Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

Happy new year!!

This is a quick one as I’d like to put more energy into writing the end of year review post.

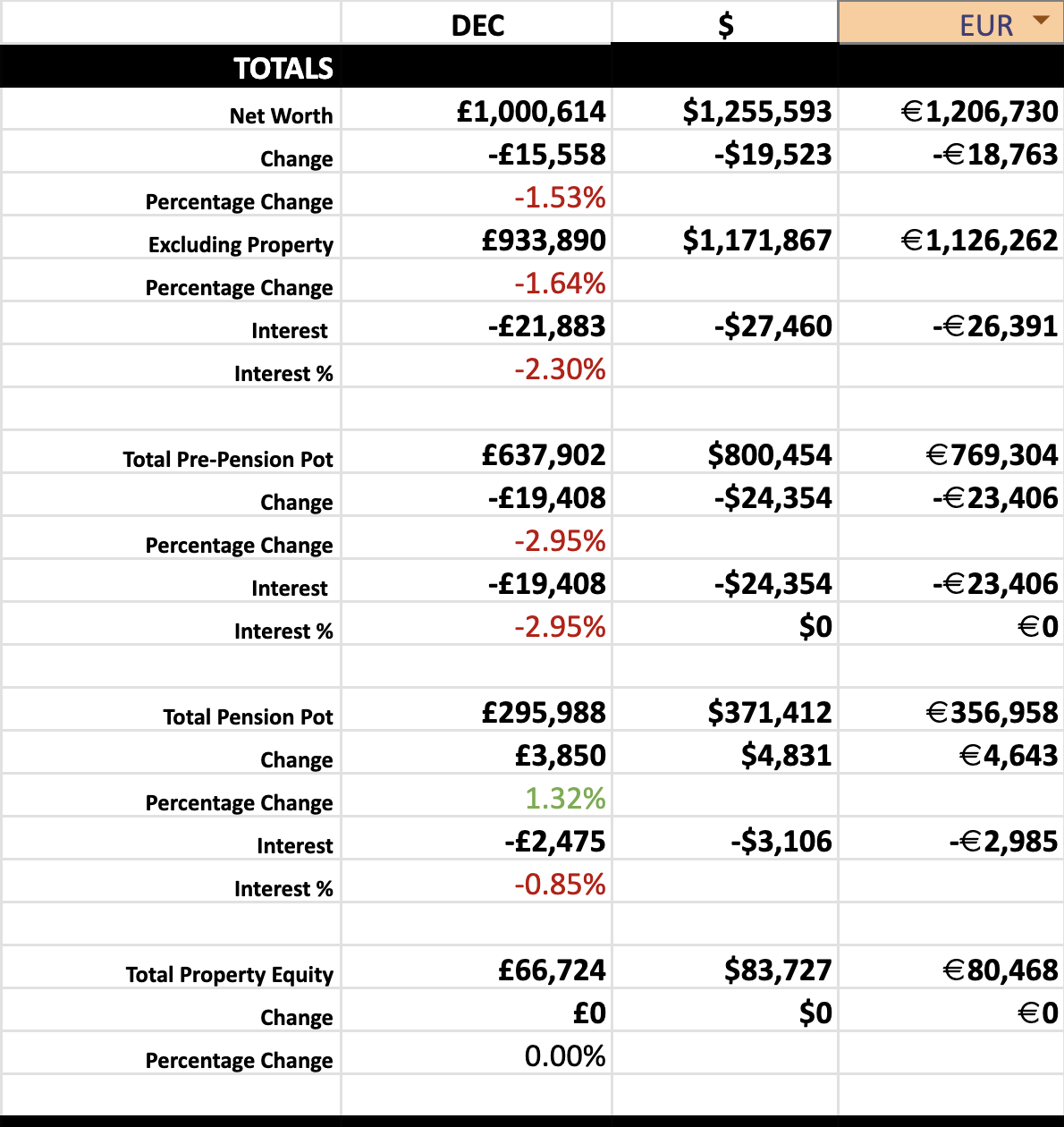

The market sank a bit in December but we still managed to stay above the £1m mark by the end of 2024, only just by £615. I’ve already created the charts for the 2024 yearly review and it’s been an insane year, both financially and otherwise really.

Piling Up Cash

I’m now starting to stock pile cash for a few different reasons.

My company updated their pension policy and now only allow us to change the contribution amount twice a year. So I’ve decided to put the minimum for the match in for now, then I’ll try and fill it up by £90k from September to April in 6 months (£60k plus 30k from this year carry over.)

This will allow me to potentially pay less NIC as my monthly salary will be much lower for these months. I’ll be able to get my income below the £100k personal allowance taper for 2025, and I’ll have more flexibility with the cash before September - great if I lose my job again.

We’ll also be trying to sell our rental house this year. If we don’t manage to sell it before September, the interest rate will go from 3% to 9%, so stock piling cash will also potentially allow us to pay off the £150k mortgage until we sell the house and can re-invest the cash.

Of course, this means that this money isn’t going to be invested in the market for quite a bit of time. But, now that our investments are at £1m, having a £150k cash buffer to allow this flexibility doesn’t seem like too much lost opportunity and it may also be a hedge for if the market falls. We’re currently at around £18k, which is sitting in a Raisin account earning 4.7% interest, and I’m transferring another £12k in under-water RSU’s from my company stock plan to sell and add to this account.

So, for the next 9 months, until September, for the first time ever, I’ll be contributing very little to our portfolio, I’ll just be leaving it at my employer pension match and minimum amount needed to get that. We may even sell more stock to reach the £150k from my RSU’s as we need to diversify anyway, we’ll only do this if the stock has negative capital gains or to use up both of our capital gains allowances.

As soon as the house sells, I’ll fill up our ISA’s and then in September start dumping a lot into my SIPP.

Student Loan Cleared!

As I cancelled my big pension contribution amount last month I got a bigger salary and ended up paying off my Plan 1 student loan! This would have lost me around £1k per month due to not maximizing Salary Sacrifice in 2025 so I’m happy it’s finally cleared, I’ve been paying this for the last 9 years.

Baby Nightmare

I wish I could say having a newborn is all roses, but it really isn’t. This month has been the worst yet, he’s going through his 4 month regression where his brain is basically waking up and he wails all of the time. He needs constant attention, and me and my wife barely have any time to do anything. We eat while sat on the floor with him while he wails, we go to bed at the same time as him in the darkness while whispering, we have to wear him in a wrap to get him to nap in the day while we bounce on an exercise ball in darkness.

One thing that has changed is we’re getting more used to not having any time of our own, it’s not as much of a shock as it was a couple of months ago. Sad really. People keep telling us it will get better though!

I honestly think if everyone knew exactly what having a baby was like, there would be a lot more people choosing to not have children.

OK, I better get to writing the 2024 yearly review! I’ll hopefully have it ready within the week.

See you then!