This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

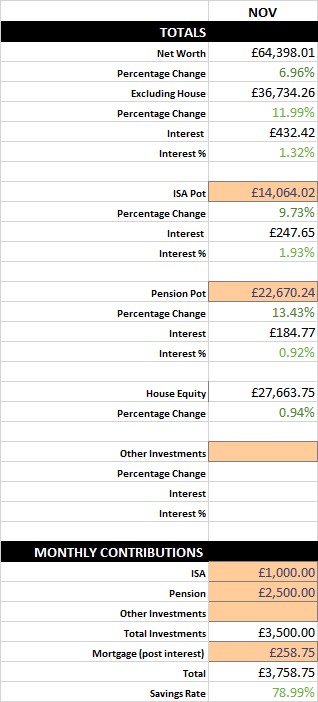

The markets seem to be recovering a little with my investments earning £432.42 this month. I’m still worse off since I started investing though, so there’s still a way to go with recovery.

My ISA pot now sits at £14k. I was really hoping to try and fill it to reach the £20k ISA limit before it resets in April but I may keep my matched betting profits to help boost my stake size so it’s not looking good on that front. I will hopefully still be able to throw an extra few thousand in though, we’ll see. My investments are now bigger than my house equity which is nice. That’s the way it should be for the savvy saver and I hope it will continue this way. I’m going to have to start a fresh savings tab for 2019 in the spreadsheet. This will mean I’ll have to build in some new functionality to look at the last month of the previous year. I’ll be able to start adding some snazzy charts to illustrate how the year went too, woo!

Other Thoughts

Matched betting has been pretty dyer this month. I got gubbed on Bet365 which was at the time my only account. So I stopped for quite a bit, I only recently started adding some alternative accounts. I’m still about £5200 up since starting, but I don’t imagine this will move much until after Christmas when I’ve secured a new B365 account. Feelings are a bit up and down at the moment. That means I haven’t got many thoughts to write down here! I’m starting to get itchy feet again at work now that I’ve been at this position for almost a year. Blogging is starting to get a bit harder with regards to thinking of what to write about next. I’m going to stick with it though :] I’ve read about the 3-month blogging itch, maybe mine is starting around now? There’s Christmas to look forward to! It’s my parents turn to have us this year, time to get thoroughly stuffed with lots of nice food and merry with lots of alcohol! Next time I write an ‘other thoughts’ section I’ll hopefully be wearing a Santa hat with a glass of wine close at hand! I hope you all have a good Christmas.