Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

January went slowly and quickly all at once. I can’t believe we only have 2 more months until we leave the USA and that terrifies me. We still have so many of our belongings to sell, including the car.

We’re planning on trying to sell the car toward the end of February and then renting one for a month, this will ensure we get the best deal as if we sold it to a dealer we were looking at a loss of around $20k.

Our flights are booked now, along with 8 suitcases and our cat, we’ve also scheduled a vet to do his flight certificates. As the UK doesn’t allow you to fly in without paying an extortionate fee to a specialized pet relocation company, (one of only a few countries in the world that require this) we have to fly into France.

Luckily, Mrs SavingNinja’s dad will pick us up from the airport and drive us back into England through the channel tunnel. This means we have to get cat health certificates for both France and the UK, but it’s still cheaper (and safer for him) than using the cargo hold.

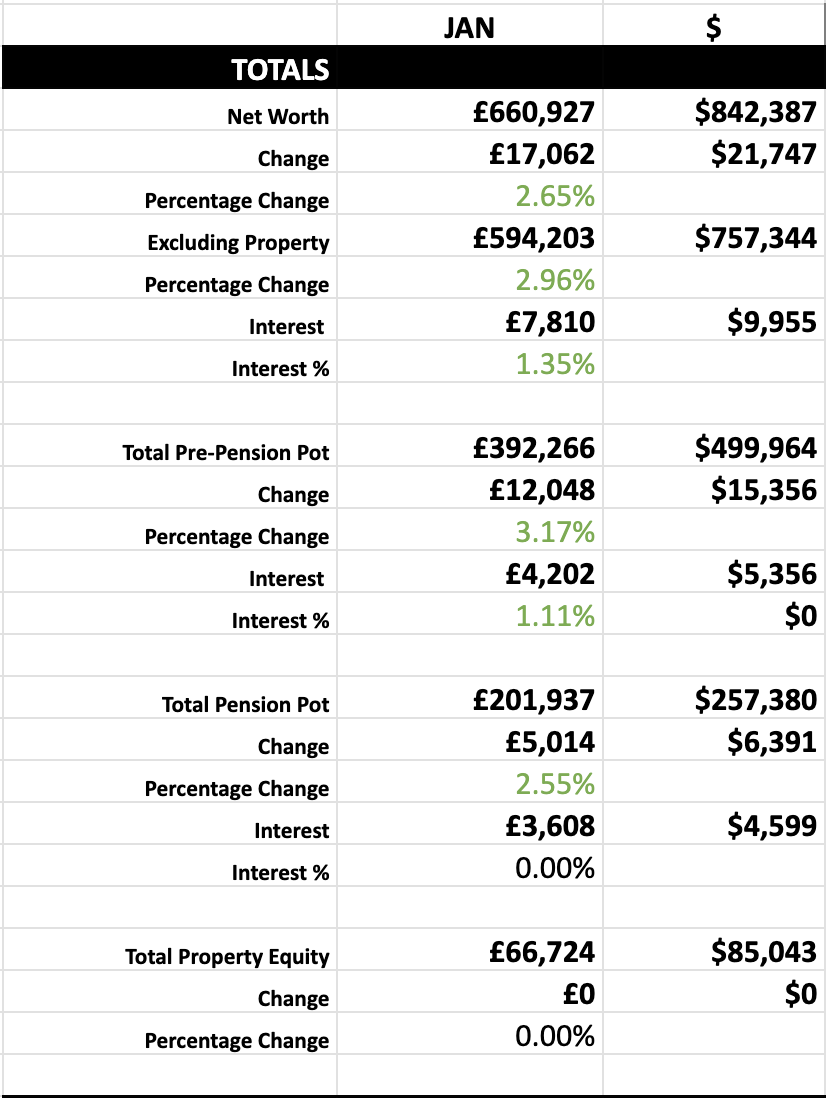

The stock market did well again, pushing our net worth ever closer to that $1m figure. I received a 7 month severance along with vesting stock and a retention bonus from last year (ironically) from my employer so this should allow us to continue to fill our investment accounts for a while.

I’m planning on investing $50k of my severance into Mrs SavingNinja’s GIA’s in IBKR, I wish I’d done this sooner as I’m sitting on a $100k capital gain in my own accounts. In the USA, you can share your tax rates and tax allowances with your spouse, this isn’t the case in the UK, so we would have been a lot better off if we’d invested the bulk of our savings in her name instead, or split it equally, but it’s too late now. For what it’s worth, now that I’ve experienced the US system of sharing allowances with your spouse, I think not allowing this is stupid. A married couple who both independently earn £40k have more money after taxes than if 1 person earned £120k and the other was a stay at home parent, which is just insane. The UK tax system almost forces both people to work otherwise they will be significantly worse off than dual income households. If I’d been smart and invested our money in Mrs SavingNinja’s name, we’d be paying a lot less tax… /rant

I’ll put £20k into a savings account earning around 5.5%, we’ll use that as our emergency fund until I find another job. And for the rest, we’ll fill up our ISA’s as much as we can.

I’ve been looking into “expert networks” to earn some money on the side. It seems that as I’ve got some big name companies under my belt I can now give mock interviews and coaching services for a pretty good hourly rate, between $125 and $200. It got me thinking that doing a couple of those a week, continuing with my technical tutorials/books, and Mrs SavingNinja editing and kindle publishing, we could probably support ourselves financially. As we’re able to also draw out £24k per year from our investments using the 4% rule as well, maybe I shouldn’t be rushing to get a job so quickly?

In any case, I’d like to be able to live in the UK, with a job, for a little bit before trying the RE thing just to be sure. Before we left the UK we were only spending £24k per year, and that was with an annual £6000 of holiday spend and £2400 for my train to London, so effective RE minimum spend would have been £16k, with extra for holidays. I’m thinking that we’re pretty much FI, definitely if we continued with side-hustles.

Obviously it would be risky right now to do this, and our expenses are almost guaranteed to change, if we get a bigger house or have children, interest rates are higher now as well, so we won’t be quitting yet. But maybe I shouldn’t rush into the first job I find and use these figures to wait for the perfect one instead? Even if it takes a year. What do you think?

In other news, interview prep is going well. I’m learning better than I have done before for the algorithm part, I think I’ve passed the hill of complexity now and it’s just a studying game, I know the basics!

System design is also going well, I’m learning a new type of system each day e.g. “How social media networks are designed.” I’ve now got a pretty broad amount of systems that I’ve deeply studied under my belt. I’m learning more about backend engineering than I have before and how popular services like Kafka, Flink, MapReduce and Cassandra work.

Each day has been filled with algorithms and system design. It’s crazy how much you can learn when you don’t have a job!

I’m still a little worried about all of the continued layoffs, my chances of using everything I’m learning to get into Google or Meta is getting slimmer due to there not being as many positions. I’ve started the interview process for one particular position and I’m really hoping that goes well but I’ve got no more in the pipe if it doesn’t just yet.

I’m unsure whether I should be focusing on re-learning Android instead and going for engineering positions. As time goes by, if I don’t get an EM position, I’ll have to pivot to re-familiarizing myself with Android development and start applying for those roles instead.

Or maybe I can try contracting?

So many options!

But for now, I’m still on the lookout for Engineering Manager roles.

We’ve also been enjoying the snow and have gone snowboarding 4 times when the weather has been good. It’s been perfect going in the week when everyone else is at work, it’s so quiet! No lift lines.

I’m hoping that in next months report I’ll be able to share that I’ve got a job offer. Keep your fingers crossed for me.

Have a great February.