Simon contacted me whilst I was on my honeymoon with an artfully drawn Ninja shuriken and asked if he could guest post on Saving Ninja. So, of course, I had to say yes!

This marks the first-ever Saving Ninja guest post, so I’ve created a new subcategory called ‘Guest Post’, and if anyone else would like to contribute, hit me up over on the Contact page.

Simon runs his own personal finance blog over at Financial Expert which he created back in 2010. He’s based out of Yorkshire and quit his accountancy career once he became Financially Independent last May at the young ol’ age of 30!

Now he concentrates fully on Financial Expert which he began to rebuild a month after he retired into a learning resource which teaches you things like how to invest in property and how to buy shares , all with an awesome gamified approach (which I like a lot).

Now, over to Simon!

Last week I shook hands on a life-changing deal. I expect that it will improve my future quality of life immensely. I sold my dream car.

Wait… sold?

Yes, that’s right, I waved goodbye to my Jaguar F-Type, which I’d bought two and a half years earlier.

So, why did I sell it?

The reasons for initially buying the car no longer existed, so it no longer made sense to stick with the status quo. The car had to go!

When I bought it, I was in a stable, respectable job. I had no financial commitments (I rent an apartment with my partner).

However, recently I left work to take a mini-retirement over the summer months and do some travelling.

Nothing focuses your attention on outgoings more than a loss of income! While I was in employment, I could rationalise away the juxtaposition of being a keen saver and owning an expensive car. Because I could still save ‘something’ in spite of its high cost, it was a tolerable expense.

Now that the salary has dried up, the wealth-munching nature of the car is clear to see.

For the record, I still loved the car, and right up until my last drive, it still made me smile. But as Heraclitus (Greek philosopher) wisely said; “Nothing endures but change.”

Calculating the cost of a dream car

Now that the car has found another home, let’s crunch the numbers and figure out how much I spent on it.

I owned the car outright, therefore I incurred depreciation rather than lease payments or finance charges. I bought the car second hand in December 2016 for £44,700. Larger wheels and tyres added £1,600, which brought the total cost to £46,300.

I sold it privately for £27,250. This equates to £19,050 depreciation over the 32 months I owned the vehicle or £595 per month.

A range of other costs also need to be taken into account. Annual servicing, consumables, taxes, fuel and insurance all add up. Unsurprisingly, each of these categories is driven higher because of the F-Type sitting in the ‘sports car category’.

The damning total cost

Cost

Cost per month

Depreciation

£595

Annual Servicing

£35

Tyres & Brakes

£61

Road Tax

£27

Insurance

£74

Premium Fuel

£80

Total cost per month

£872

I computed these figures for the first time to produce this article. I’m staggered at the magnitude of the final sum:

£872 per month. £10,464 per year. £27,904 in total.

That sum could have been spent on:

- 14 holidays for me and my partner (a £2k holiday every 8 weeks)

- 558 three-course restaurant meals (three per week)

- Part-time cleaner, florist, gardener and handyman.

- A deposit for a small home

- Half of the contents of a Primark store (surely?)

- Investments

Of all of the alternatives, investments are the most likely use of the extra cash.

The opportunity cost

This calculation began a train of thought along the lines of what if? What if I had invested the money rather than spending it on brake dust and tyre smoke?

The FTSE 100 has barely moved in the 2.5 years I’ve owned the car, therefore so far, I have only missed out on £2k of dividend income which I would have received in that time.

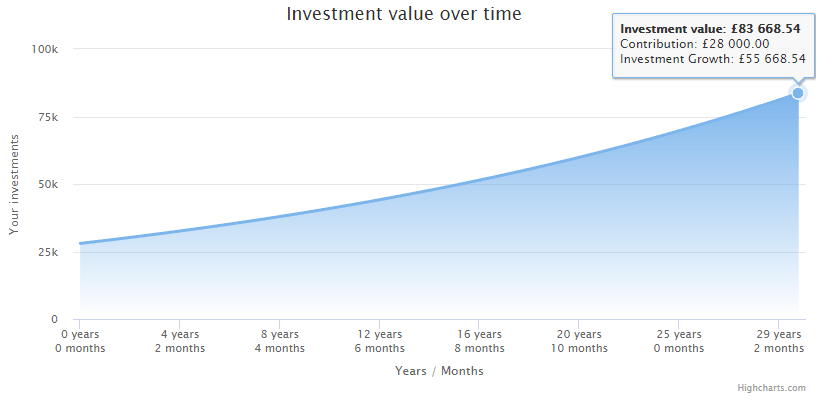

The phrase ‘so far’ is really important, because the real opportunity I have missed out on is having the £28,000 tucked away in an investment account for the next few decades. Here’s what could have happened to those funds:

Therefore the true cost of enjoying my dream car now is missing out on £80,000 in my ‘retirement years’. Yikes, that’s a pricey couple of years behind the wheel.

Looking into my future

Moving on from what ‘could have been’. The more important number for me is – what do I gain from escaping the luxury car rat race?

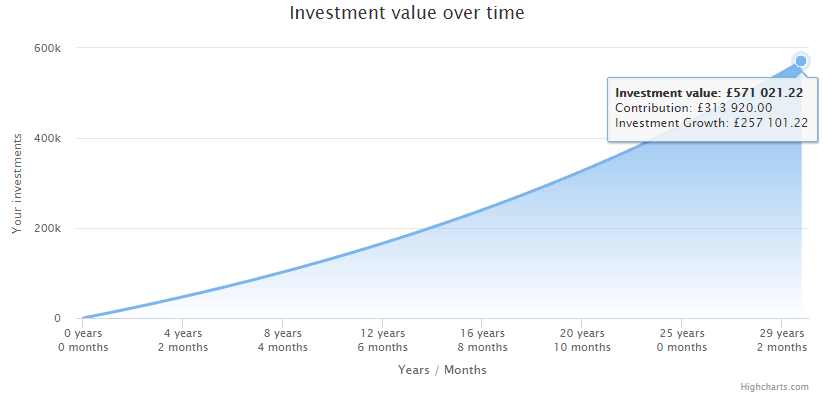

If I decide to invest the £872 monthly savings from selling my car – the following graph shows that this would grow to an incredible £571,000.

Therefore on reflection, while my consumption has certainly held back my retirement savings, the returns from staying away from luxury cars in the future massively outweighs this. I’ve made a difficult but positive decision which will transform my quality of life in retirement.

Everything becomes normal

I learned a broader lesson from this episode:

Everything becomes normal.

A super sports car was a thrill to drive, but after years of ownership, it simply felt… normal! It is difficult to even tell whether my day-to-day happiness continued to receive a lift once the novelty had worn off.

You could apply the same principle to jewellery, housing, fashion and other status symbols. As humans, we tend to always overestimate the positive effect they have on our lives.

As many celebrities and business people have observed – being rich doesn’t equate to more happiness.

Recent research supports the idea that we all revert to a stable, personal level of happiness, even after traumatic events.

If you have found contentment, in life, with family, friends or your situation, then you may be overestimating how much any individual purchase (or sale) can change this.

I hope this gives you the confidence to jettison any large material possessions that feel like a weight around your neck. It turns out that killing the dream car doesn’t kill the dream.