This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Things are starting to get exciting, I’m so close to 100k net worth!

Still, I should calm down as I’m not really going to celebrate until I have 100k invested in stocks, but it’s still exciting!? :)

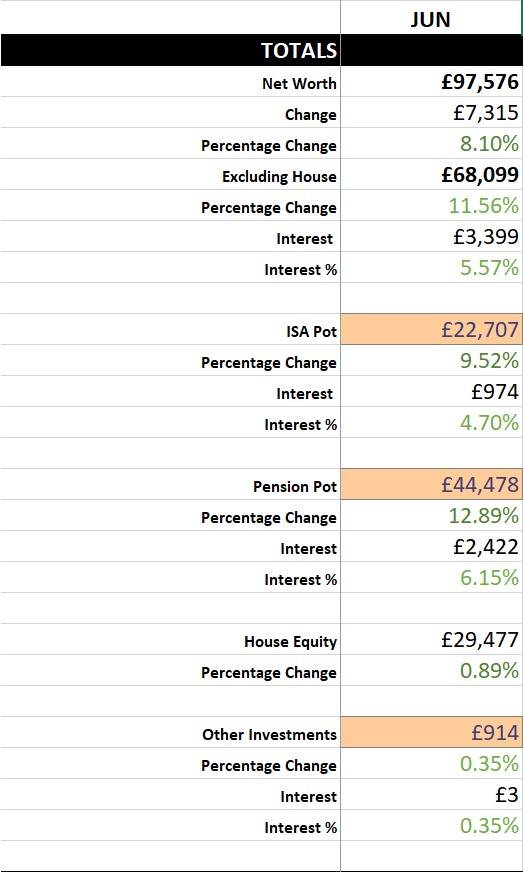

We saw a huge climb in stock values this month, earning £3,399 in interest, almost the same amount as what I contributed. It will be a pretty awesome day when stock growth earns more than what I’ve contributed for the month, I guess that will become a pretty normal occurrence when I reach a certain stash size.

I had a pretty awesome metric show up when evaluating my current company pension; since I started working here around 12 months ago, I’ve contributed a total of £31,641, it’s now worth £34,368. That’s a growth of almost 3k! Considering that it started off at £0 12 months ago and I’ve been drip feeding it the same figure each month, 3k growth is really good.

My ‘Years to FI’ number now stands at 3.7 years. If there isn’t a recession, I should be hitting my FI number of 12k per year (£300k) just before my 31st birthday. I’m hoping to accelerate this further with passive income generation and increased earning in 2020, it would be sweet to hit this target in my 20s!

My Property Partner buy-to-let ‘alt-investment’ saw a growth of 0.35%, this was from a rental dividend payment. Pretty cool, but it will take some stock value growth before I can start thinking about this investment paying off the initial £1k book cost.

Click on the image to invest in the same property!

I want to add some other ‘alt-investments’, I’m thinking £1k of TESLA stock? I know that they’re over-valued, but I really believe in Elon and his companies, so it would be a pretty awesome, fun investment for me.

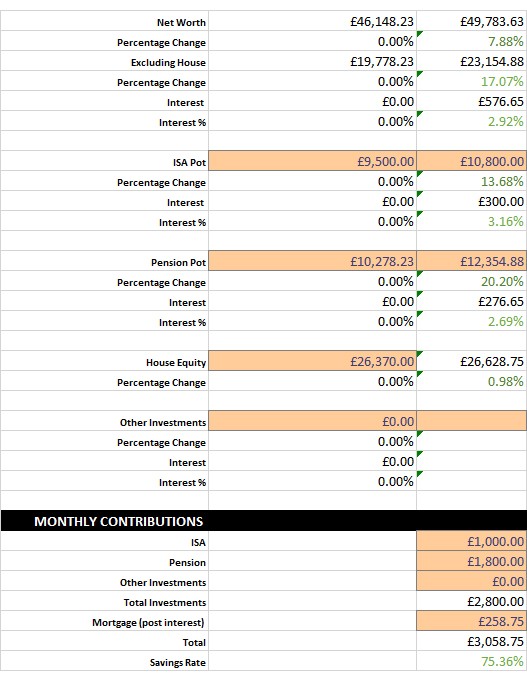

This is my 12th savings report! Can you believe it?? Here’s a throwback to my first ever one:

From Savings Report #1

Since August 2018 we’ve seen my net worth grow by £50k (mostly from stock purchases), my monthly contributions increase by £856 (seeing my savings rate go from 75% to 80%), and my pension pot almost quadruple in size!

Hopefully, this rocket burn of a start will give me enough thrust to get me into orbit over the next few years.

Other Thoughts

I moved offices this month, I’ve now got a window seat on the 15th floor of a London Skyscraper, pretty snazzy. It’s a pity I’ll be leaving to go contracting after I get back from my honeymoon.

Work just feels like a countdown clock to the wedding/honeymoon now, I’m starting to feel a little excitement take the place of nerves, which is awesome, it should be the other way around, right?!

A lot of my excitement is for after the wedding too. When we’ve tied the knot, the new Mrs. Ninja and I will be able to start really planning our lives together. We’ve decided to go on more holidays than usual over the next 3 years and scout out potential living destinations. Hopefully, this won’t affect our savings rate too much.

They’ll be lots of opportunities to clear our minds whilst on our honeymoon as we’ve got a lot of hiking planned. We’ll be doing a lot of daydreaming and deciding where we might want to live whilst enjoying the beautiful Californian coast and national parks.

The Big Sur - California

Matched Betting

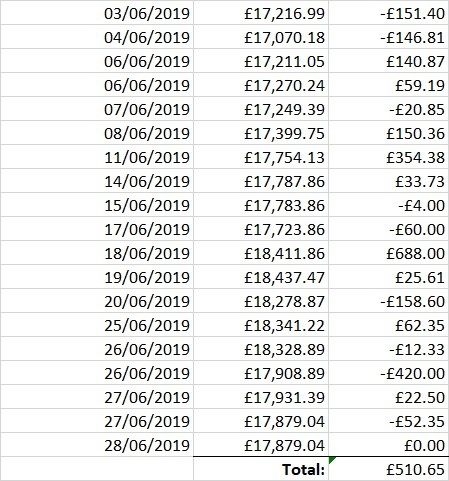

June was one of my lowest earning months matched betting; I only made £510. At one point I’d made over £1k but a massive losing day on the 26th wiped that out.

I’ve actually stopped EW betting for now as I’ve pretty much run out of accounts. I do have a new one planned, but I’ll be saving that for after the wedding.

At the end of the month, I started testing out a new arbing technique that I’ve not seen anyone do before. This technique could potentially be ‘quitting my day job’ good! But I’ll be testing it out for the rest of 2019 until I make any decisions. It could potentially co-inside with remote contracting, which would be pretty awesome.

Blogging

June saw another Thought Experiment with another massive turn out of 16 articles written, will this be the new norm now?

I also wrote my first pillar post which (of course) explained what Financial Independence / Retire Early (FIRE) is to me. I’ll be updating this pillar post with relevant articles once my website redesign is done - by the way, I’ve already updated my categories :)

How was your month?

P.S. I’ve just realised that this will be my last savings report as a bachelor, I’ll be closing up shop for a while starting on the 23rd of July. Follow me on Twitter to hear my honeymoon updates, including my First Class flight experience!