This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Click here to see all of my past Savings Reports and view my interactive net worth chart

Woooow - the markets flipped out big time.

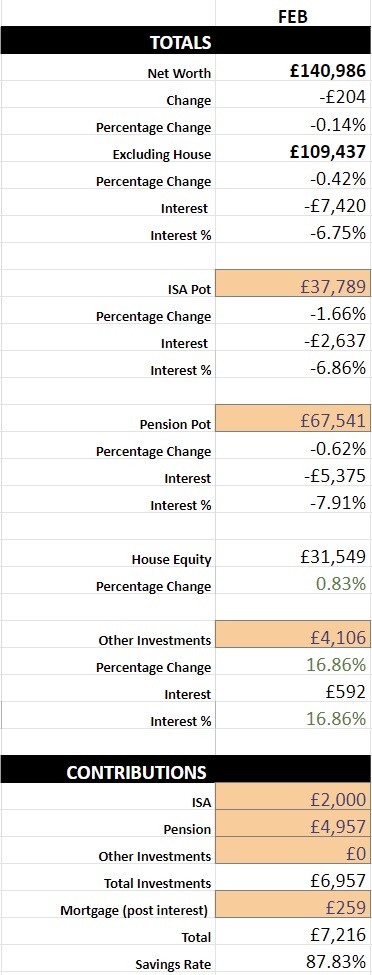

My portfolio dropped by £7,420 in value, this wiped out a lot of the interest I’ve ever earned since I began investing. My ’total earned interest’ figure dropped from £10k to £2.5k in the space of a couple of days. Ouch.

Luckily, I’m still in my accumulation phase and with my continued hefty contribution of £5k into my pension and £2k into my ISA, I almost reversed the effect of this huge decline; but my total net worth still dropped by £204.

Actually, looking at all of my savings reports this month marks the first one ever where my net worth has actually decreased.

Sure, I’ve had some months where stocks have declined a lot (by over £2,500), but due to my massive contribution amount I’ve always ended up adding something onto my net worth anyway.

Maybe I should be rejoicing as this probably just means that I’ve finally got a decent amount invested? Enough to feel a hit like this.

Anyway, buy whilst they’re on sale! The markets will surely recover (they have since writing this!) I will be leaving things exactly as they are and depositing the same amount and at the same time no matter if what the markets decide to do. Simplicity is beautiful.

Remember, the worst thing you can possibly do is sell at the bottom, so don’t!

April is Approaching

One more month to go until the end of the tax year. I’ll be continuing with my big contributions next month, then I’ll have to review how much I want to lower it to after April.

What do you guys think is going to be announced in this years budget?

There are fears that the higher-rate pension tax relief is going to be scrapped. That would be a bit of a blow to my savings going forward - but I’d be glad I managed to max the £40k limit at least once. I’d just hate to see a lot more money disappearing in tax, but I suppose it’s got to happen at some point as I should ease off the pension sacrificing soon.

I’m considering going with a £1,666 per month ISA contribution amount per month after April - or do you think I should fill it up straight away then leave it for the year?

Or maybe I could put £9k in on the first month and then 11 months of £1k each? I don’t necessarily need such a big cash buffer (which is currently being held in a Marcus account,) but I do like having that cash there and deciding how much to transfer into my investments towards the end of the tax year, especially as I’m looking at switch jobs this year (or review contracting again).

But maybe it’s just silly to have over £20k held in cash when my expenses are only £10k per year ? What do you guys think?

My ‘years to FI’ number has gone down to 1 year and 10 months. This is due to the first two months of the year having above normal monthly contributions so my savings rate average is being set to 87%. I should probably change how the average is calculated as the contributions will be going down by a lot in the coming months, but it will still take a while for my average savings rate to drop back down.

I was speaking with someone the other day and they were saying that my 6% estimated post-inflation figure for growth is a little unrealistic. It got me playing with different growth rates in my spreadsheet calculator and the new FICalc app

I was quite shocked when I found out that when you’re savings rate is so high, interest basically does absolutely nothing. In fact, I’d probably be better off just not investing at all.

If I up my predicted investment growth from 6% to 15% my ‘years to FI’ figure goes from 1 year and 10 months to 1 year and 7 months. That’s exceptional growth to save, what, 3 months?

If I lower my predicted investment growth from 6% to 0% my ‘years to FI’ goes up to…

2 years and 1 month.

Yeah, I’d have to work an extra 3 months. If I had no growth at all, I’d still ‘retire’ in around 2 years.

Maybe this is just cause for me going with a heavy bond portfolio instead of 100% equities?

Analysing this more closely I realised that for the ’extreme’ FIRE pursuer seeking retirement in 5 years or less, compound interest is virtually useless.

If you truly did begin drawdown as soon as you hit your number then you’d never ever feel the effects of compound interest. The magic won’t happen. It only really starts if you’ve accumulated for more than 10 years.

This made me feel a little sad; if your able to save 75%+ of your salary and become FI in 5-7 years, you would be a very happy early retiree; BUT, if you’d instead continued to work, the compounding effect for that extreme saver would be ten-fold. You’d potentially have created generational wealth, but you’re ’throwing it away’ for early retirement.

For example, instead of quitting work at 30 years old with £300k, I could continue saving the same amount until I’m 35 and I’d end up with a pot of around £780k. With no further contributions, that could turn into a hefty sum at 55…

£3,170,000…

That’s with no additional contributions after the age of 35.

Am I willing to throw away over £3m at the - still relatively young - age of 55 for a life of £12k per year leisure at 30?

Hmm, kinda!

But realistically, I’m probably going to meet halfway. I’ll definitely continue to work in some capacity after 30, but I’ll be focusing more on other things rather than solely my savings rate.

I really want to get SOME of the magic of compounding through-out my life. In order for this to happen, I’ll probably look to get to around a 2% withdrawal rate, that way I’d hope that the pot will continue to grow even in drawdown.

Maybe I’ll be lucky enough to have enough passive income to mean that I don’t have to drawdown my stash at all?

But yeah, something to consider: to extreme FI pursuers compound interest doesn’t mean shit!

Other News

I bought the cod liver oil capsules that Nick recommended, I’ve been taking them for a little over a week now.

I think I feel happier.

I noticed that my eyes almost seemed to stay open wider after the first day. It’s extremely hard to know if this isn’t just a placebo effect though. I did feel a little sad for one day, but my mood generally seems to be up. It’s only been one week so I’m unsure what I’m really expecting!

I’ll probably just continue to take them for now as they’re not too expensive when having one a day (sub £10 per month). Although I do think that mindfulness and consistent meditation may give me the same or a better effect; so I’d like to get back into that. I just need to find the time… I’ve still only read half of a book from Project Happiness :(

Algorithms

I’ve started to make a little bit of progress with my interview training . This is because I’ve begun to focus only on a singular subject rather than skitting around to a lot of different Computer Science problems.

I’ve actually started a SCRUM board in my office and I’ve been adding each problem that I solve onto it via a sticky note with some hints on each. This has helped motivate me to try and solve at least 1 problem per day.

My current area of study are Trees and Graphs . I’ve also been using a new note-taking tool called Roam Research to store all of my training notes; it’s been absolutely awesome - go and check it out!

Leetcode has also been invaluable as my one-stop-shop for Computer Science problems (especially as I can make a bookmark for a certain subject like this .) I’ll probably purchase their premium subscription soon so I can start doing mock interviews.

Coronavirus

It seems like the world is going crazy over the Coronavirus. I’m just hoping that we can still go on our snowboarding holiday in April as we fly into Milan!

The UK seemed to have finally got out of Brexit limbo and then this virus hit. Has the world always been one crazy thing after another and am I only now getting old enough to start observing the anarchy? Or do we not normally have this many life-altering events happen so close to one another?

Blogging

This month has seen virtually no blog posts. I seem to have developed extreme writer’s block. Since I moved to my laid-back approach, I’ve been unable to begin anything new from my drafts list. I’m hoping this will pass soon.

Mrs SavingNinja has still got a half-finished introductory post that she begun writing last year, unsure when that will get finished, she’s really busy with work right now.

A lot of my effort is going into interview prep and app development . I still have two really cool app ideas that I want to get out there and I’m also in the middle of developing an app for my father-in-law. Life is busy right now.

These saving reports are, at least, easy to continue writing - so I’ll keep you guys in the loop!

How was your month?