This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

What on earth happened this month!?

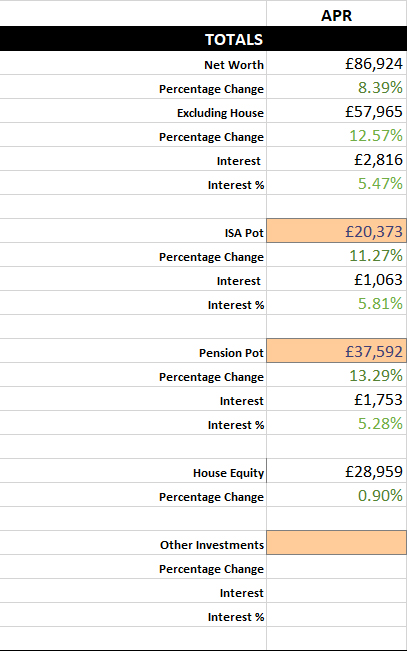

My investments made a staggering £2,816, the most it’s grown in a single month yet.

Surely some of my formulas are out of whack? That’s 5.47% interest gained in only 1 month; jeez!

Anyway, I’m not complaining. My total net worth grew by £6,732! Pretty darn awesome.

For some reason, my pension contribution this month went up to £2,657, up from £2,579 last month. I have no idea why this has happened as I haven’t changed anything. Maybe it’s still re-jigging from my pay rise last month ?

We’ll see what it is next month, it will probably go back down.

My years to FI now stands at… Drum roll please…

3 years and 11 months!

Wooo, finally under the 4-year figure. Seeing that 3 makes it seem so soon, exciting stuff! I know it will probably flip-flop up and down, especially as the pot grows (and with this month’s insane 5.81% growth), so I’m not celebrating just yet.

Other Thoughts

April has been a pretty busy month. My Dad came to help me lay new flooring in the hallway over the Easter bank holiday. We successfully did it, but it took almost 3 full days and was pretty hectic. I may have to re-think my house building project (or at least try some smaller building projects first!)

It probably would have been more enjoyable if there was more time to complete the project leisurely, but as it stands I have no place to store any big tools so my Dad had to bring a bunch down (from across the country).

Turned out alright in the end though!

Sub-floor to level out the wonky floor boards.

Need to replace the carpet next.

Blogging

I wrote my first fiction piece of writing responding to Marc’s microfiction series , which was pretty fun. Again, one of my after-FI projects was to write a fantasy novel, so April saw a lot of “testing the waters” for these types of projects. It’s always good to try smaller scale projects out before committing to a full-blown one!

We saw the 5th installment of the Thought Experiment series which had over 16 articles written, our biggest turn out yet! I’m really happy that so many people like and participate in these posts, it’s almost sad that I switched from monthly to bi-monthly, but, I have to remember the reasons for doing so; there are still plenty of other topics that I want to write about.

The Thought Experiment posts are hard-work, not only do I have to write up the question and answer, but I have to keep track of everyone’s responses and read them all, which I enjoy doing, but is of course time-consuming. Once per month will be way too much I think, but we’ll see for now.

Wedding

Wedding prep is still ramping up, a lot of things have been completed now and I see the finish line in sight. There is now under 3 months to go until the big day.

We also got our half-dome permits so we’ll be going on a 12-hour hike at the end of our honeymoon which will be awesome!

We get to climb up this thing!

Matched Betting

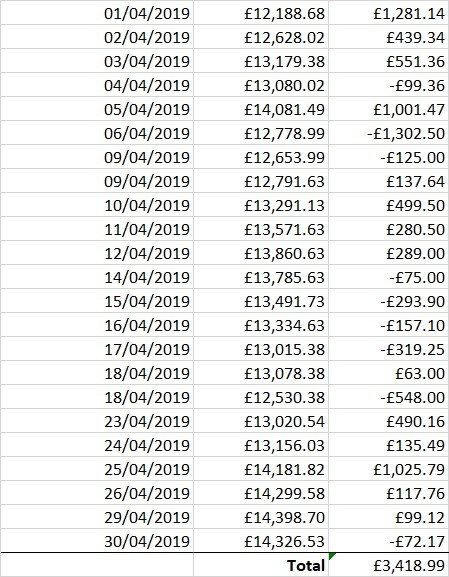

April saw my EW betting profits stay strong, making £3,419 (tax-free). This was from a very strong beginning of the month, a massive mid-month dip and then a strong finish.

I will be beginning to taper EW betting down over the coming months as a lot of my highest earning accounts have been gubbed. I still have a couple of account sources up my sleeve but I’ll be waiting until after the wedding to begin these. So, for now, I’ll be reducing EW betting efforts to around 20 minutes per weekday and I’ll be aiming for £500-£1000 per month profits.

This would still be a nice income with very little effort and should be doable on stake restricted accounts.

Rebo Portfolio Tracking

One of my favourite bloggers Andy @ Liberate.life has just released his super-secret new project to the world, portfolio tracking software called Rebo .

The software lets you compile all of your investment accounts into a single view and analyse all of your assets, great for if you have multiple accounts with different providers, they even have an option to add multiple people into a single view (for the family accountant ;) )

It also tracks all of your investments automatically, so you don’t have to manually update your fund values each time the market changes.

I’ve been a beta tester for a while now and I’ve been enjoying using it. The best thing is, it’s free! Go and give it a try and let me know what you think.

See ya next month!

How did your month go? Let me know in the comments below.