This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Click here to see all of my past Savings Reports and view my interactive net worth chart

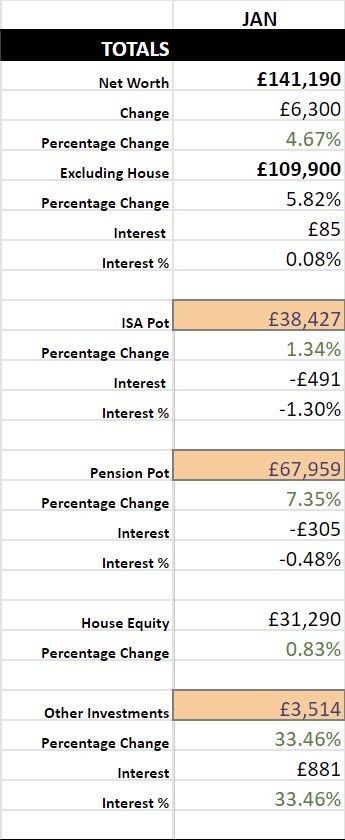

January saw the stock market take a bit of a tumble and I lost £491 from my ISA and £305 from my pension.

It’s actually quite strange how I lost so much less from my pension as I have almost double the amount invested.

The majority of my SIPP is invested in a work-place pension scheme and I’ve chosen the option of ‘Passive World Index Tracker.’

I assumed it would be pretty similar to Vanguard LS100 but the difference in capital lost this month has showed me that it isn’t.

I only hope that when the market goes up, I won’t be losing too much money in this work fund!

I do plan on transferring it into Vanguard after I leave my current employer, which will hopefully be this year.

My Tesla investments grew by a staggering £881 this month (it actually grew by a further £500 on the 31st of January but I took the snapshot before this), gaining me back all of the interest that I lost in my passive funds! This is insane considering how little I have invested. My ‘Other Investments’ fund has actually grown by over 100% from Tesla alone in the past 3 months.

I also got a free share by opening up a Trading212 account. Use my referral link to get a free share worth up to £100 yourself, you only have to deposit £1 to get the free share; it’s extremely quick and easy!

My net worth is almost at £150k which I’m very happy with as it was only July last year when my total net worth crossed the £100k barrier.

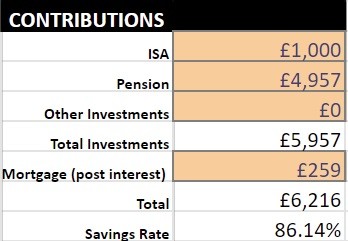

It’s growing very fast, although I have to remember that I’ve been dumping a lot of excess cash into my ISA and pension before the end of the tax year arrives in April so it won’t be growing this fast all of the time.

January marks the first month of my rush to max my £40k pension contribution this year. I’ve got two more salary sacrifices to ensure this happens. I’ve actually upped my sacrifice again from 75% to 82% as I calculated that with the current contributions I’d be around £800 under the £40k limit; luckily my employer allows me to sacrifice up to 85% of my base pay.

It feels great paying barely any tax and zero student loan repayments and knowing that these savings are helping to increase my FI fund. In April after my full years’ tax status has been calculated I’m also hoping for a big rebate as HMRC took away my whole bonus in 2019 as tax.

Other News

Retire In Progress was generous enough to give me some invaluable advice on how to best prepare for an interview at a tech giant (thanks to Indeedably for the suggestion of reaching out).

We chatted for quite a while about the interview process; what to expect; how best to train for the difficult problems; and all of the red flags which I should try to avoid.

I gathered a lot of useful intel, but I also ended the call thinking damn; it’s hard! It’s like…really really hard. I’m not just talking about the immense pressure that you’ll be under at your 4 or 5 interviews (one after another), but the questions are hard as well.

Have I really got the cahoonas to even attempt one of these interviews?

I don’t know, I definitely don’t feel like I do right now.

I’ve set up a rigorous training schedule but I’m struggling to find the brain-power-time to commit to it each day. Couple that with failing miserably at seemingly easy questions and it’s starting to get me down.

I’m just going to continue slogging through for now and hope that things begin to get a little easier, I’ve still got over 4 months of preparation time left.

Blogging

I’ve been a little light on the info posts lately. I’ve been spending some more time on website improvements like the interactive charts in the My Journey So Far page.

I’ve also been spending all of my creative writing time on a guest post for a friends blog which should be ready for release in February, so, unfortunately, it will probably be another somewhat quiet month…but I’ll let you guys know when the guest post is out so you can go and read it :)

Happiness

Of course, due to being so happy prior to Christmas , my mood has crashed a little in January. It was inevitable that this was going to happen, what goes up must come down - just like the stock market.

I’m trying to reassure myself that it’s just my mood fluctuating but my dampening mood of lethargy and unexcited-ness for the future is not very pleasant.

I really need to try and combat these swings more, I can’t just keep pointing at FIRE as the answer. I’ll have to do some more investigation into meditation and potentially go to the doctors about it.

I currently feel that it’s not severe enough to go to the doctors, and I don’t want to be taking all sorts of pills, so I’m unsure whether that’s even an option. In any case, I’m thinking that they’ll just tell me to practice mindfulness and meditation - that’s what they told me to do when I complained about weekly migraines.

Do you think I should just stop being a baby and realise that everyone in the world has mood swings and is depressed every so often?

Anyway, I hope that February can get me across £150k net worth!

How was your month?