This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

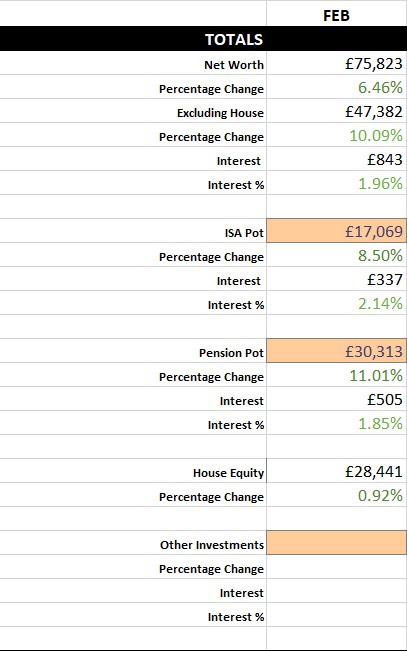

Another positive month which sees my investments interest grow by £843! This brings my investments back above water and over the book cost, which is great.

Hopefully we’ll start to see some compounding this year if things continue to go up.

My ‘Years to FI’ number is now down to 4.2 years, sliding ever so close to the under 4 number (maybe next month?)

I’m almost at the 50k investment balance which is awesome! Remember when my total net worth crossed the 50k threshold all the way back in July’s savings report ? It’s now sitting at 75k, a growth of 25k in just 8 months. SO CLOSE to that 100k mark!

Other Thoughts

It’s been another dreary month which is to be expected at this time of the year. I’m still having a pretty crap time at work, it’s the first time in my career that I feel that I can’t leave due to my month long holiday for my honeymoon and a big bonus pay out. Maybe that’s a good thing? That I can’t jump ship as soon as things start to get a bit political and crappy.

I’ll definitely be looking for a new position straight after my honeymoon. If I wait much longer I’ll be trapped again with the lure of another bonus so better to move straight away.

All that I’m focusing on now is my wedding! It’s now only 146 days away and I know that it’s going to come around quickly. There is still so much to plan, there has been barely any progress made to the scrum board which I posted in last months Savings Report , we really need to get our head down!

Cheltenham is next week which I suspect is going to be the most profitable matched betting time of the year and I’ve been saving up my best bookies to use on that week. This is the reason I rushed to bring out the EW Betting Guide , so you guys can utilise it before Cheltenham! I’ll hopefully have some good stats to share with you in April’s Savings Report.

How was your month?