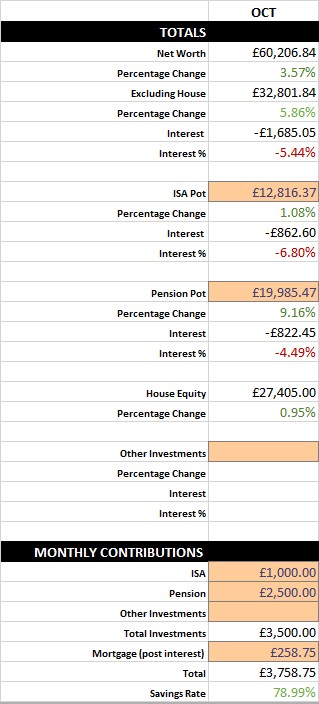

This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Wow. What a month! The stock market took a massive dive and I actually lost £1,685.05 from my investment accounts. Both my pension and ISA pots dropped by over 5%. This is the first big correction I’ve been in since I started investing!

Looking at my Halifax Share Dealing account, Vanguard LT 100% EQUITY is currently trading at 20,516.86p. This is actually the price that this was when I first started depositing into my ISA 12 months ago, so we’ve taken a huge dip and gone back about a year. This is still really small fry stuff for me compared to some other people I know that lost over 30k, but it still is a bit of a bummer. I actually ended up with an additional 2k net worth even with the losses so my total is now sitting at £60,206.84; I really shouldn’t be complaining :] My years to FI figure is now sitting at 4 years and 11 months. The increase in pension contributions really has helped to reduce this number massively. I still expect it to jump down further over the next year as I contribute more. I’m starting to see the benefit of recording all of this now as when looking at my first three savings reports it tells me that my investment pots have increased by almost £10k! Awesome! It’s really exciting to be able to look back and see what I was doing on that month and think “It really wasn’t that long ago!” It really makes me look forward to the future; I can’t wait to look back after a year or two of monthly reporting and see how much I’ve saved.

Other Thoughts

The potential inforcing of IR35 in the private sector has really put a haze over my future as a software engineer. I was considering a switch into contracting in 2019 and it was always something that I knew I’d eventually do. Now a lot of my colleague contractors are saying that if it came into effect, it probably won’t really be worth contracting anymore. Crap. It’s made me think about potential alternatives for next leveling my career. Another option would be to try and move into one of the ‘God’ companies such as Google or Facebook. This actually coincides quite well with finding out this month that Trump revoked the right for H1B visa holders spouses to work. If I still want to go ahead with my relocation escapades to the USA then getting transferred there by an international company via an L-1 VISA may be better than trying to get an H1B. I just have to get through 8 staged interview hell. I may do a blog series on training for this!

Kitchen Update

My kitchen has started! Woooo…Finally! I’ve literally been living out of dozens of boxes for months as I opted to remove the old kitchen myself and I was very eager with the task. The fitter actually started on Monday and the kitchen is already starting to take form. He says he’ll be done on Tuesday or Wednesday next week! Hurray!

More Free Money!

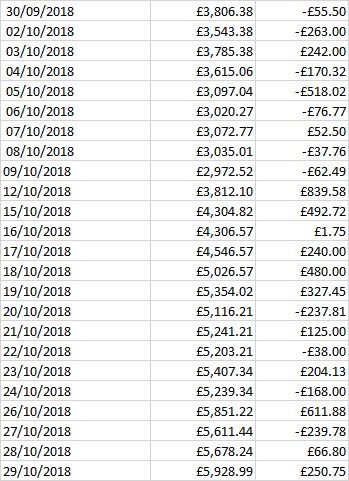

Matched betting is still going incredibly well. Since my last savings report where I quoted £3,816.88 profit, my total profit is now sitting at £5928.99. This was also all only EW betting at £10! I’ve now upped to £15 EW and will stick with that until I get to 8k profit.

As you can see from the snapshots, it was a bumpy ride. On the 5th I lost £518 in one day! But I soon was back on track by the middle of the month. I’ve decided I’m probably going to wait until after Christmas to write the EW betting guide. As I’ve only been doing it for about a month now, I’d like to get a bit more data and ride the variance wave for a little longer before I start it.