This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Click here to see all of my past Savings Reports and view my interactive net worth chart

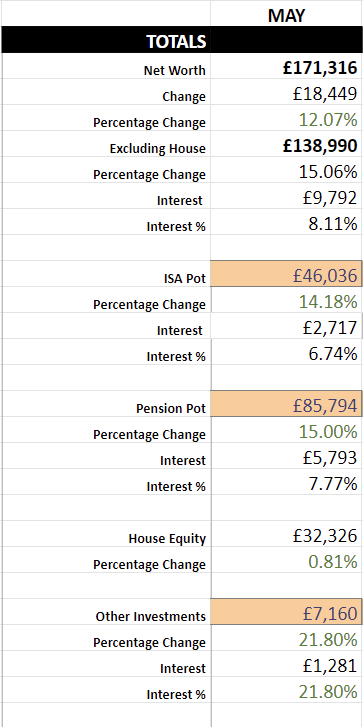

Stocks have well and truly recovered and due to buying whilst they were on sale, I’ve now broken even with the book cost.

Who knows if we’ll have another drop? The market seems to be very sporadic at the moment, so I’m just grabbing some popcorn and watching the show whilst continuing to invest as normal.

I managed to re-purchase my 10 Tesla shares after trying to time the market last month . Lucky too as they had another great month by laughing in the face of COVID and rising 21.8%!

Maybe these shares will eventually be enough to cover the cost of a Cybertruck? Only about 400% gain to go, if Tesla carries on at the rate it’s been growing then that might come in as little as 12 months, haha.

Other News

The world seems to keep spiralling into despair, the only glimmer of happiness being the recent successful SpaceX astronaut launch .

I’ve kind of stopped reading the COVID news now, I really have no idea if we’re coming out of lockdown, having a rebound, or what. All I know is that offices are going to stay shut for at least the rest of the year.

Instead, I’ve been focusing on personal growth, my mission to pass a Google like interview has been at the forefront of my mind so my lockdown has been full of whiteboards, YouTube videos, and problem-solving.

I have some exciting news to share on my progress with the interview training soon, so hold tight!