This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Click here to see all of my past Savings Reports and view my interactive net worth chart

Errrrmmm…

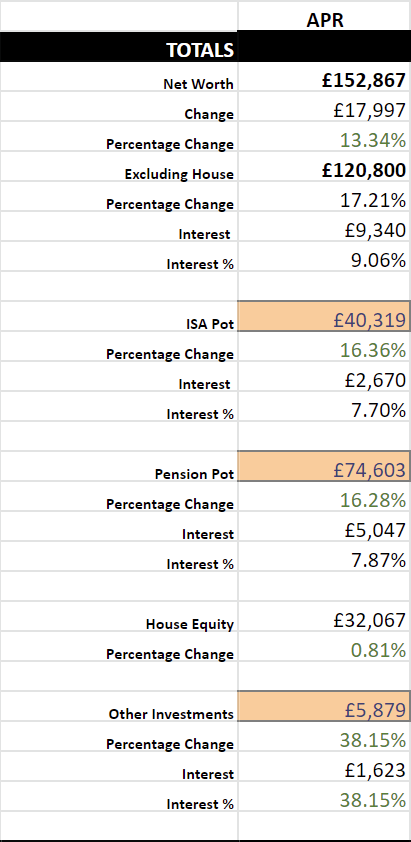

£10k interest earned in a single month? Ok…

Does that mean we’re no longer in a bear market?

I thought it would be a lot worse than that!

Then again lots of people keep saying that there will be another fall. It does seem really strange that the entire world is still effectively on lockdown and we’ve seen this huge gain, what’s going on?

I actually feel a little peeved off as due to a complication with my share dealing account this month I didn’t invest into my ISA on the normal date of the 2nd, but instead much later on the 20th, after the stock market had another huge rally.

This has been the case for a lot of the ‘bear market’, by sticking with my normal monthly deposits, I seem to have invested on a rebound every time. I kind of want there to be more crashing so I can pick up more bargains…

Anyway, I upped my ISA contribution to £3,000 this month and I also contributed another £5,398 into my pension via salary sacrifice; I’ll be leaving both contributions set to this amount until August; I’ll then reduce them to the amount that they need to be in order to hit the £40k SIPP and £20k ISA allowances.

My Tesla investment shot up gaining £1,623 in value, I then decided I’d try to ’time the market’ and sold all 10 of my shares for $725 each. This is now sitting in cash in my Freetrade account.

Tesla then shot up a little more right after I sold which made me feel a bit uncomfortable; I feel like I’ve made the wrong decision by selling as I was holding Tesla because I believed in the company and wanted them to be a really long hold, not because I wanted to make a quick buck. I’m now worried that I might never be able to buy them back if they stay above $725, which will make me sad :(

Other News

£465.

That’s an awfully low figure.

That’s how much my monthly expenses are during the COVID lockdown; it’s my normal expenditure minus any luxury spending, minus the holiday pot, minus the god-awful £200 odd I spend to commute to work.

That’s £5,580 per year. Or, in FIRE terms, £139,500 needed to be financially independent (using the 25x rule).

It’s an encouraging number. If I could get to the financial position to cover these base costs outside of my pension, I’d be extremely happy. I could fund all other expenses (holidays, luxury) by post-FI related entrepreneurial activities; I’d hope that with enough time on my hands, I’ll be able to release a couple of successful pieces of software. If all else failed, I could pick up a side-gig for a couple of weeks to fund a luxury holiday.

I’d like to try and hit that base figure in passive income before I retire, then everything would be perfect!

Meditation

I’ve got Headspace for a whole year. I used their family plan offer so it only cost me £12.50. I’m hoping that completing some of their courses will give me back some of the control over my emotions that I seem to have lost.

I just need to actually stick to a routine; has anyone else found that during lockdown they seem to be less productive and get less done?

Usually, cycling to work each day contributed to my exercise routine, without that I’ve been reluctant to do anything else. I’m dreading to look at the scales to see how many kilograms I’ve gained!

Holiday Blues

Once all of this is over I really want to splurge on a holiday, after all, our trip to Switzerland in April did get cancelled. Not being able to go on holiday is making me really want to go on one and not care about money as much.

Maybe COVID will help me break out of my frugal shell and appreciate the value that spending money on experiences can provide? People always say that you don’t realise how much you love something until it’s gone.

What is first on your list when the lockdowns are lifted?

What adventures will you go on?