In part 1 of The Boggy Marsh we discovered that there was a secret financial blueprint that would allow even lower-income individuals to get ahead; if only life was approached the correct way.

Today we’re going to delve into the specifics. How exactly will careful planning and execution help aid your journey through The Boggy Marsh, and how big will the impact be?

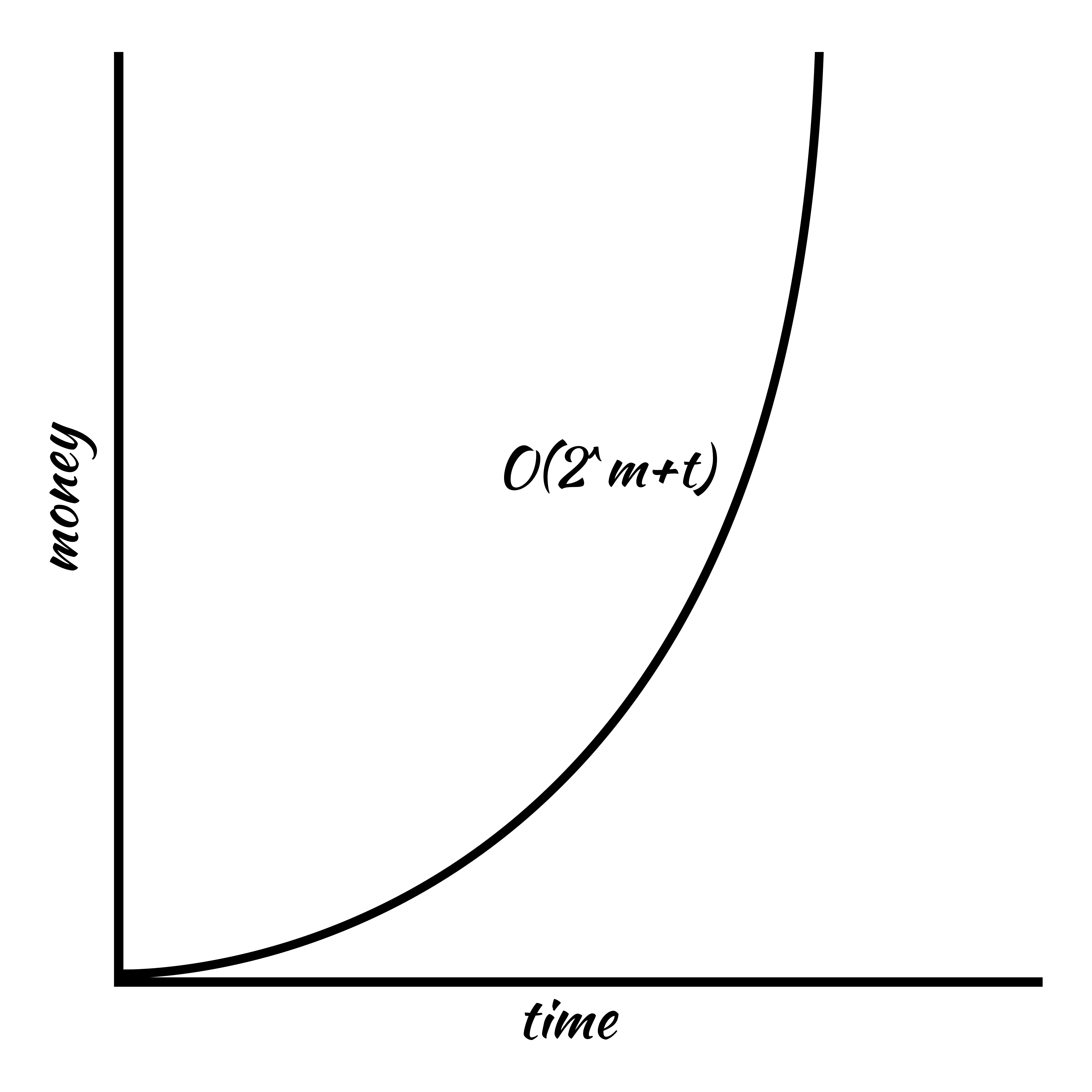

O(2^t+m).

What does this icky Math formula mean?

It’s the Mathematic equation for the growth of your money. The number one most important factor when aiming for financial independence.

It’s written in a language called Big O Notation ; an engineering invention that is normally used to determine the time cost of an algorithm depending on the input variables.

I’m currently studying the theory in preparation for a Google interview and when formulating the equation for FIRE I realised that time is just as important as money. In fact, it’s completely equal.

The time complexity of financial growth is 2 to the power of time + money.

The more time you have, and the more money you have, your pot growth will double after each iteration. It will grow exponentially.

If you prepare early enough, the amount of time that you will have on your side will allow your pot to venture up the exponential curve to the point of indifference, the money that you save at a later stage will hardly matter.

A trial run through The Marsh

Before your adventure begins, let’s simulate a few scenarios for tackling The Marsh. Remember, if you dive in headfirst you’ll get stuck .

For these illustrations the target income in retirement is 20k per year, the return on investment is 6%, and we can assume that at the beginning of year 1 the person is 22 years old.

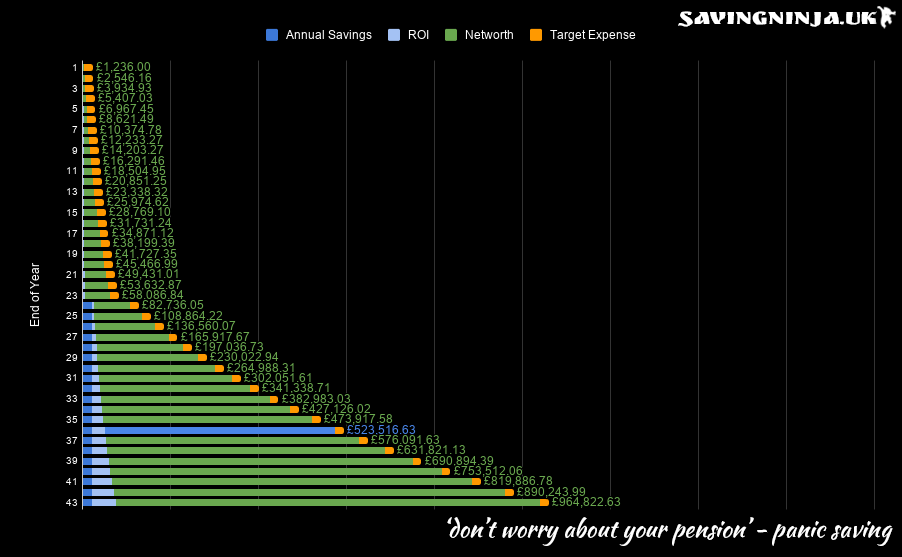

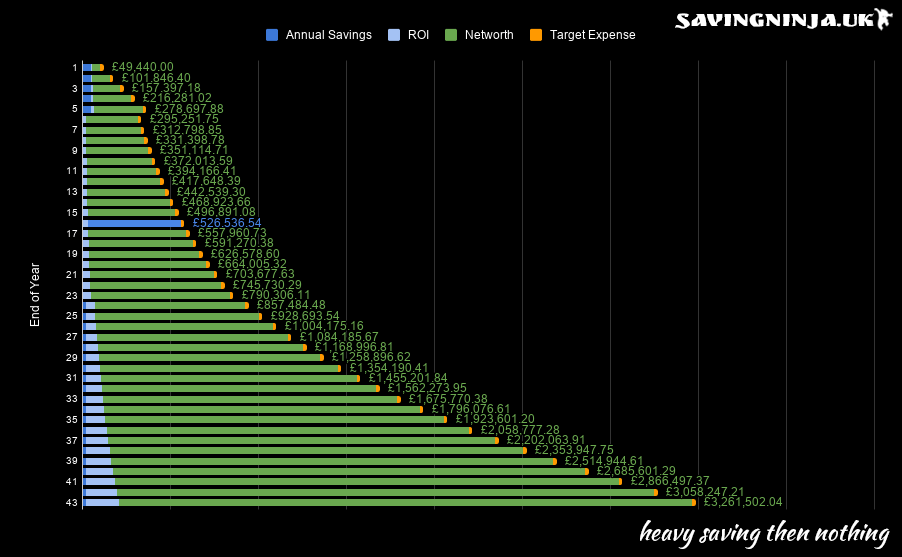

The traditional method

The first chart maps the approach that most people take, I call this the ‘don’t worry about your pension’ model. These are the people that save barely anything into their pensions (circa £100 per month) until the age of 45, they then commence ‘panic mode’ and begin to save £20k per year.

If you followed this model, by the time you’re 45 years old you would have only saved a meager 58k from depositing £100 per month since you started your career at 22.

You’ll then engage ‘panic mode’ at 45 after realising that at this rate, you’ll never retire. At great discomfort to yourself and your family (as you’ve been big spenders for 23 years), you manage to deflate your life enough to save £20k per year.

You have to live ‘struggling’ like this for a whopping 13 years before eventually retiring at 58. Over these 13 years, you’ve had to part with 260k of your after-tax earnings.

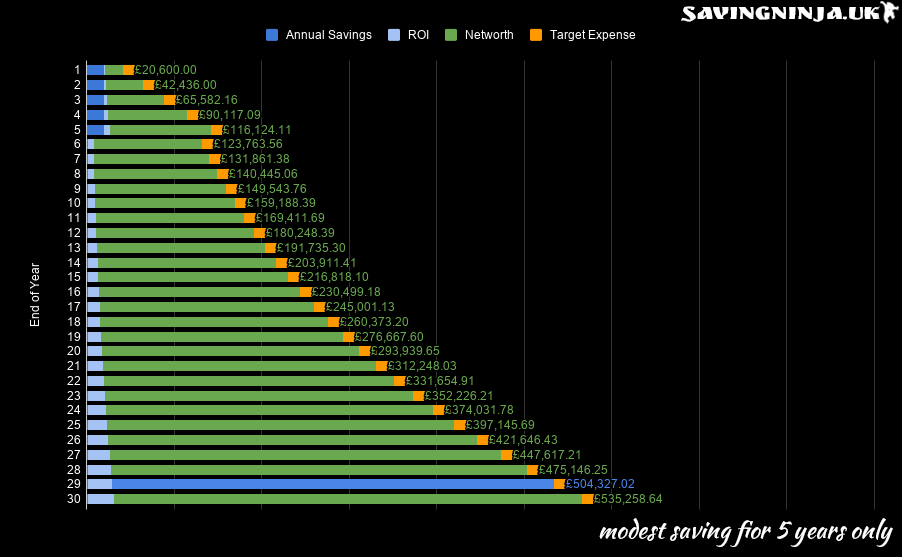

If instead, you tried your hardest to save as much as you could upon graduating and managed to save 20k per year for 5 years, your life would have turned out a whole lot different.

You ‘sacrificed’ the first 5 years of your career and saved almost all of your earnings. You knew that the time complexity of compound interest was O(2^m+t) and that it was paramount to do everything you could to save as much as you could at this early stage of your life. Whether this meant living with your parents or in shared accommodation, you were all in!

Doing so allowed you to amass 116k by the age of 27. You could then kick back, relax, and save nothing but a scant £100 per month (have to get that employee pension match) for the rest of your life, you’re saving journey is now over.

That 116k, like yeast in bread dough, took on a life of its own after you had finished with it. That little cyan coloured bar indicates the amount of interest your money is earning every year, and after being cultivated, you allowed it to continue to grow on its own.

By the time you’re 51 years old your little nest egg that you saved all of those years ago has grown into 504k. You’re now ready to retire.

‘Sacrificing’ the first 5 years of your career allowed you to retire 7 years earlier and you only had to save 100k over 5 years instead of 260k over 13.

You used time to your advantage and treated your future self to a life of leisure.

Better yet, saving for those first 5 years wasn’t even hard! You had zero commitments back then; no children or house to care for; you simply deferred your life and focused on saving until your nest egg was ready to grow on its own.

The extreme method

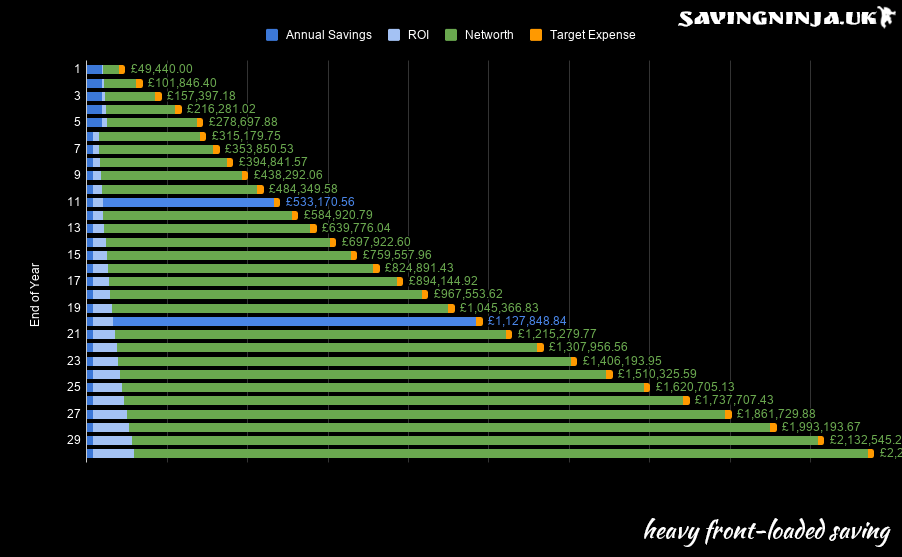

Followers of TSN will know that my own savings are actually way higher than 20k per year . A lot of family and friends (and even people from the FIRE community) scrutinise my 80% savings rate; they say that I’m under 30, I should be traveling more; living a little, “Whilst I’m still young!”

If I plug my figures into the simulator, you can soon see why these are the most important years that I should be saving.

I’ve currently just passed the year 2 line and I’m 27 years old.

If I continued with my current savings rate for 3 more years, I could save absolutely nothing ever again and retire on 20k (tax-free) per year at the age of 41. By choosing to live frugally instead of ’live life whilst I’m young,’ for the first 5 years of my career, I will have earned myself an extremely early retirement for not much struggle.

I could even choose to work part-time and merely cover my expenses at the age of 30 and I’d still get to retire at 41.

Of course, I don’t plan to stop saving in 3 years time as I believe that spending less makes you happier . My pathway will most likely look more like this:

After my front-loaded first 5 years, I’ll probably look to severely reduce my workload but I’ll still try to save at least 20k per year.

The power of time

No matter what I choose, I’d have a plethora of options; those first 5 years would have been worth it. Nurturing that little cyan line and allowing it to grow on its own has given me this superpower.

Instead of buying a big house, a nice car, and having children straight away; I’ve waited patiently.

This is what everyone should be doing, but no one is. Everyone is forgetting that time is half of the equation! O(2^m+t)

If you have time on your side you should be trying your hardest to save as much as you can. The younger you are, the more urgent; as the money you save will be worth exponentially more.

What if you don’t earn enough?

Even though I believe that anyone can make the wage of a CEO , I know that some people aren’t capable of saving a lot due to financial commitments. This is the reason why it’s even more important to save earlier before you pick up these commitments.

There are no bounds to the length you should go to save when you are young. You could live with your parents or pick up extra jobs. These years will define the rest of your working life.

All of the simulations in this post work exactly the same way if you cannot save the amount shown straight away, you just have to push back your numbers by N amount of years.

Why people don’t talk about this

The subject of time isn’t discussed much in the FIRE community. This is likely because a lot of people on this pathway found our little group later in life. As the power of time is exponential, they can’t use it to its full advantage.

Not starting earlier is the number one regret from most FIRE devotees, it’s mine too. Regret usually manifests with self-affirmation, and as blogs are portals to a persons’ inner-mind, this attitude bleeds through into their writing.

But make no mistake, if you are young and reading this, you should save right now! It’s an emergency. Yes, you could defer your savings in the hope of earning more and saving more later, but time is equal to money.

Time is the one thing that you have right now, don’t sacrifice it in the hope of earning more later.

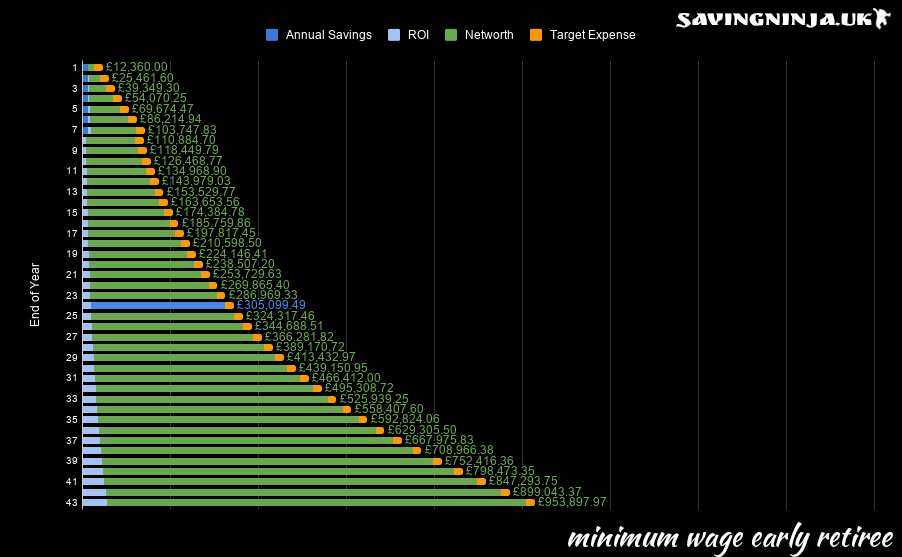

Here’s an extra little simulation to mull over:

I was working at 16 years old on minimum wage. If instead of going to University I continued living with my parents and invested all of my minimum-wage earnings until the age of 22…

I would have enough to retire at the age of 40.

Yep. For most people with early retirement as a goal, they would have reached their goal earlier if they didn’t go to University and if they never earned more than minimum wage. This stuff absolutely blows my mind.

TIME is just as important as earning more. In fact, it’s better than earning more, because it’s a commodity that is guaranteed.

If you’ve got time on your hands, don’t waste it.