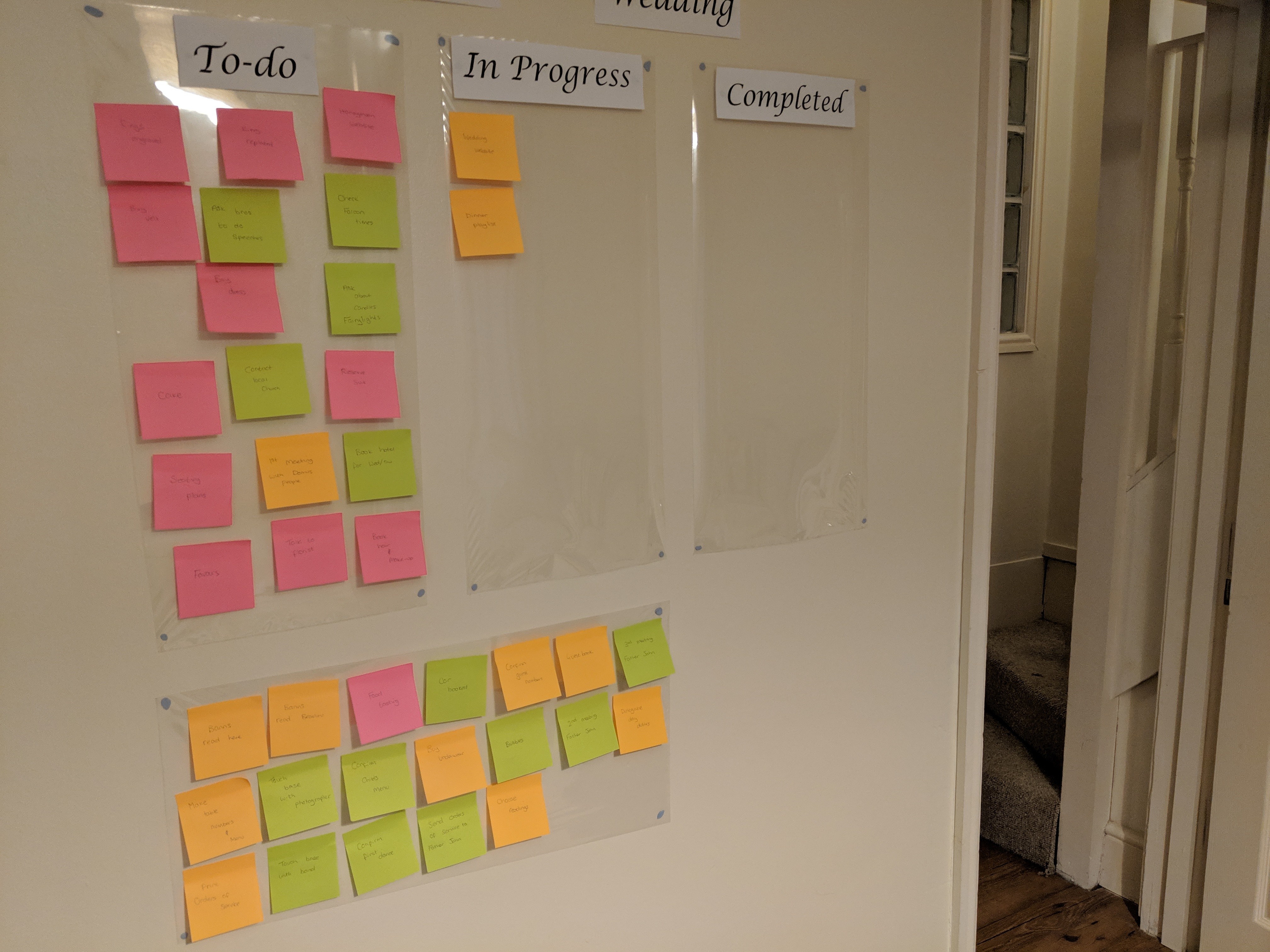

Wedding prep is going well! We’ve now got a scrum board (courtesy of Mrs SavingNinja) in the living room so we can be extra nerdy when completing our wedding tasks.

What do you guys think?

Matched betting is back on in full swing now. I’ve started doing no-lay accas each morning on two different accounts and currently have 26 accumulators waiting to be settled! I’m also doing quite a lot of EW betting but with lower stakes and not on my best accounts (waiting until Cheltenham for that). Should have some matched betting updates for you next month.

I still need to write that EW betting guide! There’s just been so much on lately but I’ll have to make the effort soon.

How did your month go?