Introduction

2023 was the first full year that we spent in the USA, our hopeful forever home. We saved the most that we have ever saved with a high income and working remotely in a low cost of living area. We explored many mountains, swam in many lakes, and we started to feel at home.

The year ended with the shattering news of being laid off and learning that we would have to leave the USA and return the UK.

This scuppered our plans of “settling down” which was one of our goals for last year and threw us right back into the fray of uncertainty and job hunting.

I’ve not thought about goals much for this year, as we’re still very unsure of what we even want to do. Writing this review post is going to be the first time I’m thinking about it, so you’ll be along for the ride.

2023 Financial Review

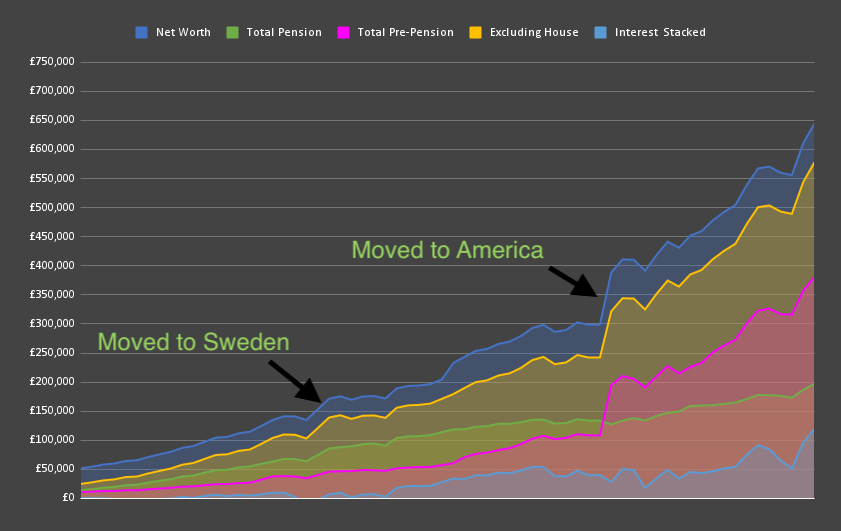

- £643,439 Networth (+£200,056)

- £576,715 Excluding House (+£200,056)

- £119,915 Contributed

- £83,944 Interest Earned

- £197,224 Pension (+£45,956)

- £22,708 Contributed

- £23,807 Interest Earned

- £379,490 Pre-Pension (+£154,113)

- £97,207 Contributed

- £60,320 Interest Earned

- £66,724 House Equity

The numbers are almost too big to comprehend. Our household net worth has grown by over £200k, which is mind boggling. It was only 2 years ago when we reached our initial £300k net worth total, I wrote that it would take us 10 more years to get to £1m , which is what I thought our family needed to safely retire.

With our new £643k net worth, it seems that with £40k per year invested and moderate 7% growth, that £1m figure is only 3 years away.

How did we cut down what was 10 years away to just 3? We skipped 5 years.

Of course, the answer is moving to America and investing a lot during a market slump. I need to not forget that inflation has also ran rampant in the past 2 years. In 2022 it was 6.5%, and in 2023, 3.4%.

Combined, that same £1m target from 2 years ago should now be £1.1m. This is something overlooked by a lot of the FIRE community, including me. We figure inflation into our predicted investment returns, but we don’t adjust our targets.

This would be overcome by looking at annual spend and adjusting targets based on that, but that can be disparaging if people think that their spending is going up a lot, either that or people would cut even more from their lifestyle assuming that they should cut back when it’s really inflation doing it’s thing.

In any case, I’m proud of our numbers, and the stock market looks like it’s finally paying metaphorical (and figurative) dividends for being invested longer term, which is now about 6 years.

Moving out of the US again will definitely slow down our contributions, but I’m hoping that now our pot is sufficiently plump, the kickback on the gains will help us get over the finish line, even if we invest less than half of what we have been investing.

Let’s delve into the 2023 analytics!

Total Net Worth

The top chart is so visually pleasing. The data from it now spans over 5 years and it really shows how an exponential curve is forming. Year after year it’s getting steeper. Yeah, it could be because we came to America, we will see in the coming years if the curve continues to steepen!

Interest vs Contributions

2023 was an insane year for interest growth. You can see in this chart that it was sputtering for most of the year and then out of nowhere November and December were really great months for the stock market. We still invested around £10k per month, which was our goal for the year but the investment gains very nearly overtook contributions for the first time ever.

Here’s another chart showing each individual month interest change, 4 months were a loss, with September dropping by almost £20k!

Lifetime interest went bananas this year. Last year I was complaining about it only being +£33k, it’s now up by 4 times that in a single year. It really shows how out of the ordinary 2023 was for the stock market.

Interest gains tracked in the spreadsheet show a growth of 23.35%. It’s one of those years that makes me glad I invested so much up front.

I really hope we can continue with this momentum for a bit!

Now that I’ve been tracking our savings for 5 years, here’s a new chart to show growth and interest on an annual basis.

Goals Results

Below are the goals that we set for 2022 Reviewed , let’s see how we did.

1. Release two full length novels

This goal hasn’t been reached. I completely gave up writing with work taking up all of my time. Although Mrs SavingNinja has kept this up!

She hasn’t released as quickly as she initially wanted as this was her first time writing a full length novel, but she has learnt a ton and is confident that going forward, she will be much quicker. She has completely finished the first book in a duet and it is 419 pages long, book 2 is also half done.

We’ve both learned a lot about the marketing side of self-publishing too. She has been building out a TikTok following, created a website and newsletter, and a host of artwork for the cover, print version, and promotions.

Book 1 release is set for the end of January with book 2 being two months later. I’m going to run some paid adverts and I’m hoping this is the start of a new career for her.

Do you think I should share the book link here? The genre for this series is paranormal-romance, let me know!

2. Earn $1000 from total book sales

Not yet.

3. Visit 3 national parks

We managed to visit 1 national park - Acadia. Our other travel was taken up by a relatively stressful trip to Italy. I wish we could have gone to more national parks, especially now that we’re leaving. This will have to wait for a big American road trip.

4. Contribute at least $100,000 into pre-pension savings

Yes! We ended up investing over $150,000, $124k in after-tax accounts.

5. Exercise 3 times per week as a default

Failed miserably. I keep going through stints of exercise and then stopping. Now, with the layoff, I’ve lost all motivation. I usually have better luck when I try to restrict my diet as well as I feel healthier. We’re still both hiking a lot, snowboarding right now, and exercise on our new virtual reality Quest 3 (very fun!) but we’re still not doing as much as we should.

6. Don’t buy anything new

We started out doing so well with this goal! We got all of the way to May with only purchasing these items from a second hand thrift store:

- Quiche dish $2.99

- Large mason jars x2 $3.00

- Champagne glasses x 2 $2.00

- Old towels for car $2.50

- Sweatpants $2.00

- Napkin basket $2.00

Then things started to fray when we decided to move to New Hampshire. We purchased these items new which we needed for moving:

- Moving straps $17.00

- Tire cover $10.00

- Mattress cover $5.00

- Ratchet straps $5.00

Where we were moving there wasn’t a Costco for one and a half hours. This made us go a bit crazy when shopping at Costco (our favorite shop). The latter half of the year we went mental with purchasing. Here are some of the bigger purchases:

- An electric piano

- Knifes and knife sharpening block

- Carbon steel wok

- Dutch oven set

- Quest 3 VR headset

I don’t know what happened to be honest. I think it was a mix of not wanting to miss a “sale” at Costco before we moved, and then as we broke the rules of the goal anyway, we slowly forgot about it.

When we found out that we were leaving the USA, we also bought a laptop each and a phone for me as tech is a lot cheaper here (and no VAT!)

The first half of the year of this goal did teach us that with a bit of restraint we could rely on thrift stores. I’m not sure if we will be able to do the same in the UK, but having a buying holiday every once in a while helped us keep our spending low.

Luckily, as Costco have such a good return period, a lot of our Costco purchases were returned when I got laid off ($1000+ worth).

Goals for 2024

It’s especially hard for me to set goals this year. I have no idea where we’ll work, what type of work I’ll be doing, or what country we’ll be living in.

Maybe instead I should focus on setting some more experience and non-work related goals aimed at improving our happiness?

Let’s give this a go!

1. Climb the 3 highest UK mountains

We’ve really enjoyed hiking up mountains in New Hampshire, I’d like us to continue this in the UK. There are 3 big ones: Ben Nevis in Scotland, Scafell Pike in England, and Snowdonia in Wales. I climbed all 3, 7 years ago, doing the Three Peak Challenge, but Mrs SavingNinja hasn’t climbed any. It shouldn’t be too difficult for us to climb all 3 at some point in 2024! Driving 5h is nothing now we’re used to the long distance driving we’ve had to do in the USA.

2. Read 25 books

I’ve fallen off the wagon of reading non-fiction books after a whole year of reading only that in 2022 . I’d like to make sure that I read at least half non-fiction, and non-fiction books are generally quicker to read, so a 25 book goal is a good catch-all.

Do you have any book recommendations for me? Next on my list are:

- The Subtle Art of Not Giving a F*ck

- Thinking Fast and Slow

- The Desert and the Sea: 977 Days Captive on the Somali Pirate Coast (reading this one now and it’s brilliant)

- Scarcity Brain

- The Comfort Crisis

3. Master interviewing

I’ve set this goal 2 years in a row and failed completely. Now shit has hit the fan and I’m unprepared. I won’t make the same mistake again, I’m going to completely master LeetCode algorithms and System Design, and I’ll continue even when starting a new job.

For this goal to be met, I want to be confident with all of the NeetCode 150 and confident passing a system design “design Twitter” style interview. I’ll also be purchasing LeetCode premium to force me to use it this year. I want to become an algorithm solving genius!

They’re the only 3 that I can muster!

I wonder what my goals will be when I finally quit work? Hopefully they’ll be full of house construction goals like Tony has set, I miss building things with my hands.

I’m unsure what 2024 will bring. Right now, I’m focusing my efforts on securing another job, I’m almost rushing back into it. Because my job was taken away from me and it wasn’t voluntary, I want to replace it straight away, maybe doing so is a bad thing and we should be taking a step back and trying to pursue what will make us happiest instead.

The issue is, the tech industry seems to be going through a down-turn right now, and these are our general options:

- Move to Scotland and work remotely, eventually buy a nice remote property, coast until we FIRE.

This is what we’d prefer to do, but it comes with risk. Maybe I won’t be able to find a job remotely? Or if I do, and I get laid off again, will there be any more jobs? A lot of positions are being outsourced to other cheaper countries now as well, will I still be able to earn a big salary?

- Go back to London and work in a big corporation.

The pay will be best doing this. But do we really want to go through the stress of working or commuting to London again? Not really, I’ve gotten used to having that extra time at home and with Mrs SavingNinja. But, for a high enough salary, maybe it will be worth it for a few more years?

- Move to another country or Canada.

This could work, but we both don’t really want to be moving again so soon after moving back to the UK. We want to spend at least a year back home first.

London is looking like the safest option, it is still the place with the most job prospects, but it also fills me with dread. I’d like to find a remote position that still pays well, those companies do still exist, but it’s even harder to get a remote gig as a manager.

That’s another question I’ve been asking myself, should I continue pursuing a career in engineering management, or switch back to individual contributor? I’ve heard that it’s a lot harder to get a role as an EM, especially with the tech down-turn, but going back to IC so soon will feel like a step back. I’m prepping for both interviews anyway.

There are a lot of unknowns, I’m going to start applying in February, until then, I’m still preparing!

I hope you all had a good 2023, and here’s to 2024 being everything that we want it to be.

See you in February.