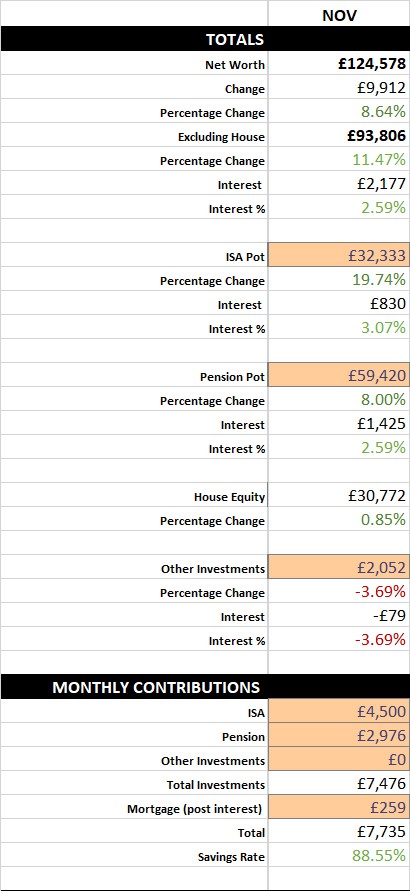

This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

The percentage change in my total invested assets this month went up by 11.47%.

Oh boy, I’m going to miss having such a big impact from my contributions when my pot grows a little larger!

As you guys can see, I dumped an extra £3500 into my ISA this month.

I’ve done this to ensure that I maximise the ISA threshold of 20k before April, and I’m doing it early because I want to hit the 100k invested goal before the end of 2019 (I’ve got the Prosecco ready to celebrate!)

This also coincidentally lined up with an unexpected pay rise from work. I usually get a car allowance which I took as cash each month (I have no need for a car). My employer has now stopped offering this perk and instead consolidated the car allowance into my base pay.

This had the unexpected benefit of increasing my employers’ pension contribution amount and the amount of bonus they pay me by quite a large sum as it gets calculated based on my base pay. So, my pension contributions seem to have gone up by £300 - almost at the pension annual limit!

This might change next month as when something changes with your pay it usually takes HMRC a while to figure out how much tax you should be paying, we’ll see.

I’ve got another £4500 lined up to go into my ISA on the 1st of December, so it’s looking like I will hit that 100k target next month!! I really hope stocks don’t take a tumble :)

I benefitted from a hefty £2000 interest earned from stock growth this month which is why that drool-worthy 6-figure invested sum is within my sights.

Alt-Investments

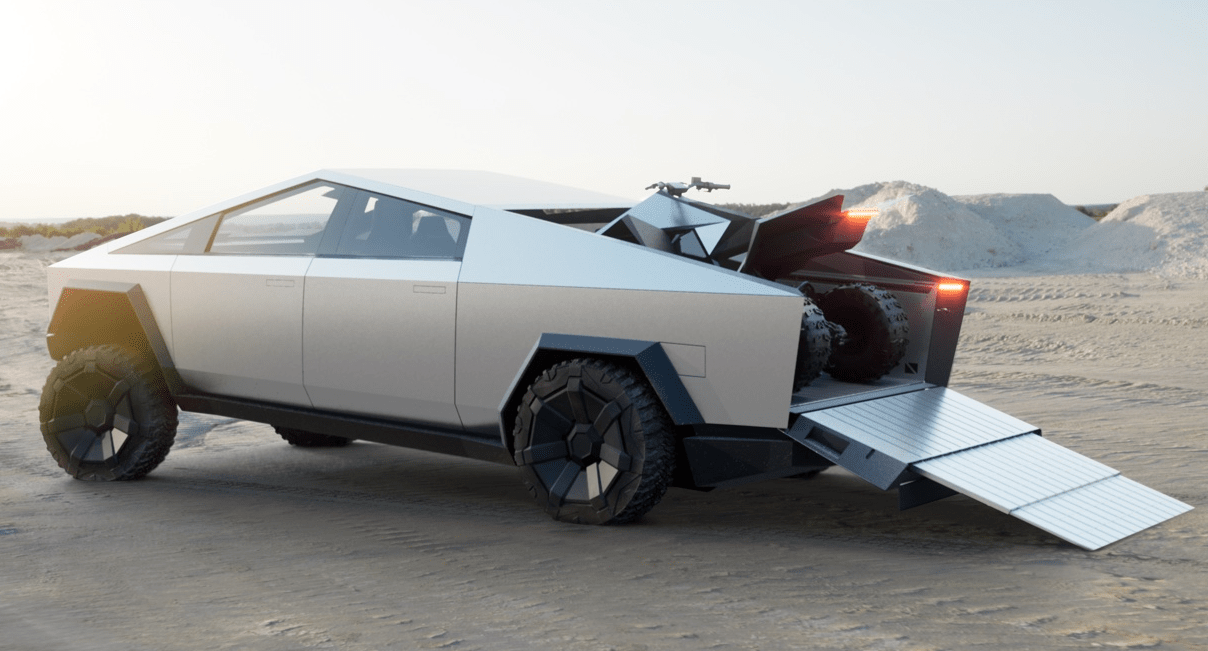

As soon as Tesla stock tumbled because of the announcement of the AWESOME Cybertruck, I took the opportunity to buy more of them!

Due to Property Partner’s fee increase, I really wanted to get rid of the platform from my portfolio and replace it with something else, so I bought around £770 worth of Tesla shares bringing my total to 8 shares (I got 3 shares for the price I paid for 5 back in August !).

Now all of my alt-investments are Tesla stock, so it should be easier to track the performance each month.

I’ve yet to officially sell the Property Partner portfolio even when I’m listing the property at a huge loss of 12%, I may have to lower the price even further if it doesn’t sell this month :(

Other News

I’ve decided that I’m going to enroll in an American graduate program to get a Masters of Computer Science. This is a huge commitment and it’s going to take up a considerable amount of my time over the next 2 - 3 years as I’ll be completing it whilst still working full time.

My interest in doing this all started when I met someone at a FI meet up who’d done this course and I was shocked at the low cost and the diploma awarded. It’s actually the cheapest Masters program that you can take from a premier USA college. Check it out here , and read some awesome opinions about it here .

I’ll be writing up an article soon about why I believe that this was the right choice for me. It’s not going to change any of my other plans, I’ll still be training and applying for a FAANG[note]FAANG = Facebook, Apple, Amazon, Netflix, Google.[/note] job next year and I still have my sights set on emigrating - this degree will hopefully help with these goals!

Life

I’ve been feeling increasingly melancholy about life recently. I seem to get like this every now and again; do I REALLY want to move to the USA? What will ACTUALLY make me (and my wife) happy? Maybe I should be doing something COMPLETELY different!? All of that jazz.

I think my partner and I need to have a really good planning session and simulate different routes that we both could take and where they may take us 5, 10, and 15 years down the line. Sometimes what we think we want now won’t actually be the best move when you consider what you want in the future.

Mrs SavingNinja is currently on the cusp of a potential career change so we need to really sit down and think whether it’s even worth it when thinking of our future goals, and if it is; what career she should be putting her energy and money into developing to align with that future.

We need to ask ourselves questions like; Do we still want to travel and/or have the ability to live anywhere whilst working?

That would be considerably easier if we could both work remotely. If we wanted to go down this route then maybe efforts should be focused on gaining skills to allow for a better possibility to work remotely?

It’s strange how I seem to get sad when I feel unsure of the direction we’re heading in. Planning for the future always makes me happier!

How has your month been? Do you think getting a graduate degree is worth it?