Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

A note before reading

I wrote this update a month ago but I decided not to release it as the very next day, I got laid off and the SavingNinja family found out that we will have to leave the USA. When I wrote this I was feeling very hopeful about our future in the USA, then it all changed overnight.

As I’ve never missed a savings report in over 5 years, I’m releasing this now, and I’ll write a December savings report in the next few days explaining what has happened.

So, without further ado, here’s Novembers update, written by a blissfully unaware SavingNinja.

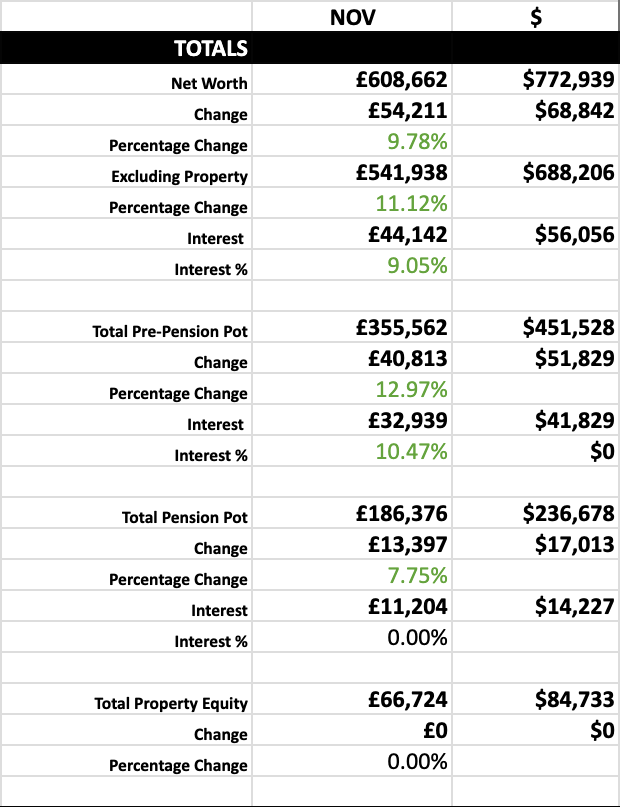

This month has been a killer month to be in the stock market. Our US stocks grew by a staggering 10.46% in interest alone, amounting to our total net worth going up by £55,000 in November.

This is more than I invested into the stock market in the whole of 2019, in just a single month!

I’m looking forward to the hopeful continued resurrection of the stock market as I’ve been stuffing our pot while the market has been cheap.

With the crazy rise we saw this month my total tracked APR for the year is now standing at 16.28% and it’s shaping up to be one of the best years in the stock market I’ve experienced, 1 more month to go until the end of the year.

This month has also made me realize just how much better the US stock market seems to do. Compared to this 10.46% US stocks rise, my UK accounts only went up by 6.33% and my Swedish accounts 2.66%. Why does the USA do so much better when it comes down to money and profit?

Of course, some of this could be attributed to exchange rates again… Actually, I’ll go and take a look at the GBP:USA exchange rate right now.

OK, the value of the pound seems to have gone up in November. On November 1st you could get $1.22 cents per £1, now it’s $1.27. So now I’m even more confused by the bad UK performance and good USA performance, what are your APR’s looking like?

Compound Interest

Over the years with our 80% savings rate, I’ve conditioned myself to not even think about compound interest, it’s too far away I thought, now it seems to be creeping up on us, it’s hard not to get excited again.

If we have a bull run ahead of us, it’s not too foreign of an idea to think that we could hit $1m in a year and $2m in 3 to 5 years if we stay in the USA. And at that amount of invested money, the freight train of compound interest will well and truly be moving and soon after purchases like deciding on a $200k or $400k house will not matter anymore.

Where will we be if there is a bull run for the next 10 years and we decide to continue working? $4m? $5m? It’s exciting to think! But then I’m probably just drunk on the recent market surge. I’ve seen similar optimistic and celebratory posts on the FIRE subreddit recently.

And what’s the point in collecting this much? When will enough be enough? Not long ago £300k was my FIRE target to be able to sustain £12k per year in the UK, or “Minimum Wage FIRE” for 1 person. This month, we’ve now crossed £600k, that’s enough for both myself and Mrs SavingNinja to retire on £24k a year combined. Our UK spending was half of that for a long time. But now that I’m seeing the possibility of it doubling, and doubling again, and again! It’s hard to resist. Is this one more year syndrome?

Winter is Here

Winter is well and truly here now we’ve had lots of snow and ice. We’ve bought some micro-spikes and gators to go hiking up the mountains in the snow and we’re excited to get back out there! It’s getting more challenging to get out of bed in the morning though with old, non-smart heating we have to get out of bed in the cold to switch it on. These were luxuries we’ve never been without before and we didn’t realize how much we’d miss them.

Christmas is coming soon and I’m excited to create my annual review and compile our analytics.

See you next month!