It’s that time of year again where I create the charts, review the data, analyse, and seek to improve.

Looking back at 2018 reviewed I’m aghast at how much I’ve forgotten and shocked at the amount that can get accomplished in a single year. That’s why these posts are so important; not just for personal finance but for all of your goals.

The clarity that journaling gives you means that you can achieve anything that you set out to do as you’ll have time to reflect, analyse and get incrementally better!

Let’s get stuck in.

Introduction

2019 has really been a pinnacle year.

There was a wedding, lots of traveling, saving has gone through the roof with multiple milestones being hit; The SavingNinja audience has grown exponentially, and things are looking promising career-wise. It’s the first year that I’ve properly felt content and excited since I left University almost 6 years ago.

Up until 2019, I’d felt like I was slugging my way through the middle bit of growing up; saving for a house, climbing the career ladder, and starting my investment snowball from nothing. Now, in part due to reaching six-figures invested over Christmas , I feel like I’ve finally made it to the good bit - I can start to live a little more.

Like last year, let’s start with the finances - we are a personal finance blog after all!

2019 Financial Review

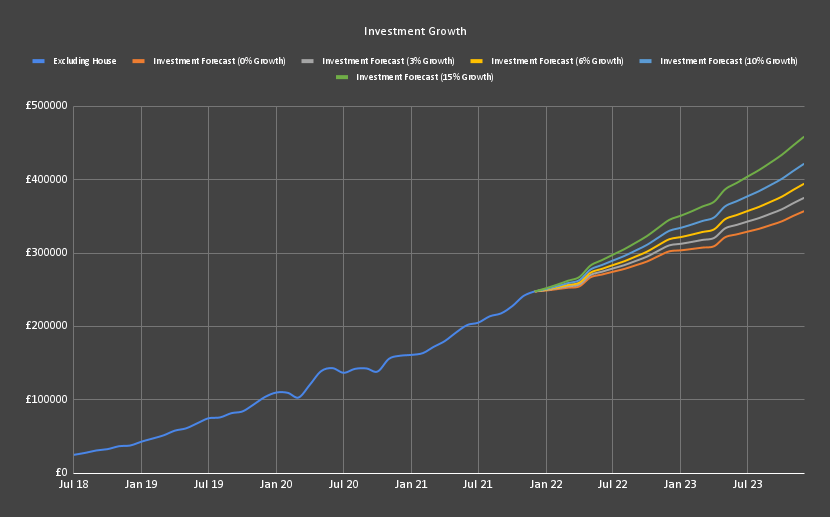

There has been a considerable overhaul to the Analytics section of the Super Spreadsheet . Google Sheets didn’t have all of the forecasting functions that Microsoft Excel had, so I had to manually forecast all of the future data. Luckily, this actually made the results better! I was able to forecast growth depending on 5 different investment return predictions.

To house all of this new data, the spreadsheet now contains a ‘Chart Data’ tab. This tab amalgamates all of the separate yearly data into one set and also calculates extras such as forecasts.

The Chart Data tab allowed me to create a whole suite of new charts in the ‘Analytics’ section (over 15 - I may have gone a bit overboard!) These charts now show data spanning all of the way back to 2018 and will be updated every month.

Subscribe to SavingNinja to get access to all of the same juicy charts for personal use.

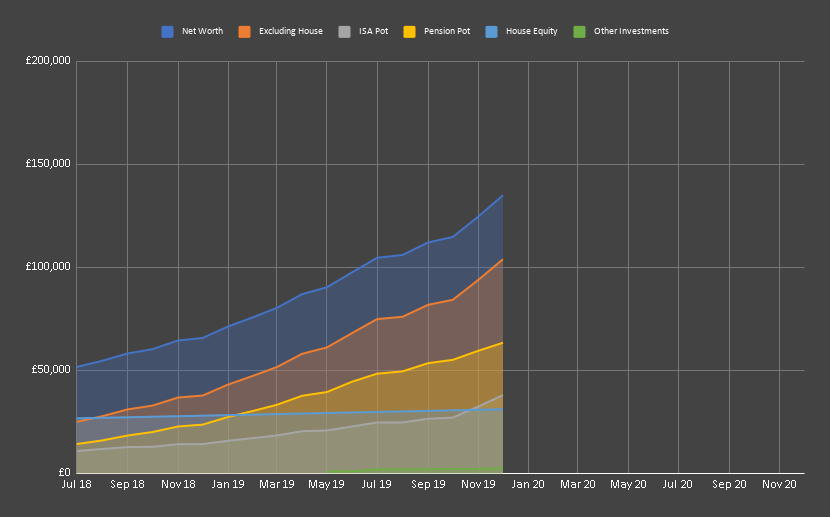

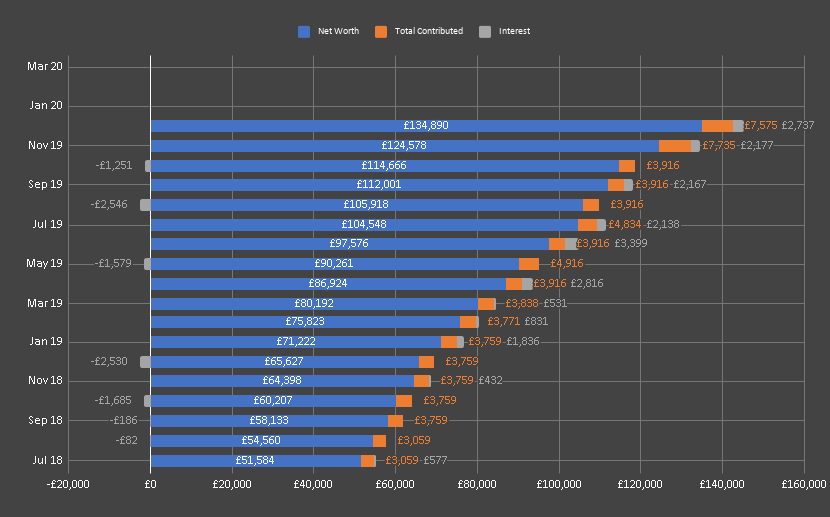

£134,889 Networth (+£69,262)

£103,858 Excluding House (+£66,154)

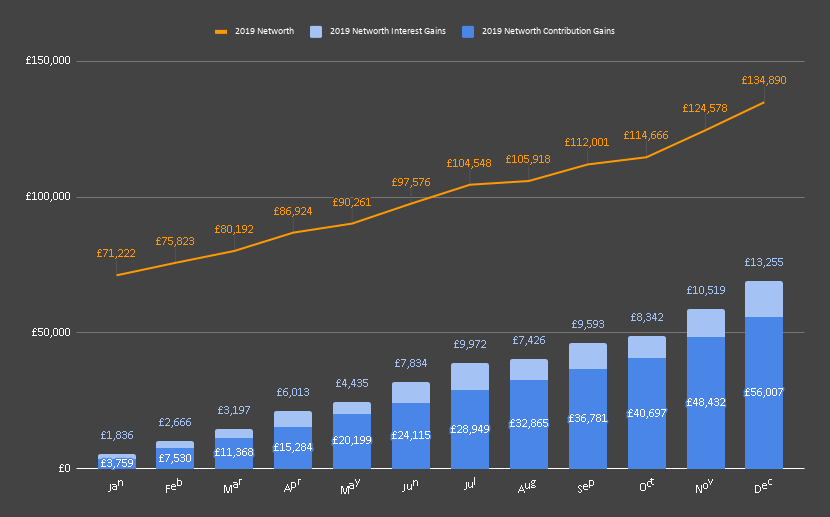

£56,007 Contributed

£13,255 Interest Earned

£63,307 Pension (+£39,734)

£31,981 Contributed

£7,753 Interest Earned

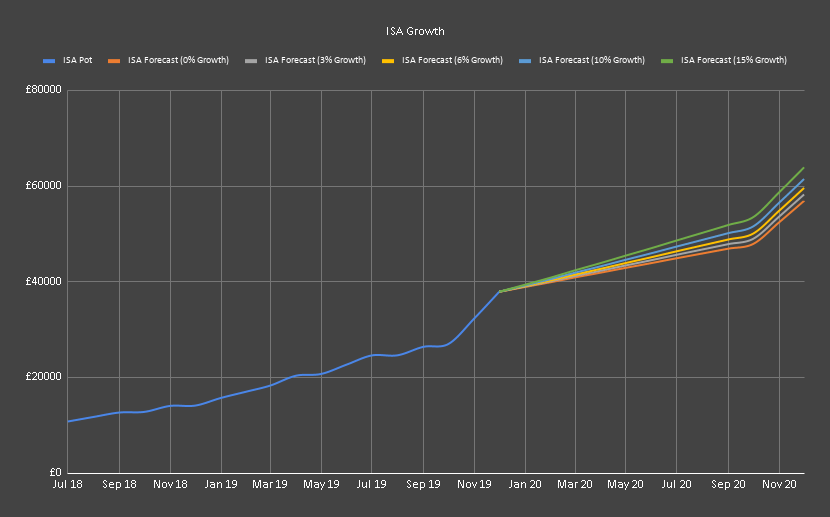

£37,918 Stocks & Shares ISA (+£23,787)

£19,000 Contributed

£4,787 Interest Earned

£2,633 Other Investments (+£2,633)

£1,918 Contributed

£715 Interest Earned

£31,031 House Equity (+£3,108)

£3,108 Contributed

Financial Growth

Networth soared this year with my pension and ISA pot both surpassing my house equity total. My net worth has increased by a whopping 175.46%; I doubt I’ll ever see that kind of growth in a single year again.

I filled my ISA with £19k contributions and gained £4,787 from stock growth in 2019. It’s nice to finally see my ISA pot surpass my house equity at £37,918, especially as last year my pension had only just achieved this feat.

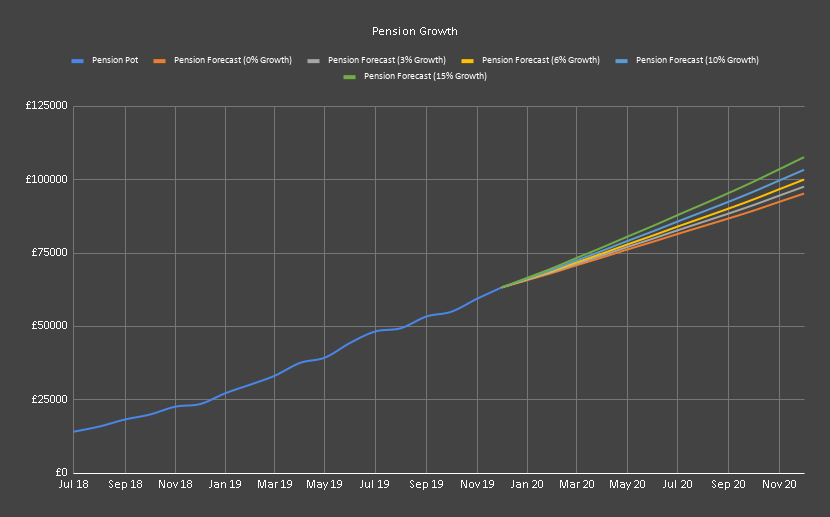

My pension is now a behemoth with £63,307 invested. This has grown almost 3 times the size of the measly £23,573 that it was at the beginning of 2019.

I’m going to have to seriously start considering stopping my pension contributions next year due to lifetime allowance concerns when my pension pot grows above £100k.

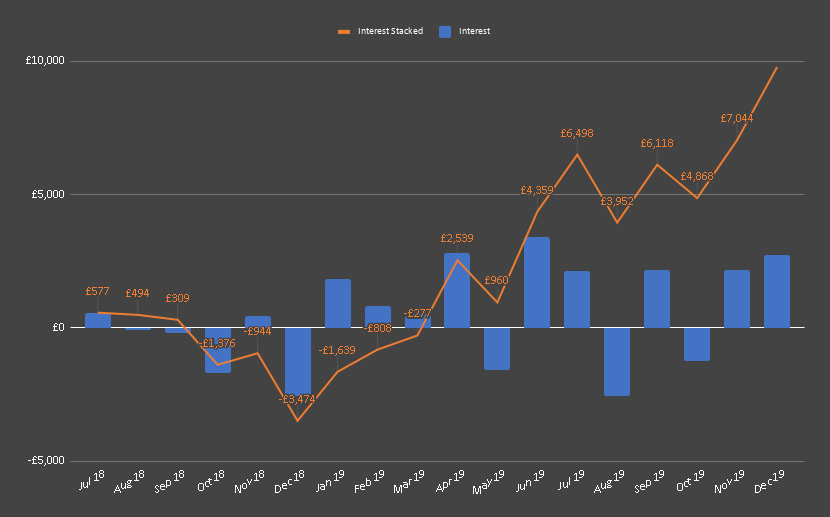

2019 was a very good year for stocks as my portfolio grew by 23% earning a combined growth of £13,255. Very different from the -£3,474 that I made going into the year.

My contributions still vastly outweigh my interest gains, but you can see that slowly starting to change as my pot grows larger with my biggest gain being in June earning £3,399 in one month; almost beating my lowest contributions amount of £3,500!

How Stocks Performed in 2019

Stocks rose by a huge amount this year. I have no idea how with the Brexit turmoil and Trump rampage, but it’s been the best year for growth I’ve ever seen.

The amazing returns bought me out of the deep trench that I was in at the end of 2018 and into the all-clear. My interest earned since I began tracking now stands at £9,781.

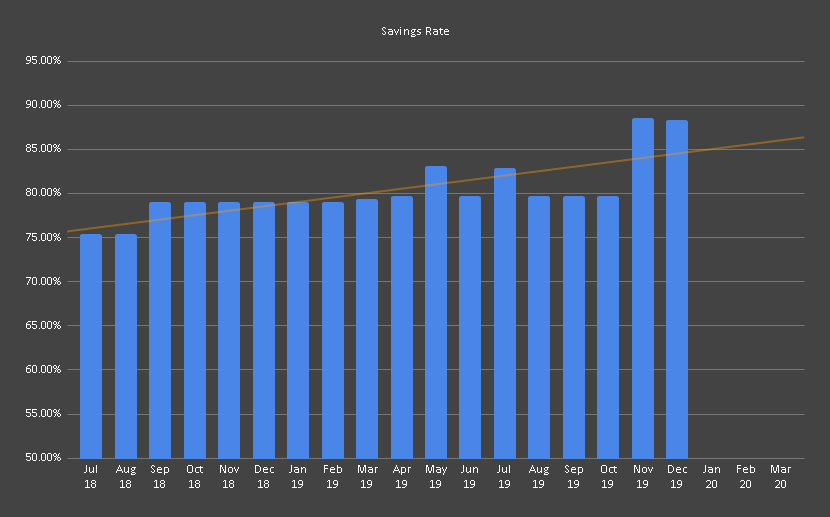

I’m Still Increasing my Savings Rate

Although my savings rate has always been high at around 75%, it almost touched 90% by the end of the year. At such high numbers, it takes a huge amount to move by a single percentage point, so although the chart doesn’t seem like it’s grown much, the difference in contributions vs 2018 has been monumental.

I wouldn’t have been able to achieve such a high savings rate without taking advantage of the generous government tax saving schemes (I’m paying zero tax for the next 4 months !) Or the huge amount of tax-free income I earned in 2019 (over £20k).

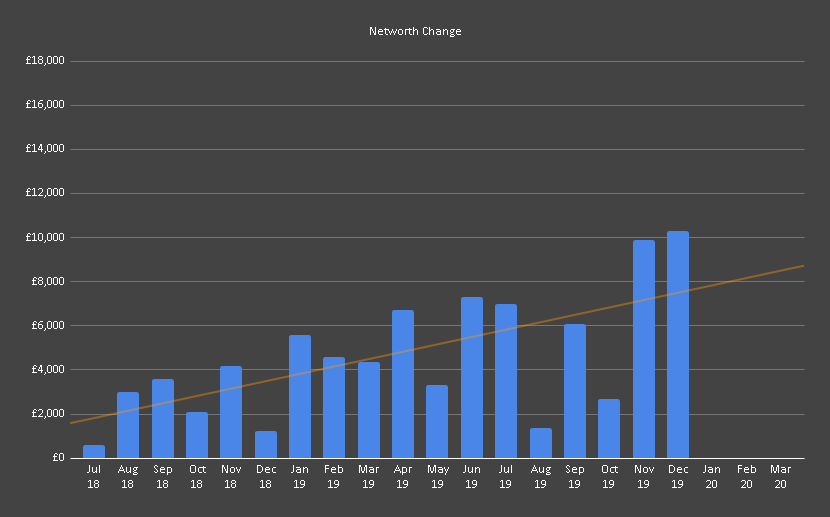

Monthly Contributions

My monthly contributions have increased almost every month as I earned more and spent less. I never would have dreamed of contributing over £7,000 into stocks for two months in a row before I started my FIRE journey a couple of years ago.

My change in mindset has been huge and I’m lucky to have adopted the FIRE mindset before I started earning my current salary.

December was the first time ever that I surpassed £10k in net worth gains in a single month - which is 10% of my total investment portfolio!

Contributions are very much still king at the moment.

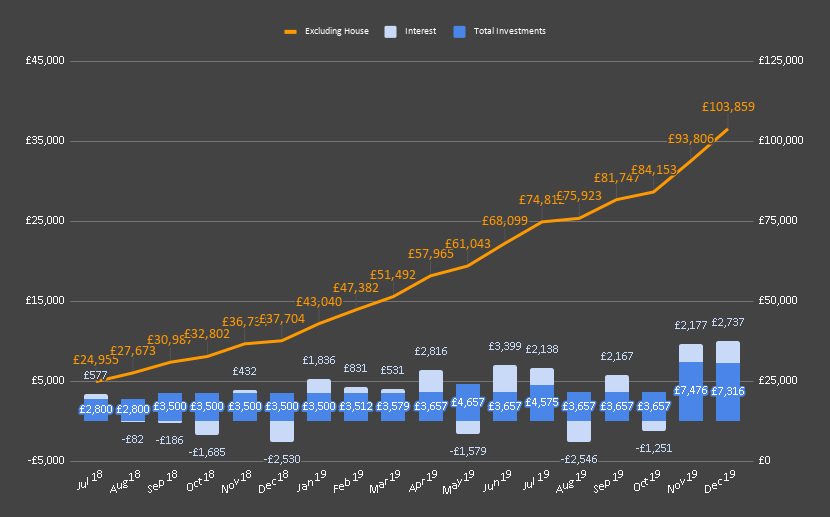

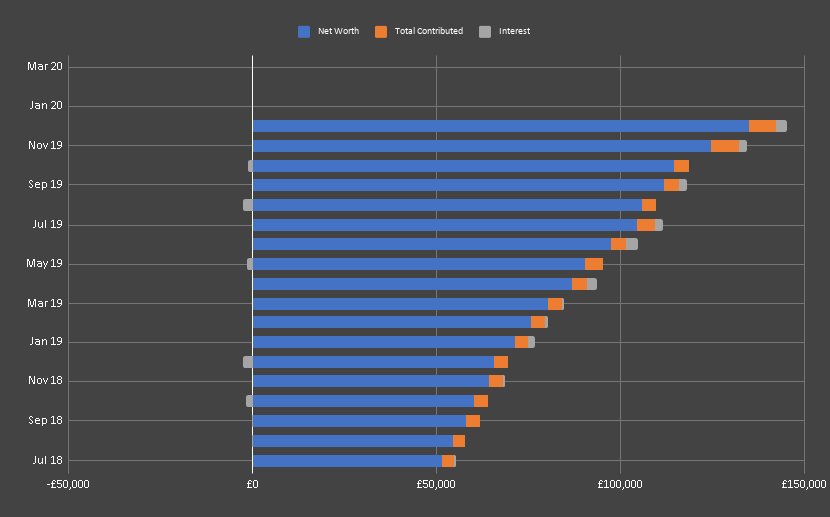

The below chart shows my total contributions and interest earned since July 2018 on top of the £48k I already had saved.

You can see the difference in my monthly contributions (and some interest gains) over the last 18 months below.

I hope to increase them further in 2020!

Forecasting

Last year’s forecasts were actually pretty accurate. Forecasts become harder to predict the larger your pot as stock market swings can affect you more drastically, so this year I’ve added 5 different predictions ranging from 0% growth all of the way to 15% growth.

Of course, we could still see a net loss if a correction occurs, but I’m putting my faith in the market to return at least 6% over the super long term; so it should even out.

It’s pretty unlikely that I’ll reach my £200k invested milestone in 2020. If stock markets grew by 15% I’d still be £23k short. Although I am planning to increase my contributions further this year and you never know, we might have another 30% growth year?

It would only take 3% growth, however, to hit the £200k total net worth goal, which would be absolutely awesome!

It’s looking pretty promising that I’ll surpass the £100k milestone for my pension pot in 2020, especially as I’ll be contributing more into it. I’ll have to explore the Lifetime Allowance a little more in 2021 as with 30+ years growth, a lot can happen with £100k!

My ISA pot continues it’s slow chug up the curve. The £20k limit slows down my ability to kick-start the compounding snowball somewhat so I’ll be lucky if it hits £100k by the end of 2021.

Goals Achieved

1. Reach £100k net worth (A++)

£135k net worth and £103k investments achieved! I blew this goal out of the water thanks to side hustles and increased earning.

2. Finish renovating the house and get a valuation (B-)

We’ve laid new wood flooring, painted the hallways and skirting boards, renovated the kitchen and bathroom, and installed a new boiler. We do still have to fit a new carpet and replace the front wall (or change it into a driveway), so it’s a B- for this goal.

We’ve decided that we’ll be staying here for at least another 2 years now so there isn’t as much rush to get everything finished at the moment, but I’d still like to complete everything as we’re so close!

3. Marie Kondo ** the house and simplify** (B)

We did Marie Kondo our biggest category; our clothes. Remember the 20 full bin-bags of clothes that got donated to charity? That was tough, but our life has been better ever since.

The only problem is, the meticulous organisation has started deteriorating as we’ve accumulated more things without getting rid of others. We will have to Marie Kondo the clothes again in 2020, but hopefully this time it will be way easier.

We successfully Marie Kondo’d the papers and kitchen, although that was way easier than we thought it would be. The only one left is the Loft of Dread, which we will be doing soon.

4. Get married! (A++)

Yes! We got married and everything went better than I could have ever imagined; there’s not one thing that I would change.

Looking Forward

I feel like 2020 is going to be a bit of a pivotal year, where things will change drastically - hopefully for the better.

Last year I was feeling down with the sensation of being stuck somewhere that I didn’t want to be; wanting to get to my destination faster. This year solely due to my growth in 2019 I’ve felt a renewed vigor.

I can see my FI target approaching fast (only two and a half years away) and I am confident that my salary and saving will increase more as I climb the career ladder.

I can almost taste the finish line and it’s making me enjoy the present more; the pursuit is exciting again. I’m also feeling the strain in my shoulders relax when it comes to spending on what makes me happy, with the vow to go on at least one snowboarding holiday per year.

I have the financial independence movement to thank for all of these feelings.

Next Steps for my Career

I’m approaching the 6th year of my career and the 2nd year at my current employer, I feel like it’s about time I level up. I can feel the itch and excitement to move already building; I need to progress.

I’m already in a senior role in a top FTSE 100 company, to level up again I’m going to need to put in more work - much more work than I’ve ever done before.

This is why you’ve heard me begin to ramble on about taking courses and enrolling in MA degree programs over the last 6 months. The type of role that I’ll have my sights on next will need a lot of preparation if I’m going to pass the interviews.

The feeling of advancing my career wasn’t really present at the beginning of last year. I’d started making a killing with Each Way Betting . I was also sure that I would go into contracting and hit my peak earning potential without much preparation required.

Through-out the year, IR35 dampened the contracting dream (at least for now), and the bookies started banning my accounts and killing off my tax-free money trees.

That left me with the ambitious and more demanding option of climbing the corporate career ladder with:

A) The much more difficult (but way more exciting) option of getting hired at a tech-giant like Google or Facebook. This would also give me a much better chance of making it to the USA.

B) Moving into a leadership position in the FinTech industry (my current industry). This is the natural next step for me. It would come with the higher salary (and progression) that I crave, but it would also invoke more stress with less working from home, more office politics, and no exciting projects.

I could, of course, re-visit the notion of contracting after the IR35 woes have settled down, but I want to at least try my luck with the tech-giants. If I fail, it will only bolster my ability when interviewing with other companies.

Improving my Happiness

I mentioned previously that I have a problem with spending money . As my six-figure investment pot came into view (and probably due to thinking about the above post,) I’ve started to be more considerate when thinking about how I can spend more to increase my happiness.

I’ve already booked a family snowboarding holiday in Switzerland at the beginning of April, and we plan to go to Canada later in the year. I want to make sure that the increased spending goes solely on things that will bring the most joy, but I’ll maybe have to experiment a little.

Going into 2020 I’ll be forcing myself to seek additional happiness without thinking about the monetary cost. I’ll be taking a leaf from Brandon over at The MadFIentist and starting a happiness spreadsheet to ensure that I meet this goal. It’s worked for my finances, it could bolster my happiness too!

Blogging

Last year I was worried about the need to release content every week, I’ve now decided that I’m going to focus on quality content and site improvements.

There is so much that I want to do in 2020 that it will be insanely hard to keep up with the 1 post per week schedule, so I’m going to go down a ‘post if I have time’ route and try to stick with a minimum of 1 every fortnight.

The Thought Experiment series I enjoyed very much and loved seeing the responses by sometimes 15+ other bloggers. But this, like most things, has started to become tedious.

I don’t want to have to force a new experiment out. I’m going to create a dedicated post for all of the Thought Experiments and release a new question only when there is something exciting to discuss. I’ll potentially write a post myself first and then decide if it should become a Thought Experiment. I’m still open to suggestions.

Blogging Statistics

Now I’ve never shared my blog statistics before. I don’t like the idea of doing so as I don’t think blogging should be measured by a metric, it should be measured by the quality of content. Most of the time a high page count can come from a few lucky backlinks or Google rankings and not by writing something awesome.

But, I have to share it; just this once! I have to because my page views are nearing a very special milestone…

My page views have been almost identically tracking my investment total for the past year! I was REALLY hoping that they would cross the 100k milestone at the same time as my investments over Christmas!! But they were just shy of the goal :)

Goals TL;DR

- Reach £200k total net worth

- Complete a 6-month Coursera Specialisation in Algorithms

- Apply to at least 2 tech-giant companies

- Get a new job which is higher pay / in leadership / a tech-giant

- Go on more than 1 holiday

Let’s get going!