Charles Stanley has been the cheapest percentage based platform that offers a SIPP to invest from for a long while. How will their recent price hike change things?

Who is the best investment platform? Investment platforms are really complicated. They each have different rules and prices depending on different pot amounts and transactions. You won’t find a ‘here’s the price’ type statement on any platform. Basically, all of the platforms have different fee structures between an ISA and a SIPP; it’s messy! I created the tables below to try and figure out for myself what the best platform to use is. I focused on gathering all of the charge information and then figuring out the costs at each stage of your investment pot growth.

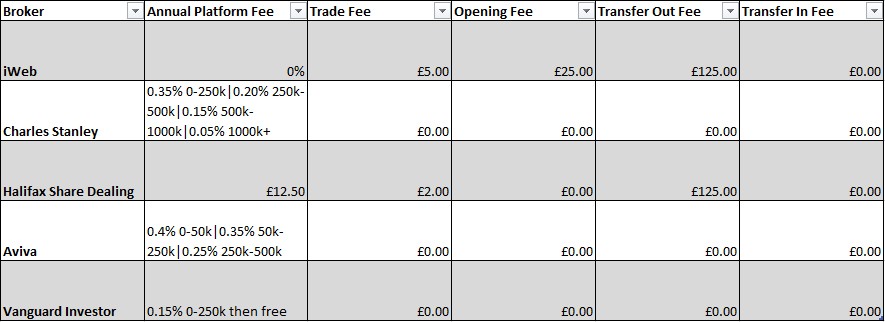

ISA Platform Fees

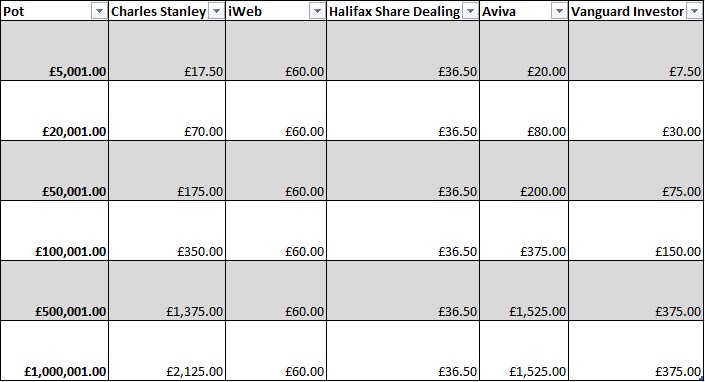

Different Pot Sizes

For ISA’s, Charles Stanley still takes the leading spot for a multi-fund percentage based platform, costing you only £17.50 per year to invest a fund pot of £5000. If you are looking to invest in Vanguard funds only, this is even cheaper at £7.50 for a £5000 pot! However, the price (as always) starts to look very glum for percentage based platforms when you have a larger pot. Charles Stanley will charge you a jaw-dropping £2125 per year when you have £1 million invested! Comparing this to the £36.50 that Halifax Share Dealing will charge you (if you invest 12 times per year), it’s hard to believe anyone is invested with these platforms when their pot is so large. At least Vanguard has the decency to cap the charge off at £375.

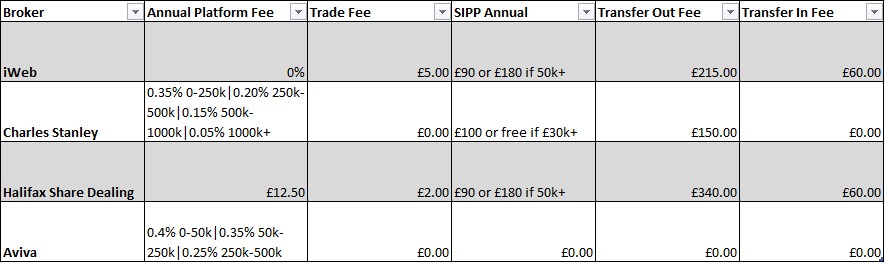

SIPP Platform Fees

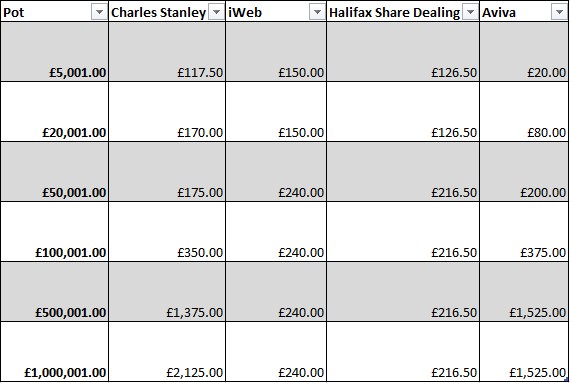

Different Pot Sizes

For SIPP portfolios Charles Stanley falls even more behind percentage based platform Aviva with a difference of £97.50 per year if you have £5000 invested, that’s 2% difference! This will affect investment performance in a big way! You will be losing even more money if you keep your pot in a percentage based platform when you have £500k - £1 million invested, but the pot size you need to have before you should look into switching to trade based is much bigger than with ISA’s.

You can get access to the editable version of this spreadsheet and much more on the ninja page which all subscribers have access to. If you’ve not yet subscribed, enter your email below. You can always unsubscribe again if you don’t want to keep in touch!

What platform you should use comes down entirely to how much you have invested and how much you intend to invest. The cheapest platform is clearly Charles Stanley or Vanguard Investor for ISA products and Aviva for SIPP products. But this changes drastically when your pot size increases. Halifax Share Dealing is the clear overall winner for price, both with SIPP and ISA products. I decided to go with Halifax Share Dealing from the beginning (based on these excel sheets!), as I knew that I was planning on investing a lot. I didn’t want to change platforms and incur transfer fees after only one or two years. Charles Stanley’s price hike doesn’t change the ideal platform choice. It does however make them an even worse deal than they currently are. So if you’re using them for your SIPP, or you have a larger pot, transfer quickly before your pot loses too much value!