Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

Hello!

I’ve put this update off for two months now. So much has happened that I felt it would be too laborious to write about it all, but I’m forcing myself to try this morning.

What’s changed since the last Savings Report when I was leaving America?

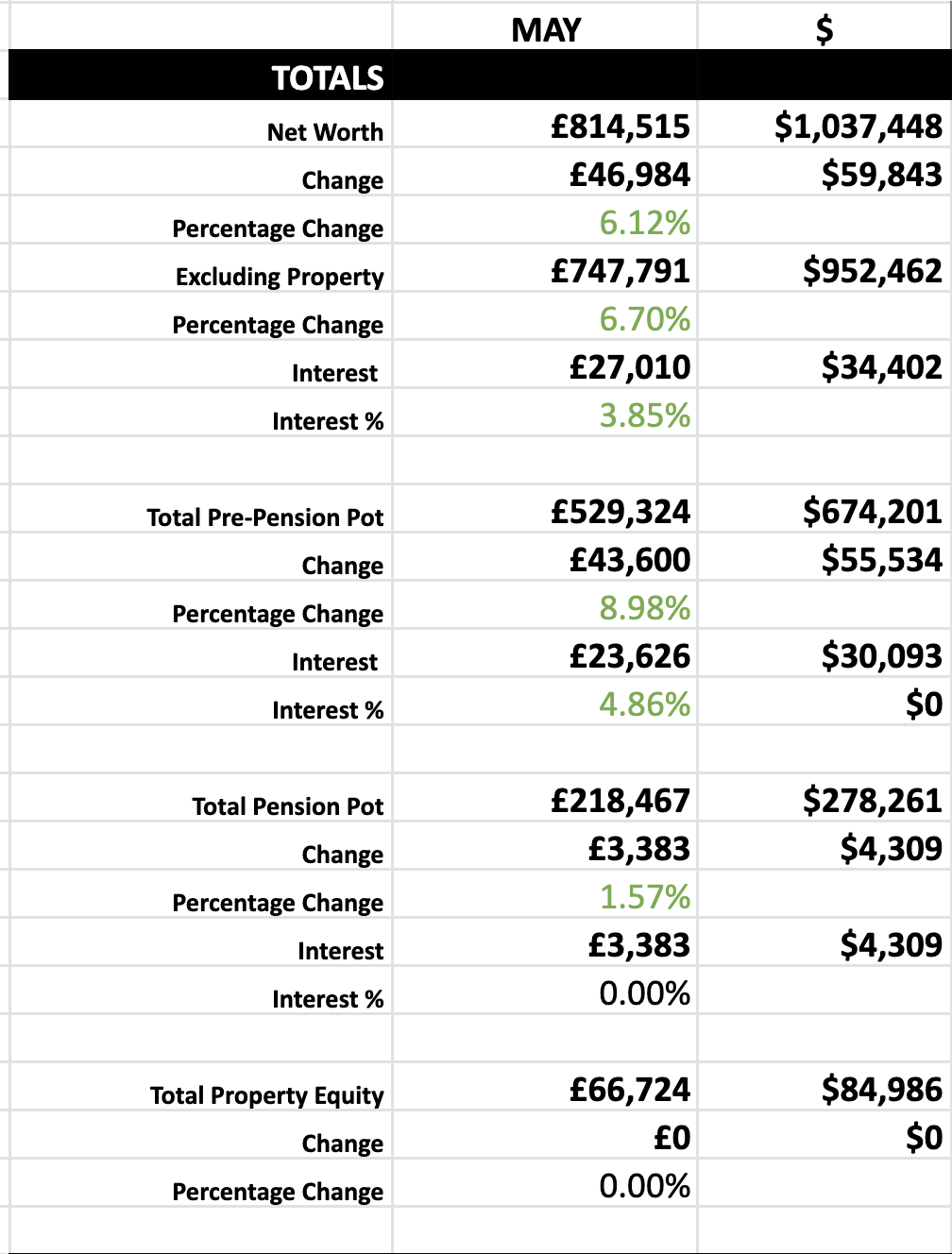

- Our net worth has crossed $1m on the spreadsheet

- We moved to the south-west of England

- We bought a spendy car (RAV4!)

- I accepted another job

- I worked at that new job for 2 weeks and then resigned

- I started working for my former employer again, from the UK

Whew.

Oh yeah, and we’re having a baby.

Baby SavingNinja

The biggest change we’ve actually known about for a few months now. This added to the equation when deciding where we should live, what jobs to accept, and also, the spendy car.

We’ve been trying for a baby for a while now and it happened to coincide with getting laid off and having to leave America. Now we’ve settled in a bit we are more excited, we’ve started preparing, and have came to the realization that our lives will change a fair bit more in just a few months.

We’re still trying to stay frugal when it comes to baby purchases. We bought a lot of clothes and furniture second hand, second-hand baby things are so cheap!

We plan on using re-usable nappies (they’ve come a long way,) and Montessori-style re-usable toys. It’s going to be insightful to see how much our spending goes up.

Working Again

After several months of interviewing it turned out that my former boss got a backfill and wanted to bring me back from the UK. I’m very happy about this, although it was challenging to hand in my notice at my new company after only being there for a couple of weeks.

Going back was difficult to say no to. The pay was roughly 50% more, and the paternity leave is significantly better, not to mention it being easier as I already know the domain and people.

I’m still working remotely. And I still hope to continue prepping for the worst (another layoff,) although this will be challenging with the lack of time that’s coming my way. If I make it until past Christmas without being laid off, it will have been the right call.

Living in England Again

We signed for a 6 month lease in the countryside and have set up our life from scratch again. The plan is to stay in this location and rent until we can sell our rental property, which is just over a year away from completing it’s 5-year fixed mortgage. Then we’ll re-evaluate and consider where we want to buy.

Moving to Scotland sounds like it will fit the bill for rural living in the UK, but the plan is to travel to rural Scotland, Wales, and Ireland, and see which areas we like the most before moving there.

Finances

This month I filled Mrs SavingNinja’s ISA with my severance money. I’ve also managed to transfer all of our stocks into her account so we will pay less tax when trying to sell stocks in our American general investment account (still over $100k capital gains to pay.) Next month, there’ll be more deposits into my ISA.

I’m hoping that we’re not too far away from reaching £1m net worth. If I keep my job, I plan to max the pension allowance going forward, with that and some continued stock growth, we’ll hopefully reach £1m at some point next year, at 33 years old, this will be quite the achievement! Just two years of American earnings seems to have propelled us by a lot.

We still don’t know yet if we are financially independent. Each month we’ll be tracking all of our expenses to find out, and of course this will change when Baby SavingNinja arrives.

Spendy Purchases

When we moved to America we were forced to buy a more expensive, nearly new, car due to the chip shortages, it seemed even buying an older car was expensive at the time.

Now we’ve, kind of got used to driving a nicer car. We liked the space, and the raised suspension of the Nissan Rogue (Qashqai in the UK), and the ease of automatic drive.

As we’re expecting a little one soon, I also didn’t want to buy an English banger again. And we had plans to travel around the UK in the car to explore… All of this is probably just excuses I’m telling myself.

But, I decided to research reliability and buy with the hopefulness of the car lasting 10+ years instead.

This meant we ended up buying a 2020 RAV4 for £18k. It was a huge purchase (although still cheaper than how much we paid for our Rogue in the US,) I’m partly blaming theFIREstarter as well for his advice of “just treat yourself, mate.”

I hope we don’t live to regret it. Toyota has a 10 year warranty and as it’s a (non plug-in) hybrid, the MPG we’re getting is over 60 even with town driving. It’s spacious for hauling furniture and a baby, and has a lot of great safety features.

It will have been a good purchase if we still have it in 2034!

A lot of our purchases seem to have tilted to reliability these days. We bought a Bosch washer-dryer and dishwasher which were more expensive but cost less energy to run and had 5 year warranties along with a good reputation for reliability. We got a Henry hoover with a turbine head for carpets instead of a Dyson or Shark. Usually we purchased like this for things like hiking backpacks, but now it’s with most items that we see value in them generally being better.

This may be lifestyle inflation, but the verdict is out for if this is cheaper in the long run.

See you next month.